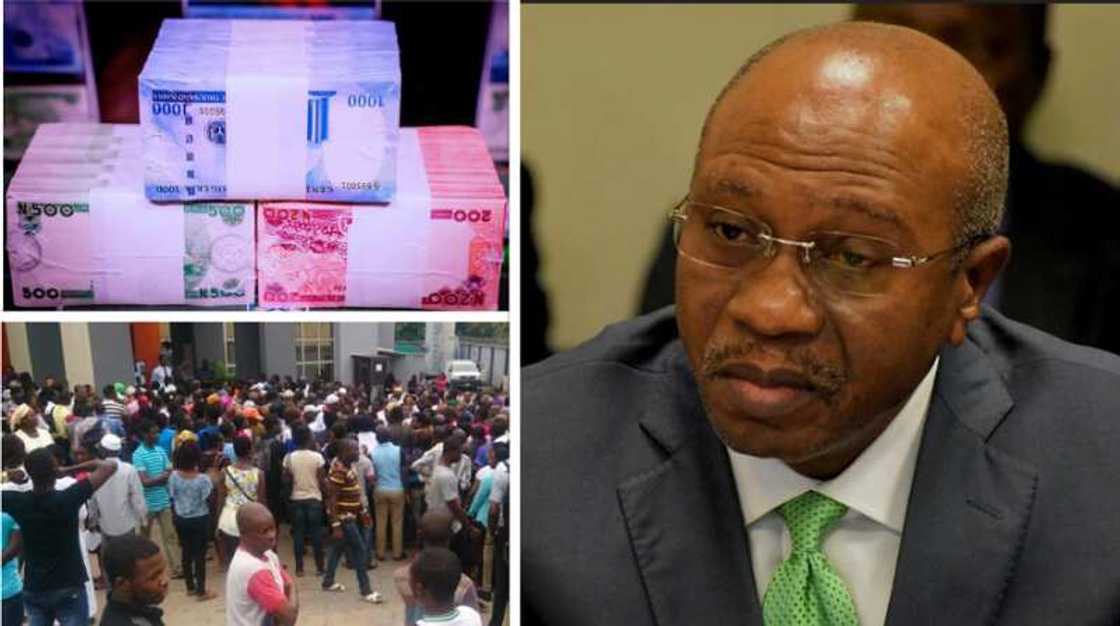

CBN's New Naira Notes Swap Policy Causing Untold Hardship on Nigerians

When the Central Bank of Nigeria thought out the plan to redesign the naira and enforce the depositing of the old naira notes, it's obvious they did not envisage the kind of chaos that has risen in the last week.

Since the January 31 deadline that was issued by the CBN, there have been chaotic queues in banking halls and ATM points. The pandemonium escalated last Friday to several protests and vandalisation of properties of some commercial banks in Ibadan, Oyo State. There have also been reports of more protests and riots in some parts of Ogun State and Edo State where protesters made bonfires and blocked major roads.

Source: UGC

While the protests were ongoing, videos emerged of customers stripping inside banking halls demanding for their money. Customers are fighting each other and also fighting bank staff. Many ATM points have been converted to temporary sleeping camps by some customers. The people are obviously angry that they have to beg the banks to give them back the money which they saved. They are not asking for loans, but for their money.

While Nigerians have to queue to get their money from ATMs, they also have to deal with the queues at filling stations as fuel scarcity lingers. Many others have to also daily queue to collect the Permanent Voters Cards (PVC) ahead of the forthcoming election.

Nigerians are used to tolerating grueling government policies, but the naira swap which has led to a scarcity has to be the one that bites the hardest. For weeks, most Nigerians are unable to withdraw cash from their bank accounts. No cash in the banking hall and no cash being dispensed through the Automated Teller Machines across most cities in Nigeria.

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

Unfortunately, bank app transactions in recent times have become more strenuous and unreliable, probably because of an increase in the volume of transactions since cash became scarce. PoS operators who could have served as alternatives are also dealing with a shortage of cash. Most do not even have cash to give out, and the few who manage to get a hold of a little cash have turned 'overnight celebrities' and are charging as much as N1000 extra for a N5000 withdrawal.

Banks have been accused of hoarding the naira notes and refusing to dispense to customers, as evident in some of the banks that the Economic and Financial Crimes Commission (EFCC) and the Independent Corrupt Practices Commission (ICPC) have busted in recent times. The disarray has forced some banks to shut their doors to customers for fear of being attacked.

Businesses and social livelihood are today being negatively impacted by the scarcity of new naira notes. I learnt that as a result of the scarcity of cash parents are unable to give money to their children going to school. Workers and business people are also unable to find money to pay for already hiked transport fares or buy high priced fuel for use.

A lot of businesses right now are suffering from fewer patronage as customers lack cash for payment for goods and services. The restriction of spending as a result of shortage of cash is unfortunately injurious to the economy.

Presently, there seems to be some sort disorder in some locations as a result of the scarcity of cash. If not properly handled, this could result to an uprising and anarchy in the country. With current events, you can be sure that the inflation rate which eased in December will shoot up in February.

The cashless policy, even though necessary has brought nothing but untold hardship on Nigerians because of poor and inadequate planning by the CBN, the commercial banks and other stakeholders. At this point, many are beginning to read political meanings to the scarcity, with political parties pointing fingers at each other.

No one is against the CBN's effort to instill a cashless society and enforce reasonable withdrawal limit, but it is evident that the way the apex bank flagged off the policy lacked proper and adequate planning. The frequent changes in CBN's directive on weekly withdrawal limit and over-the -counter cash withdrawal is proof of this inefficiency.

Read also

Expert lists 10 lessons Nigerians can learn from India as CBN deadline for old notes ends in hours

This was attested to by Ajuri Ngelale, the Senior Special Assistant to President Muhammadu Buhari on Public Affairs when he stated in an interview that the information given by the CBN that "they have adequately supplied all banking branches in Nigeria with sufficient amount of the new naira notes is absolutely false," hence the extension of the deadline to February 10.

Perhaps it is time for the CBN to admit that it has failed in the course of implementing the policy and return to the drawing board and fix the issues which simple research and surveys across selected locations and population groups could have foreseen and checked, instead of exposing citizens to intense hardship.

What the CBN and the presidency should now do is to accept the shortcomings of the naira distribution and consider extending the deadline by a month or two to enable the bank to make more money available. In the course of the deadline extension, the old naira notes must be in concurrent use with the new notes.

Source: Legit.ng