Tax Identification Number: how to get TIN number in Nigeria in 2023/2024

- The Nigerian Taxpayer Identification Number (TIN) is a unique number assigned to a registered tax-paying entity (individual or company).

- The number is unique to every taxpayer and can only be used by the person or company to whom it is registered.

- The number is usually issued by the Federal Inland Revenue Service (FIRS) upon successful registration as a taxpayer.

- Kazeem Kayode Lawal, a seasoned tax professional, delves into the essence of TIN, unravelling its impact on both individuals and businesses.

Source: UGC

TABLE OF CONTENTS

The FIRS is responsible for assessing, collecting, and accounting for the money collected in taxes as well as other revenue accruing to the Nigerian government. Therefore, all Nigerian individuals and companies that sell products or services, work for the government, other public entities, private companies, or freelance systems are required by law to have a Taxpayer Identification Number (TIN).

In an interview with Kazeem Kayode Lawal, an experienced tax professional, he informed Legit.ng that the obligation to register and obtain a TIN extends to every person, including both natural and legal persons, irrespective of whether that person is exempted from paying taxes in Nigeria. Lawal clarified that legal persons pertain to corporate entities established through registration with the Corporate Affairs Commission (CAC).

He emphasised that the TIN serves as a unique identifier assigned to each person, playing a crucial role in facilitating the administration of their fiscal responsibilities.

How to get TIN number in Nigeria

Here is a look at the process, requirements, and benefits of getting the TIN.

Why do I need to get the TIN?

Here are some of the most common reasons you need to apply for a Tax Identification Number.

- It is required when you apply for a government loan.

- It is a must-have when you wish to open a business account.

- It is a must-have if you need an import, export or trade license.

- It is necessary when you register your vehicle.

- It is needed for getting tax clearance, allowance, waiver, or incentive.

Will I pay for the application?

No, the entire application process is free of charge. The application process is quite straightforward and only requires you to visit an FIRS office (for individuals). You will be asked to fill out the application form in three copies. You will not have to pay anything.

Read also

Ireland grants work permits to Nigerians, others as labour shortage grows, gives easy conditions

Things to note for TIN applicants and holders

Source: UGC

Here is some important information for those looking to apply for their TIN.

- You must ensure the address and name lines include no more than 200 characters (per field).

- Ensure you provide the correct 11-digit phone number.

- Each applicant must provide an active email address.

- You need to fill out all the fields marked as * in the TIN application form.

- Only the official taxpayer can use his or her TIN (no third-party persons are allowed).

- Usually, you don't have to apply for TIN if you are an incorporated trustee (but laws can change, so double-check this information at the FIRS office).

- Each Nigerian should get TIN if his or her business receives revenue.

- You can validate your TIN on the official FIRS site.

Addressing misconceptions about TIN, Lawal highlighted common misunderstandings, such as the belief that persons must make payments before acquiring a TIN and the misconception that those exempted from taxes in Nigeria are not obligated to obtain a TIN. Clarifying these points, he said:

Registering in the tax net and acquiring a Taxpayer Identification Number is completely free of charge. As a matter of fact, any tax official who is demanding money before registering a taxpayer must be reported so that appropriate disciplinary action can be meted out.

It does not matter whether the company is below the threshold for paying taxes or that it is an NGO. We must understand that obtaining a TIN is the first step towards tax compliance, the other steps are prompt filing of returns, prompt payment of due taxes, and complete and accurate reporting of one’s financial affairs.

Having a TIN even where one is exempted from paying taxes does not imply that one would have to pay taxes, rather it helps the tax authorities to accurately account for taxes forgone or tax expenditures, waivers, and incentives in general.

It could also be used to identify the less privileged amongst us so that the government can effectively give out cash transfers and other palliative programs. As a matter of fact, during the COVID-19 lockdown period in Sweden, it was the taxpayer register that was used to allocate and distribute palliatives to the citizens.

Read also

NAHCO makes final decision on new rate for Air Peace, Max Air, other airlines operating in Nigeria

How to apply for TIN in Nigeria

How do I apply for a TIN? Typically, applicants are either individuals or companies. Here is how to get a TIN number for the different types of entities.

How does an individual apply for tax identification number in Nigeria?

Here is a look at how to get the TIN for individuals in Nigeria.

- The applicant will have to visit the nearest FIRS office.

- Ask for a TIN application form from the reception or customer service desk.

- Complete the application form, ensuring you fill out every space with an asterisk symbol.

- Append your signature on the document once you are done filling it out.

- Ensure you have correctly attached all the documents that are required.

- Submit it to the relevant person at the FIRS office.

- Your application will be forwarded to the relevant department for review.

- The FIRS will then contact you regarding the issuance of a TIN.

Read also

Nigerians protest as MTN, Glo, Airtel, others set to increase call data rates by 15 percent

Recently, the government made it possible for individuals to have an automatic TIN once they get their BVN (Bank Verification Number) or NIN (National Identity Number). One can check whether they have been automatically assigned a TIN via the verification portal.

How companies get a TIN

Non-individuals such as limited liability companies, incorporated trustees, enterprises, cooperative societies, MDAs, and trade associations are required to apply for TIN online. Here is a look at how to get a Tax Identification Number online in Nigeria.

Source: UGC

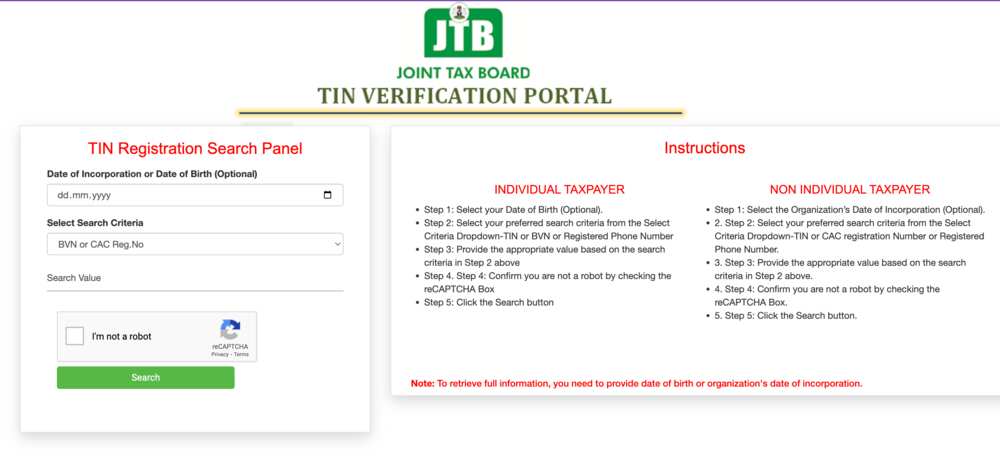

- Visit the JTB (Joint Tax Board) TIN registration portal.

- Enter the required details in the respective fields.

- Make the respective selections that apply to your business and complete the application form.

- After completing, click the 'Submit' button. You will be redirected to another page on which you will be required to upload the documents listed in the 'required documents' section of the page.

- Follow the onscreen instructions and then proceed to submit the duly filled form.

- The application will be approved once the information and documents you have provided have been verified.

- The officials will then process the TIN for issuance. In case of any issues, the applicant will be contacted and asked to provide the correct information or documents.

- After about ten business days from the date of application, your non-individual TIN will be emailed to the applicant. Keep in mind that this period might often stretch to about two months, depending on numerous issues.

Read also

"Make sure you have them ready": Lady names 9 documents needed for UK care job and visa application

Modern technologies implemented

Lawal highlighted the modern technologies implemented by the federal government to streamline the process for individuals and businesses to obtain a TIN. The list includes:

- Every company in Nigeria needs to enrol on the TaxPro Max (an initiative by the FIRS for tax administration in Nigeria) and validate their TIN if they have not done so already.

- Newly incorporated companies can automatically obtain their TIN upon registration with the CAC. This enterprise is an inter-agency collaboration between CAC and FIRS.

- The JTB also has a platform that automatically assigns TIN to individuals using the BVN or NIN of the individual, and there is a verification portal where one can log on to see the assigned TIN.

- There is also an online registration portal where individuals and businesses that have not been assigned a TIN can log on for registration.

- Lastly, the JTB is currently championing a “National Data for Tax” project, which presently is at the incubation stage, but when hatched, will eventually see to the unification of the NIN and TIN for individuals, and RC number (Registered Code assigned by CAC to every entity that registers with the Commission) and TIN for companies.

What documents do I require when applying for a TIN?

Source: UGC

Those trying to figure out how to get TIN number online in Nigeria often want to know what documents they will be required to present.

For individuals

- A duly completed TIN application form

- A verifiable form of identification. Common options include a national driver's license, international passport, national identity card, or a certified copy of your full birth certificate.

- Utility bill

For a registered but not incorporated business

These are businesses that have been registered with the Corporate Affairs Commission but are not yet incorporated.

- A duly filled TIN application form

- Application letter

- Business name registration certificate

- Utility bill

For incorporated companies

- Duly completed TIN application form

- Memorandum & Articles of Association (MEMART)

- Certificate of incorporation

- Particulars of the company's directors

- Statement of share capital

- Utility bill

One must present the original and two copies of each document. The originals are only required for sighting and verification. One copy is left with the FIRS, while another will be signed and stamped by an FIRS official as proof of your application.

Read also

"I don't know what to do with it": Nigerian man with N1.5 million cash begs for business idea

Finally, Lawal elaborated on the impact of TIN on business operations in Nigeria, he said:

- Having a TIN presents a business in a very good light as a tax-compliant business enterprise. It impacts the ability of the enterprise to relate and transact businesses freely with other entities not only in Nigeria but across the world, and to carry out its fiscal obligation as an agent of the government for the deduction and remittances of withheld taxes from transactions with other business entities and from the payment of salaries to its workers.

- It ensures a smooth business operation for the business enterprise because several business activities cannot be done in Nigeria today without having a TIN. For example, you cannot open a bank account for your business without having a TIN; you cannot import spares and raw materials without a TIN; you cannot export your products for sale outside Nigeria without a TIN; you cannot apply for land allocation for your business without a TIN, and so on.

- No business will survive without capital and having a TIN impacts the ability of small businesses to access finance, particularly loan finance from the bank, as registration in the tax net is a requirement before any bank would grant a loan.

Read also

“Apply with the link”: Canada reopens two programmes for Nigerians to relocate with family permanently

If you have been trying to figure out how to get TIN Number in Nigeria, this guide has you covered. For individuals, the process just got easier with the automatic TIN allocation. For non-individuals, the online application process is also quite straightforward.

READ ALSO: How to write an application letter for a job?

Legit.ng recently published a guide to writing the perfect application letter for a job. An application letter is the first correspondence you are going to have with your potential future employer. An employer will almost certainly judge you based on your application letter.

Your application letter must stand out since employers usually deal with numerous applications for a single vacant position. How do you come up with the perfect application letter, and what do you include?

Source: Legit.ng