Tier 3 Savings Account in Nigeria explained: bank options and what they offer

A Tier 3 savings account allows unlimited deposits and increased withdrawal limits. Banks like UBA, Wema Bank, and Parallex Bank offer these accounts valuable features. Tier 3 savings account offers the highest level of access and flexibility within Nigeria's banking system.

Source: UGC

TABLE OF CONTENTS

Key takeaways

- In contrast to Tier 1 and 2 accounts, Tier 3 offers unlimited deposit capacity and higher withdrawal limits, making it ideal for active account users and small businesses.

- Tier 3 accounts demand comprehensive Know Your Customer (KYC) documentation, such as a valid ID, utility bill, and Bank Verification Number (BVN).

- Top Nigerian banks, including Kuda Bank, Wema Bank, and TAJBank, offer Tier 3 savings accounts.

- Tier 3 savings account holders enjoy benefits such as earning interest, mobile and online banking services, access to debit cards, and eligibility for loans and other credit facilities.

Read also

GTBank raises ₦365bn to hit ₦500bn target as nine banks now meet CBN’s recapitalisation rules

What is a Tier 3 savings account?

A Tier 3 savings account, also known as a Tier 3 bond, is the top level of a bank's savings account options, aimed at promoting long-term financial stability. It usually has no cap on savings, no limits on individual deposits, and no restrictions on multiple withdrawals, offering flexible access to funds while still earning interest.

Bank options and features

What are the Tier 3 banks in Nigeria? Tier 3 savings accounts in Nigeria offer a superior banking experience and come with a variety of features. Below are some of the banks that provide Tier 3 savings accounts, along with their features.

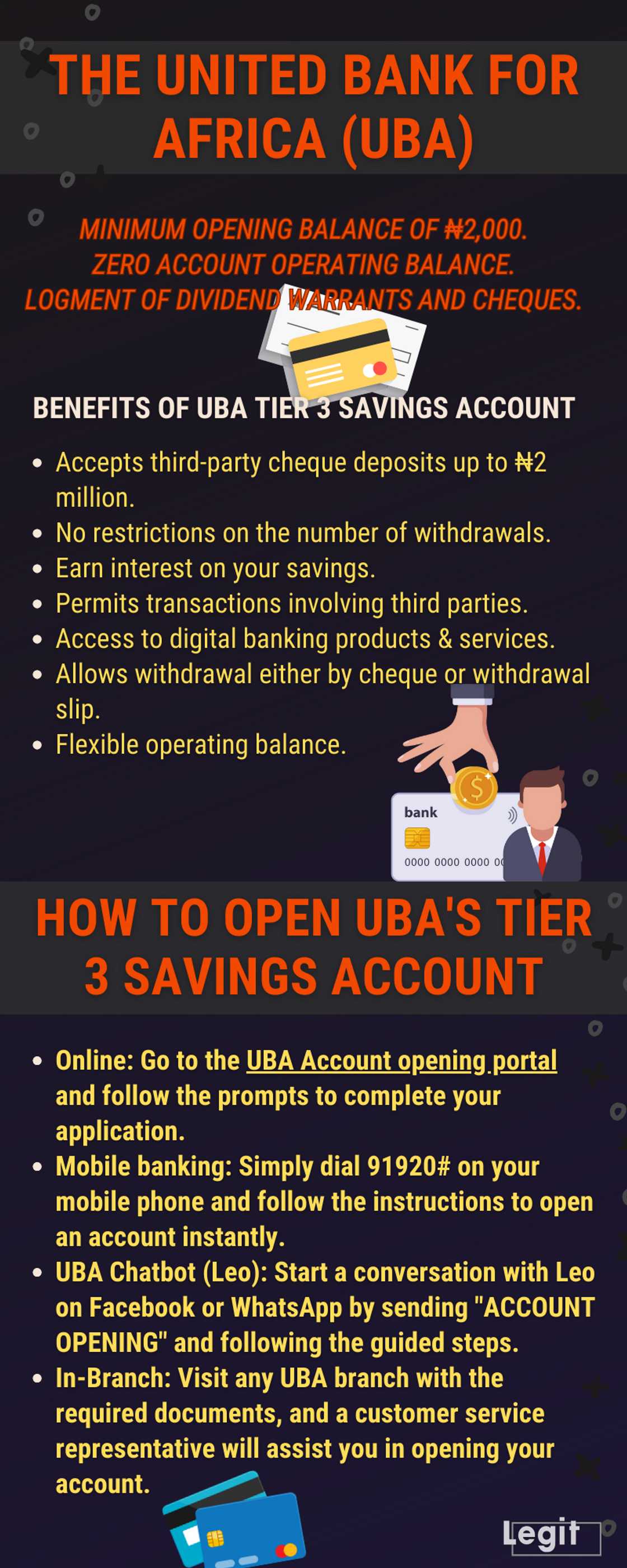

The United Bank for Africa (UBA)

Source: UGC

The United Bank for Africa (UBA) in Nigeria offers a Tier 3 savings account, which provides customers with comprehensive banking services and greater flexibility than Tier 1 and Tier 2 accounts. The key features of the UBA Tier 3 savings account are:

- Minimum opening balance of ₦2,000.

- Zero account operating balance.

- Logment of dividend warrants and cheques.

Benefits of UBA Tier 3 Savings Account

UBA's Tier 3 savings account is designed to deliver full-service banking with added convenience and flexibility. Below are the benefits associated with it.

- Accepts third-party cheque deposits up to ₦2 million.

- No restrictions on the number of withdrawals.

- Earn interest on your savings.

- Permits transactions involving third parties.

- Access to digital banking products & services.

- Allows withdrawal either by cheque or withdrawal slip.

- Flexible operating balance.

UBA's Tier 3 savings account requirements

To open a Tier 3 savings account with UBA, you are required to provide the following documents.

Source: Facebook

- A duly completed account opening form.

- A valid ID, such as an international passport, driver’s license, National Identification Number (NIN), or Permanent Voter’s Card (PVC).

- A recent passport-sized photograph.

- A utility bill, such as an electricity bill, issued within the last three months.

How to open UBA's Tier 3 savings account

There are several ways to open a UBA Tier 3 savings account. These methods are:

Read also

Race against time: Meet Nigerian banking giants scrambling to meet CBN recapitalisation target

- Online: Go to the UBA Account opening portal and follow the prompts to complete your application.

- Mobile banking: Simply dial 91920# on your mobile phone and follow the instructions to open an account instantly.

- UBA Chatbot (Leo): Start a conversation with Leo on Facebook or WhatsApp by sending "ACCOUNT OPENING" and following the guided steps.

- In-Branch: Visit any UBA branch with the required documents, and a customer service representative will assist you in opening your account.

Wema Bank

Wema Bank is also among the Nigerian banks that offer Tier 3 savings accounts to their customers. Below are the benefits you can enjoy when you open a Tier 3 savings account with Wema Bank.

Source: Facebook

- Make deposits of any amount without limitations.

- Accumulate savings without a maximum balance limit.

- Earn an annual interest rate of 1.5% on your deposits.

- Utilise Wema Bank's digital platforms, including ALAT, for convenient banking.

- You can access your funds using Wema debit cards at ATMS, POS terminals, mobile apps, and online banking platforms.

- Get timely notifications of all account activities through SMS and email.

Wema Bank Tier 3 savings account requirements

Below are the requirements to open a Wema Bank Tier 3 savings account.

- A minimum opening balance of ₦2,500.

- Duly completed account opening form, including a signature mandate card.

- Bank Verification Number (BVN).

- Valid ID such as an International passport, driver's licence, National Identification Number (NIN) slip, or Permanent Voter's Card (PVC).

- A utility bill, such as a water or electricity bill, issued within the last three months.

- A recent passport photograph.

How to open a Wema Bank Tier 3 savings account

You can open a Wema Bank Tier 3 savings account using any of the following methods.

Source: Instagram

- Online via ALAT: Go to the ALAT website or download the ALAT app. Then, follow the instructions to complete your application online.

- USSD: Dial *945# and follow the prompts to open an account.

- Visit a Wema Bank branch: Go to any Wema Bank branch, and a representative will assist you in opening the account.

How to upgrade to Tier 3

If you already hold a lower-tier account, such as Tier 1 or Tier 2, and wish to upgrade to a Tier 3 account, follow these steps.

- Download the Wema Account Upgrade or Conversion Form.

- Fill out and sign the form.

- Attach a valid means of ID and a utility bill.

- Send the completed documents to purpleconnect@wemabank.com or help@alat.ng.

Parallex Bank

Parallex is another bank that offers a Tier 3 savings account to its clients. The features and benefits associated with the Tier 3 savings account offered by Parallex Bank in Nigeria include:

Source: Facebook

- No initial deposit required to open the account.

- No minimum balance requirement.

- Competitive interest rate of 4.2% per annum (30% of the Monetary Policy Rate).

- Free intra-bank transfers through the mobile app.

- Daily lodgement of cheques and dividends up to ₦2,000,000.

- Access to mobile banking services, including online statements, SMS alerts, and fund transfers.

- The maximum transfer limit is ₦25,000,000.

Parallex Tier 3 savings account requirements

Check out the Parallex Tier 3 savings account opening requirements.

- Completed the account opening form with the signature mandate.

- One recent passport-sized photograph.

- Bank Verification Number (BVN).

- Valid means of identification (Driver’s license, voter’s card, national ID card, or international passport).

- Proof of residential address.

- Residence permit (for non-Nigerian nationals).

Parallex Bank Tier 3 savings for the diaspora

Parallex also offers diaspora account options through its Tier 3 savings account. Below are the key features and benefits associated with this offering.

Source: Instagram

- Asset acquisition & milestone payments.

- Business support loan available.

- Financial planning services.

- Investment opportunities.

- Zero initial deposit.

- No minimum balance.

- Competitive interest (30% of MPR).

- Cheque/dividend lodgement up to ₦2,000,000 daily.

- Mobile banking: statements, SMS alerts, transfers.

- The transfer maximum limit is ₦25,000,000.

Parallex Bank Tier 3 savings for the diaspora requirements

Check out the requirements for the Parallax Tier 3 diaspora savings account below.

- Completed the account opening form.

- Bank Verification Number (BVN).

- National Identification Number (NIN).

- Valid ID from any of the following: Nigerian international passport, driver’s license, Permanent Voter’s Card, NIN slip/card, or a notarised foreign passport showing Nigeria as your birthplace/country of origin.

- Proof of address from any of the following: Recent utility bill (within 3 months), bank statement (within 6 months). Foreign documents must be notarised, or a local address provided for KYC verification.

- Signature mandate.

- One passport photograph.

TAJBank Limited

Source: Facebook

TAJBank Limited is a leading non-interest financial institution, operating according to Islamic banking principles. It offers a Tier 3 savings account, known as the Qard Tier 3 savings account. The key features of this account include:

- Mobile and internet banking access.

- Debit card availability.

- Cheque deposits up to ₦2 million.

- No minimum opening balance.

TAJBank Limited Tier 3 Qard savings account requirements

Below are the documents needed to open a TAJBank Limited Tier 3 Qard savings account.

- Completed the account opening form.

- One recent, clear passport photograph of the account signatory.

- Valid ID for the signatory (Driver’s license, international passport, national ID card, or voter’s card).

- Residence permit (if applicable).

- A recent utility bill dated within the last three months (e.g. electricity, water, tenement rate, rent receipt, or telephone bill).

- Two independent and satisfactory references are required for cheque deposits exceeding ₦2,000,000.00.

Kuda Bank

Kuda Bank is Nigeria's first fully digital bank, licensed by the Central Bank of Nigeria (CBN). It offers its clients a Tier 3 savings account with the following features.

Source: Facebook

- Unlimited total account balance.

- Unlimited single deposit limit.

- Single transfer limit: ₦1,000,000 (default), up to ₦2,000,000 with signed indemnity, up to ₦25,000,000 upon Enhanced Due Diligence (EDD) and compliance approval.

- Daily transfer limit: ₦2,000,000 by default, up to ₦10,000,000 with indemnity, above ₦10,000,000 with EDD and compliance clearance.

- Airtime purchases: ₦50,000 per transaction, ₦200,000 per day.

- Bill payments: ₦5,000,000 daily limit for betting-related bills, limits for other bill payments depend on the service provider.

- Daily gift card limit is ₦5,000,000.

What is the Wema Tier 3 savings account limit?

Wema Bank's Tier 3 savings account has no upper limit or restrictions on transfers, deposits or total savings. This allows you to save freely and make transfers without any constraints.

How much can a Tier 3 savings account hold?

A Tier 3 savings account in Nigeria generally has no maximum limit on the total balance you can hold, allowing you to deposit and save any amount without restrictions.

The Tier 3 savings account in Nigeria provides advanced features, including no upper limit on deposits and savings, making it perfect for those who need flexible and high-limit banking options. Banks like Kuda Bank, Wema Bank, and Parallex Bank offer these accounts with added benefits.

Source: Original

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Legit.ng recently published an article on how to get a bank statement online in Nigeria from different banks. Bank statements are helpful for financial tracking, reconciling your bank account balance, and identifying discrepancies or errors.

You can generate your bank statement on your bank's mobile application or online banking portal. Alternatively, you can request one from the bank, and the bank will send the statement of account via email. Read on to learn more ways of obtaining a bank statement online.

Source: Legit.ng