What's the best virtual dollar card in Nigeria? Top 10 most popular options

Digital banking providers offering the best virtual dollar cards in Nigeria include Cardtonic, Vesti, ALAT by Wema and GeegPay. These providers prioritise security and convenience, easing access to domestic and international payment services. Discover the most popular and effective virtual dollar cards in Nigeria.

Source: Getty Images

TABLE OF CONTENTS

- Key takeaways

- The best virtual dollar card in Nigeria

- 1. Cardtonic virtual dollar card

- 2. Vesti virtual dollar card

- 3. ALAT by Wema virtual dollar card

- 4. GeegPay virtual dollar card

- 5. Eversend virtual dollar card

- 6. GoMoney virtual dollar card

- 7. Chipper Cash virtual dollar card

- 8. Grey virtual dollar card

- 9. Dantown virtual dollar card

- 10. Cardify virtual dollar card

- How does a virtual dollar card work?

- Which virtual dollar cards in Nigeria are free?

- Is there a Kuda virtual dollar card?

- Is there an OPay dollar card?

Key takeaways

- A virtual dollar debit card is a digital version of the Mastercard traditional plastic or physical debit card.

- It costs between $1 and $5 to create a virtual dollar card in Nigeria.

- While some virtual dollar cards have no maintenance fees, others require about $1 in monthly maintenance.

- The best virtual dollar cards with no maintenance fee in Nigeria include Cardtonic, Vesti, Alat by Wema, GeegPay, GoMoney, Grey and Cardify.

- The best free virtual dollar cards to create are provided by ALAT by Wema, Eversend, and GoMoney.

The best virtual dollar card in Nigeria

Virtual dollar cards are increasingly popular around the world as they ease the process of international trade and travel. From online shopping to subscriptions, bill payments and international money transfers, the cards below offer the best in digital banking. Additionally, discover how to create a virtual dollar card in Nigeria.

Rank | Virtual dollar card | Creation fee | Card maintenance fee |

1. | Cardtonic | $1.5 | None |

2. | Vesti | $10 | None |

3. | ALAT by Wema | Free | None |

4. | GeegPay | $3 | None |

5. | Eversend | Free | $1 |

6. | GoMoney | Free | None |

7. | Chipper Cash | $3 | $1 |

8. | Grey | $4 | None |

9. | Dantown | $1 | $1 |

10. | Cardify | $2 | None |

1. Cardtonic virtual dollar card

Source: Facebook

Cardtonic virtual dollar cards are a favourite among Nigerian users. The globally accepted card costs $1.5 to create and $5 as the minimum funding amount. Here is how to get started with this card;

- Download the Cardtonic app on Google Play and the iOS App Store.

- Sign up by entering your details, such as name, email address and Nigerian phone numbers.

- Complete the Know Your Customer process to verify your account.

- Fund your wallet with Naira or Cedis.

- Click on the 'Virtual dollar card' icon in the application and choose your preferred card type, either Visa or MasterCard.

- Enter your details, and tap on the 'Create virtual card' button to generate the card instantly.

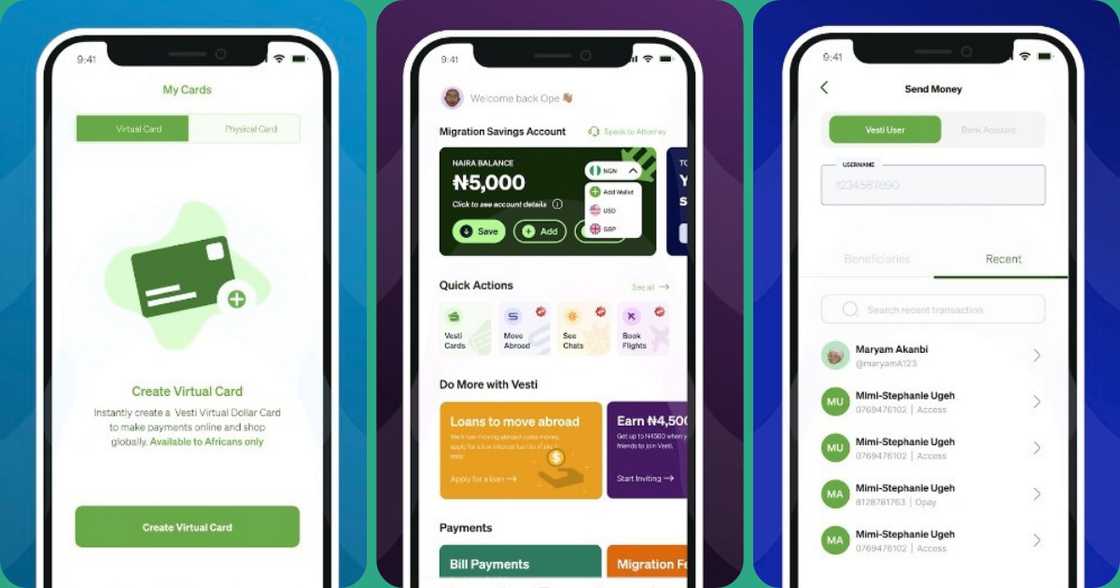

2. Vesti virtual dollar card

Source: Original

The Vesti virtual dollar card is a gift that keeps on giving for Africans moving abroad. The digital banking product allows immigrants moving to the United States, the United Kingdom and Europe to access financial services. To get started, follow the guide below;

- Register in minutes by signing up on the Wevesti website.

- Complete the identity verification process using a government-issued ID and a valid KYC document number.

- Select your desired destination country and begin using the card for international payments.

- Add funds to the Vesti app in Naira by bank transfer or mobile money.

- You need a minimum of $10 to fund your virtual card.

- On the app's cards section, select the virtual dollar card option, which you can start using immediately.

3. ALAT by Wema virtual dollar card

Source: Original

Popularised as Nigeria's first fully digital bank, ALAT by Wema offers virtual dollar cards with zero creation or maintenance fees. Here is how to join and create your very own ALAT virtual dollar card;

- Sign up as a new user on the ALAT website to get a savings account, a free debit card, as well as deals and discounts.

- Enter your details, BVN number and a clear photograph of your face.

- Request a virtual dollar card by navigating the 'Cards' section app or website.

- Fund your card by transferring money from your main ALAT account.

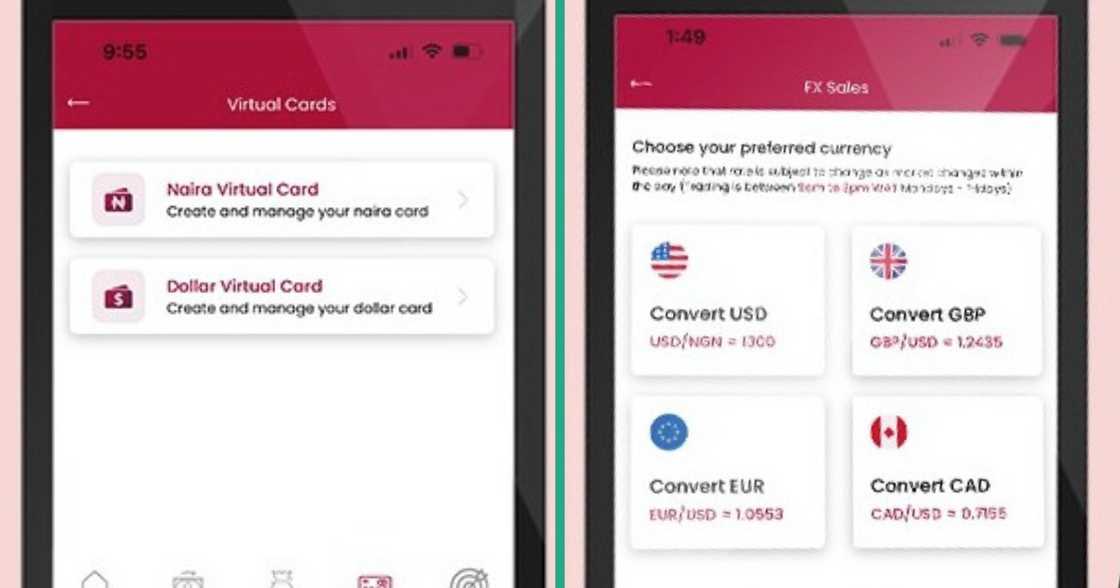

4. GeegPay virtual dollar card

Source: Original

GeegPay offers Nigerian users a USD virtual debit card at a fee of $3 and no maintenance charges. The card offers you a means for global payments for all business transactions.

- Visit the official Geegpay website and log in using your registered email address and password.

- Once logged in, navigate to the 'Cards' section on the Geegpay dashboard.

- Look for the 'Get a Virtual Card' option and click on it.

- Enter your name as you want it to appear on the virtual card.

- Select the type of card you prefer, either Mastercard or Visa, and the preferred card colour to personalise.

- Click on the 'Continue' button to proceed with the virtual card creation.

- To create the virtual card, a one-time fee of $3 and an initial deposit of $2 are required for creation and card activation.

- Choose the currency in which you want your virtual card to be denominated.

- Click 'Create Card' to finalise the process and use it.

5. Eversend virtual dollar card

Source: Twitter

For a zero charge for card creation and a minimum loading amount of $1, the Eversend virtual dollar card is one of the cheapest virtual dollar cards in Nigeria. You have two plans, one with a monthly recurring cost of $1 and another with a one-time fee of $3. Here is how to get started;

- Create an Eversend account by downloading the Eversend app from your smartphone’s app store or the official Eversend website.

- Enter your basic information and verify your identity using your passport or national identification card and a selfie video.

- Navigate to the 'Cards' section and click on the plus sign to create a new virtual dollar card.

- Choose the specific card you want and, preferred card colour.

- Tap on the 'Fund' button and select a wallet that has funds to add to the card in your preferred currency.

6. GoMoney virtual dollar card

Source: Twitter

The GoMoney virtual dollar card by Raenest offers Nigerian customers maximum security in digital banking. Here is how to set up the free GoMoney virtual dollar card;

- Create a GoMoney app account by downloading it from your smartphone’s app store.

- Enter your basic information and verify your identity using your BVN number, passport or national identification card and a selfie video.

- Swipe right on the GoMoney app, click on 'Cards' beside accounts on the top left side of the home screen.

- Select 'Get a virtual card.'

- Choose and confirm a PIN for your card.

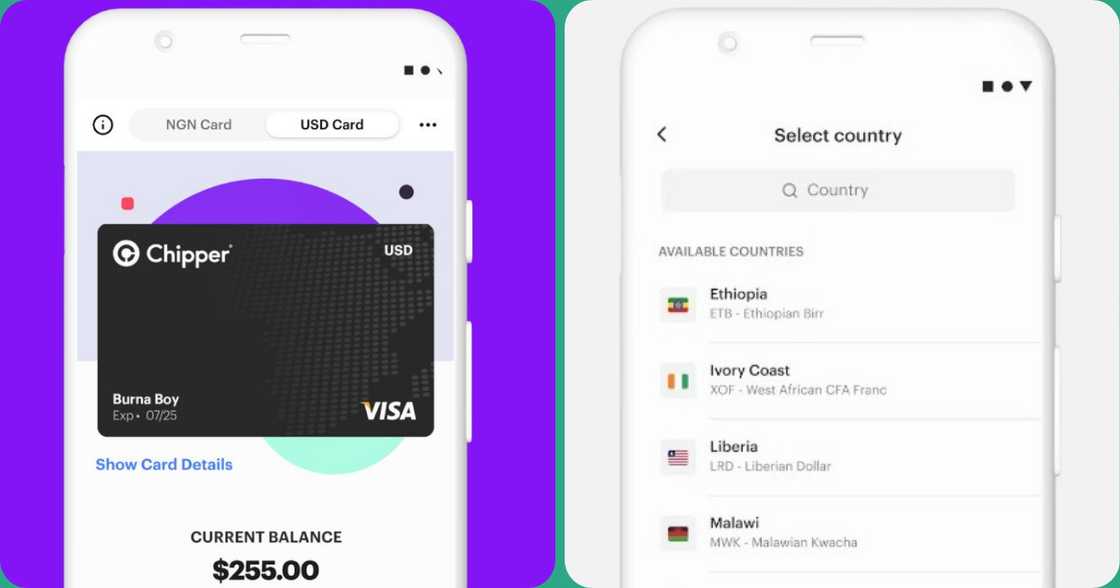

7. Chipper Cash virtual dollar card

Source: UGC

This reloadable virtual dollar card by Chipper Cash costs $3 for creation, with a monthly maintenance fee of $1. Other charges include an original credit transaction cost of 1% of all received funds and a $1 flat fee for transactions less than $4. Here is how to get started on the Chipper Cash virtual dollar card.

- Download the latest version of the Chipper Cash mobile application on your Google Play Store or iOS App Store.

- Log in to your Chipper account.

- Top up funds on your Chipper wallet in Naira.

- Tap the 'Card' icon in the top right corner of your phone and click on the 'Claim Card' to get your card.

- Complete the verification process by adding your identification documents, Nigerian address, and phone number.

- Select your preferred identification document: NIN number, driver's license, or passport.

- Choose which card you would like to create (USD Card) and tap the 'Next' button.

- To add funds, go to your 'Card' tab on the app and click on the plus sign.

- Select your preferred source of funds, enter the amount you would like to add, and click on the 'Top Up' button.

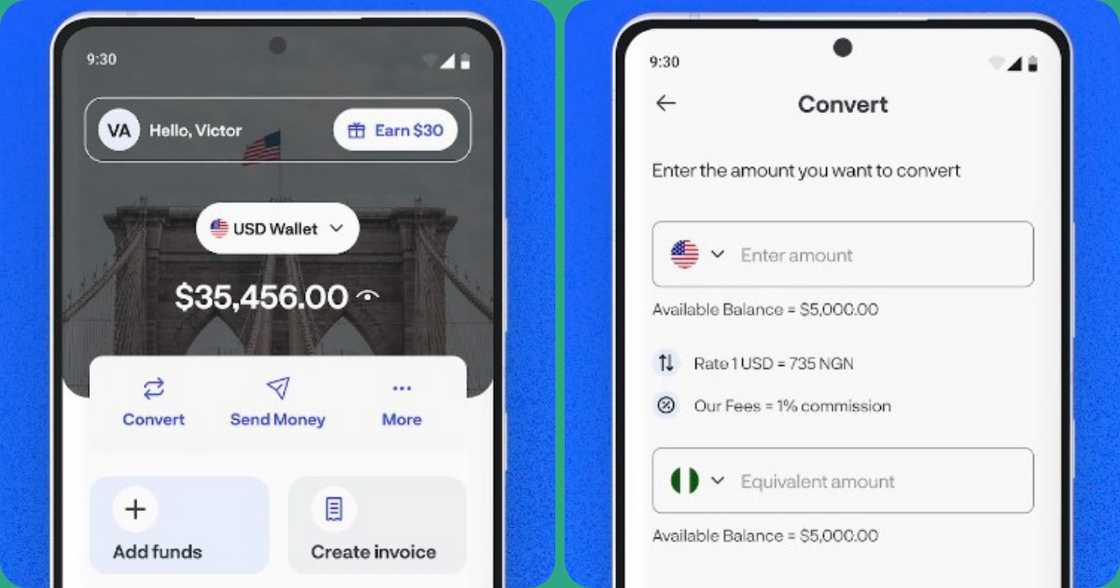

8. Grey virtual dollar card

Source: Twitter

The Grey virtual dollar card is a must-have for frequent travellers and freelancers. You will need to pay at least $5 to create a card. Get started by using the steps below;

- Create an account on the official Grey website.

- Once signed in, click 'Virtual cards' on the sidebar and click on the 'Get Started' button.

- Tap on the 'Create Virtual Card' button and follow the prompts to request a card.

- Fund your Grey wallet in Naira, pounds or euros and convert them into US dollars by selecting the USD currency in 'Accounts'.

- Load your virtual dollar account with any amount between $2 and $2,500.

9. Dantown virtual dollar card

Source: Twitter

The Dantown virtual dollar card is one of the cheapest options. Other benefits include no spending limits or decline fees. Follow the steps below to get a Dantown virtual dollar card in Nigeria;

- Download and log in to your Dantown App.

- Complete the verification process by providing your identification documents and other necessary documentation.

- Navigate to the 'Virtual card' section and click on the 'Create Card' section.

- Input your BVN and click 'Enter' to create your virtual card.

- Complete the validation process by uploading a selfie.

- Fund your card by transferring the desired amount in USD to your card.

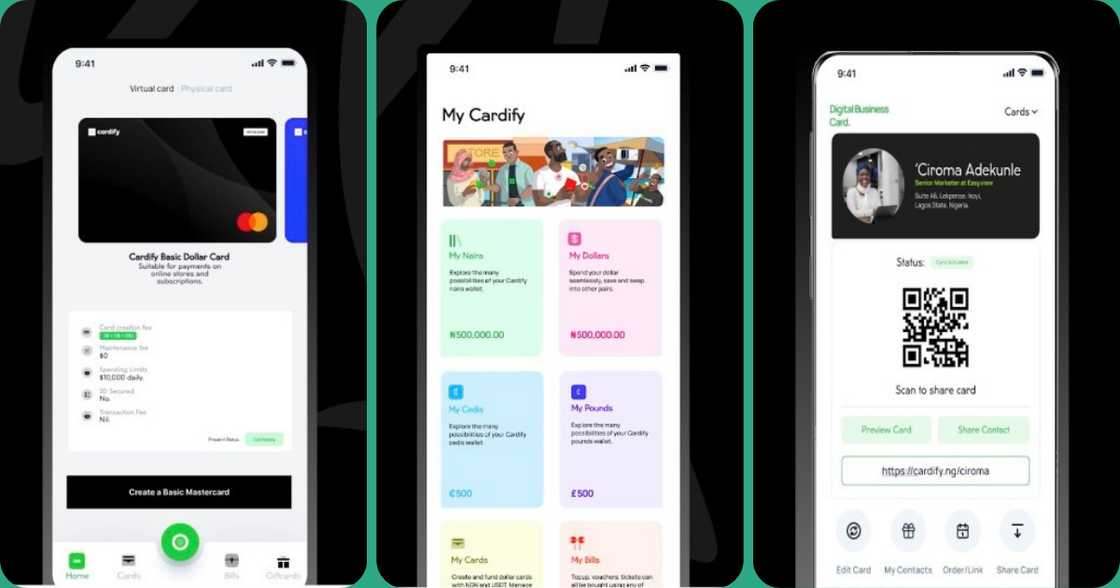

10. Cardify virtual dollar card

Source: Original

Cardify virtual dollar cards are digital debit cards that users can create and fund with NGN and USDT. Here is how to get the card available as Basic Dollar Cards (Mastercard) and the Standard Dollar Card (Visa);

- Download and sign up to create an account on the Cardify mobile app.

- Create a virtual debit card by navigating to the 'Cards' section and choosing the desired type, either basic or standard.

- Transfer funds in Naira from your Nigerian bank or US dollars to your unique Tron network USDT wallet address provided by Cardify.

- Fund your virtual dollar card by allocating funds in Naira or US dollars from your Cardify wallet.

How does a virtual dollar card work?

A virtual dollar card functions like a traditional debit or credit card, providing a unique card number, expiration date, and CVV code that can be used for online transactions. The main advantage is that it allows you to make digital payments like you would with a physical debit card.

Which virtual dollar cards in Nigeria are free?

There are various free virtual dollar cards available in Nigeria. Those free to create include ALAT, Fundall, Eversend and GoMoney.

Is there a Kuda virtual dollar card?

No. Kuda Bank does not offer a virtual dollar card. However, that can only be used for online payments, but not specifically for US dollar transactions.

Is there an OPay dollar card?

An OPay account provides a virtual card for online payments in local currency, However, it does not offer a card but specifically for US dollar transactions.

The best virtual dollar cards in Nigeria provide customers with competitive features such as affordable creation, maintenance and transaction fees. In addition to instant activation, the cards allow Nigerian users to load them with affordable minimum local currencies.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Legit.ng has recently published an article detailing the process of sending and receiving dollars on OPay. OPay was established to provide a financial service platform for Nigerians.

OPay allows customers to make transfers, payments, and take out loans, but does not directly handle US Dollar transactions. Read on to find out how Nigerians can still send and receive money in US dollars through OPay.

Source: Legit.ng