Crypto and Compliance: Understanding Nigeria’s Youth, Markets, and Tax Reform

- Driven by the desire to earn big, young Nigerians are drawn to Bitcoin, Solana, MetaTrader, Pi Network, and Ethereum: digital assets built on blockchain technology

- Thousands of Nigerian youths turned to cryptocurrency as a last resort amid an economy that, until recently, was struggling under high inflation and volatile exchange rates

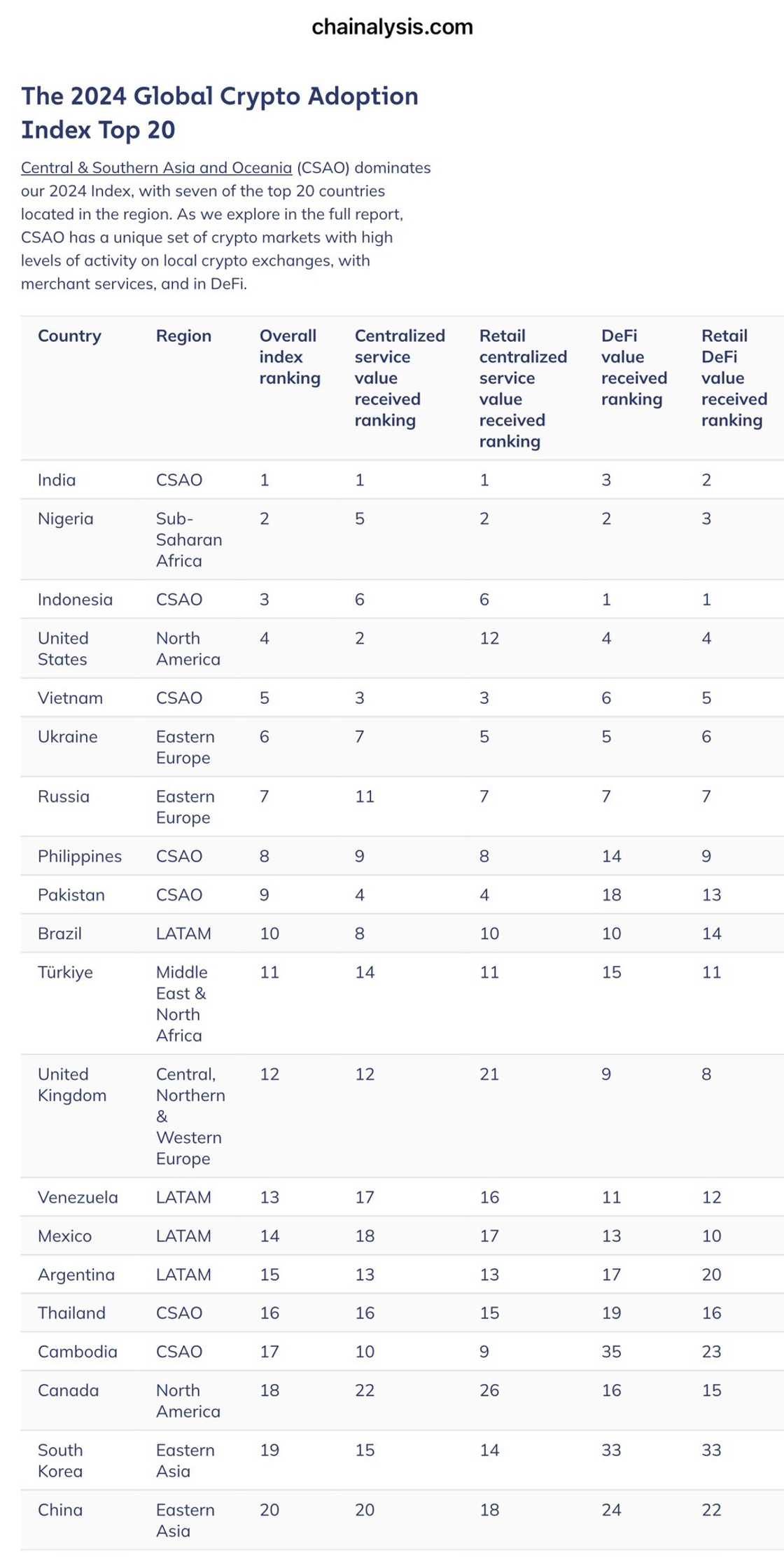

- Over the past year, Nigeria has quietly transformed into one of Africa’s fastest-growing hubs for cryptocurrency activity, even as new tax reforms are yet to fully take effect

Legit.ng journalist Ridwan Adeola Yusuf has over 5 years of experience covering economic matters in Nigeria and Africa.

FCT, Abuja - Adewale Abdulkabir belongs to Nigeria’s youth-heavy population, a demographic that remains deeply engaged with cryptocurrency, a digital currency that operates on a decentralised public ledger known as a blockchain.

In 2021, when Nigerian authorities blocked the websites of major crypto exchanges, the appeal of making a quick buck, which had drawn young people like Abdulkabir to risky assets such as cryptocurrency and non-fungible tokens (NFTs), was somewhat dampened.

Source: UGC

In December 2023, the West African nation lifted its ban on cryptocurrency, citing global trends that highlighted the need to regulate digital assets rather than prohibit them. Crypto platforms now operate under the oversight of the Securities and Exchange Commission (SEC), while a comprehensive tax framework is expected to take full effect on Thursday, January 1, 2026. The government has pledged to implement a fair, balanced, and globally competitive tax regime as it seeks to tap into proceeds from crypto-related activities.

However, amid the transition, Nigerian traders and users who spoke with this reporter described the lifting of the ban as a “mere formality.” They questioned the rationale behind taxing virtual assets while access remains constrained, noting that the websites of several leading crypto exchanges are still partially restricted and often accessible only through virtual private networks (VPNs).

Source: Original

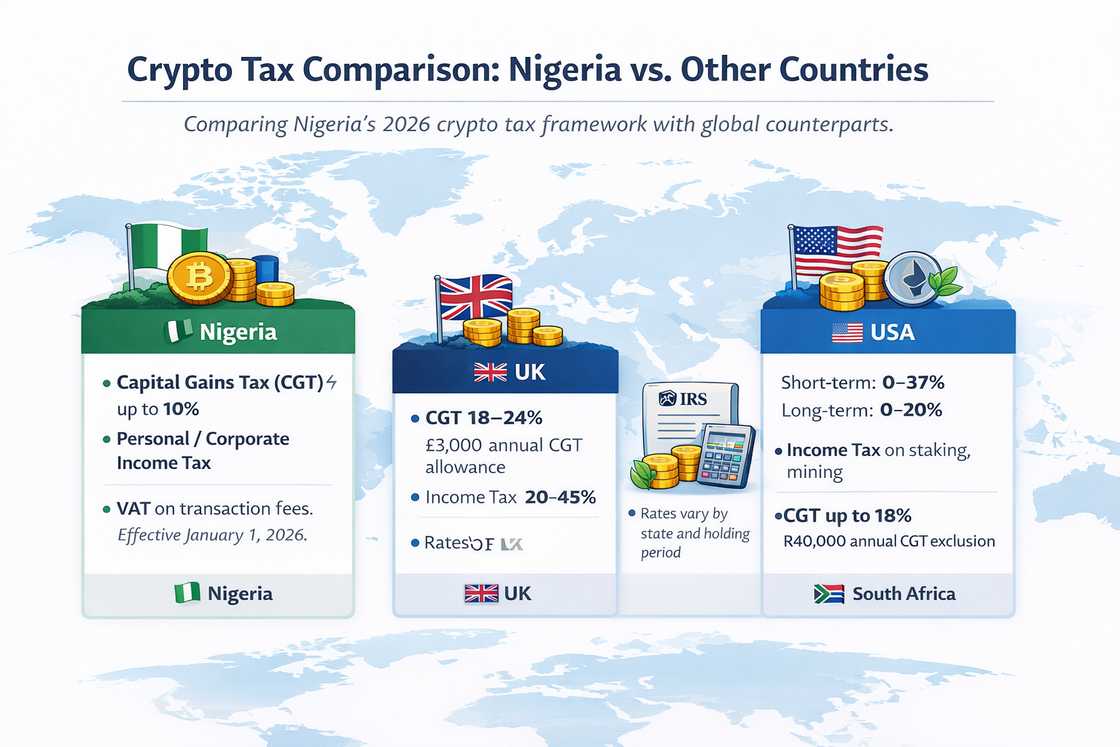

“I don’t think taxing virtual assets like crypto is fair,” Abdulkabir argues. “However, NFTs are essentially digital artworks, similar to traditional art, so taxing them makes sense. And compared with the 30% tax on crypto gains in many other countries, the rate here is relatively balanced and globally competitive.”

How Nigeria compares to UK, others

Incomes earned from virtual assets, including cryptocurrency, are not newly taxable under the country’s revised tax laws. Rather, such income has long been subject to taxation under the existing Personal Income Tax Act, with the new legislation largely aimed at clarifying the framework and closing ambiguities.

An investor who requested anonymity, citing financial privacy concerns, explained that transactions exiting crypto platforms already attract fees. According to him, users are charged a 0.01 fee before funds can be moved off a platform.

“For example, if I am purchasing 50 Ethereum, which converts to N219,040,766.35, the platform deducts a 0.01 charge from the transaction,” he says.

Internationally, crypto taxation regimes vary. In the United Kingdom, crypto gains are subject to Capital Gains Tax (CGT) after a £3,000 annual allowance for the 2024/25 tax year. Gains are taxed at 18% or 24%, depending on an individual’s income band, following rate increases from 10% and 20% after October 30, 2024. Income earned from crypto activities such as staking or mining is taxed as regular income, with rates ranging from 20% to 45%. Traders pay the basic CGT rate of 18% if their total taxable income falls within the basic rate band, and 24% if it falls within the higher band.

In the United States, crypto gains are taxed as capital gains, with rates determined by the holding period. Short-term gains (on assets held for less than one year) are taxed as ordinary income at rates between 0% and 37%, while long-term gains benefit from lower rates of 0%, 15%, or 20%. In addition, crypto received as income, such as staking rewards, is subject to federal income tax and, in some cases, state taxes. High-income earners may also be liable for an additional 3.8% Net Investment Income Tax.

Source: UGC

South Africa similarly distinguishes between investment and trading activity. Crypto gains are taxed either as capital gains (at a maximum effective rate of 18% for individuals after a R40,000 annual exclusion) or as income, with marginal rates of up to 45% for frequent or high-volume traders. While long-term holdings may qualify for CGT treatment, mining and staking rewards are generally considered taxable income. The South African Revenue Service (SARS) classifies cryptocurrency as an asset and requires all profits to be declared.

Crypto gains under tax spotlight

The recent debate over the proposed 2026 tax laws has intensified focus on attitudes toward taxation in Nigeria.

Findings show that many young Africans engage in spot trading or cryptocurrency mining. Nigeria alone leads with $59 billion in crypto trades, while the West African region recorded $125 billion between 2023 and 2024. Yet, these crypto enthusiasts have reservations about the government’s tax-levying power.

Cryptocurrency holder Abdulkabir shares:

"Generally, I’m not against taxation. My concern is whether the taxes collected are actually being used for the development of the country."

Similar concerns were echoed by a cryptocurrency futures trader who prefers not to be named.

He told Legit.ng:

"The new tax laws in Nigeria are focused on widening the tax net, especially in the digital space. Crypto proceedings are now subject to personal income tax, and transaction fees may also attract VAT. As a trader, this directly affects my earnings by reducing my net profit. While I understand the economic reason for these taxes, my main concern still remains how the government is able to transparently and effectively use the revenue."

Source: Facebook

2026 crypto taxes: What traders need to know

To clarify common concerns about the impact of the new tax laws on crypto traders and investors, this reporter reached out to tax expert Bamgboye Adeniyi Emmanuel, who offered insightful explanations.

His key points are outlined below:

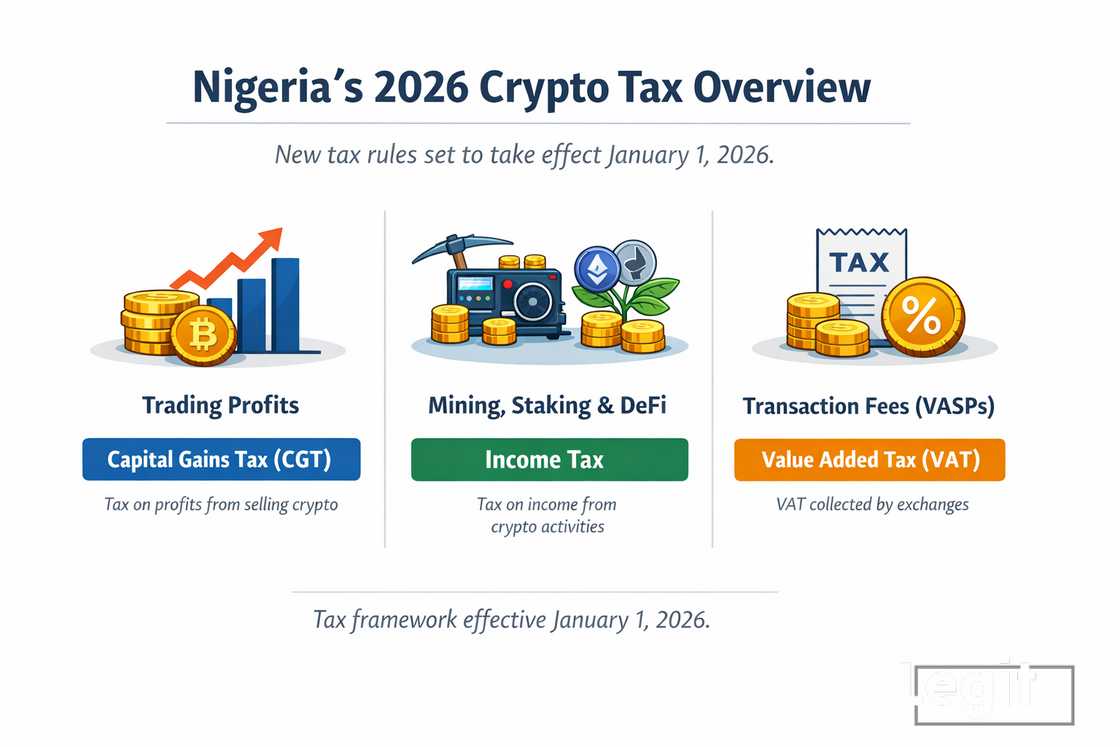

How will 2026 taxes impact crypto?

- The laws will likely bring greater formalisation and clarity.

- CGT will almost certainly apply to profits from selling cryptocurrencies (trading).

- Income from mining, staking, lending, and DeFi activities will likely be subject to personal or corporate income Tax.

- Expect more stringent reporting requirements for traders and crypto exchanges (VASPs).

Source: Original

Will crypto transaction fees attract VAT?

- Yes, it is highly probable that transaction fees charged by crypto exchanges (VASPs) for their services will attract VAT.

- This VAT would be collected by regulated exchanges, similar to other service fees, and remitted to the Federal Inland Revenue Service (FIRS). The tax applies to the service of facilitating a trade, not the crypto asset itself.

What challenges will crypto traders face?

- Complexity and lack of understanding: The diverse and technical nature of crypto activities (trading, mining, DeFi) will make it hard for traders to grasp specific tax obligations.

- Record-keeping difficulties: Tracking transactions across multiple platforms, wallets, and accurately calculating cost basis for various activities will be a major hurdle.

- Enforcement challenges for FIRS: Widespread P2P trading, reliance on offshore/unregulated exchanges, and the decentralised nature of many crypto activities will make monitoring and enforcement very difficult.

- Trader sentiment and resistance: Existing distrust in government taxation, the perceived anonymity of crypto, and the effort of tracking many small transactions could lead to non-compliance.

- Regulatory ambiguity: Initial implementation will likely face periods of unclear guidance for both taxpayers and authorities.

As Nigeria aims to integrate crypto into its formal tax structure, it is expected that both traders and authorities will face significant challenges in navigating this complex and rapidly evolving digital asset landscape.

Source: Legit.ng