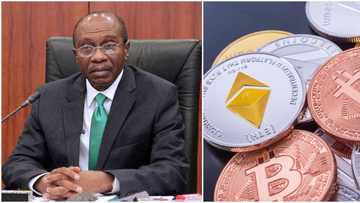

How N110m Crypto Trade, Others Forced CBN to Close Riseinvest, Bamboo Accounts, to Go After Fintechs in US

- The accounts of Bamboo, Riseinvest, Chaka Technologies, CTL/Business Expenses, and Trove Technologies Limited have been closed

- The financial technology companies' accounts were closed by the Central Bank of Nigeria due to various financial contravention

- CBN looks to solicit US assistance in its clampdown against Bamboo, Riseinvest, Chaka Technologies, Trove Technologies, others

The Central Bank of Nigeria (CBN) has turned its attention to tech-enabled investment platforms in Nigeria as the apex body freeze the accounts of Bamboo, Riseinvest and three others.

The CBN received a court exparte order to freeze the accounts after accusing the tech companies - among which are Chaka Technologies, CTL/Business Expenses, and Trove Technologies Limited - of operating illegally in the country.

Why CBN froze accounts of Bamboo, Riseinvest, Chaka, others

It was gathered that the six fintech firms are contributing factors to the devaluation of the naira and they don't have licenses to operate as asset management firms in Nigeria.

Read also

CBN insists Crypto trading is illegal transactions, asks court to freeze accounts of fintech firms

Source: Getty Images

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

According to Micheal Aondoakaa (SAN), counsel to the CBN Governor, Godwin Emefiele, the mentioned asset managers illegally purchase foreign bonds/shares with the forex sourced from the Nigerian foreign exchange market.

Aondoakaa, who is the former Attorney-General of the Federation and Minister of Justice, said the activity contravenes CBN circular with reference No: TED/FEM/FPC/GEN/01/012 and dated July 01, 2015.

The startups trade in foreign securities on behalf of their users or clients who are interested in owning shares in companies like Amazon, Netflix, Microsoft, Alibaba and more global firms.

Role of cryptocurrency in CBN clampdown on Riseinvest account

According to the statement from CBN, it was gathered that Riseinvest was involved in cryptocurrency activities, using its Nigerian account despite an embargo from CBN.

Legit.ng had previously reported that the CBN banned activities of crypto exchanges in Nigeria on February 5, 2021, directing banks to shut down the cryptocurrency accounts.

The financial regulator said cryptocurrency purchases worth N110 million was recorded as outflow from Riseinvest account to BuyCoins, a Nigerian-owned cryptocurrency exchange.

According to the CBN, the digital currency trade by Riseinvest indicated that the company contravened its circular referenced BSD/DIR/PUB/LAB/014/001, dated February 5 2021.

How long will Bamboo, Riseinvest, Chaka, others accounts be frozen?

The CBN asked that the Federal High Court, presided by Justice Ahmed Mohammed, on Tuesday, empower it to freeze the accounts of Bamboo, Riseinvest, Chaka, Trove, and CTL/Business Expenses for 180 days.

This means that the companies will not have access to their Nigerian accounts in Zenith Bank, Standard Chartered Bank, Guaranty Trust Bank, Access Bank, VDF Microfinance Bank until February 2022, when CBN concludes its investigation.

Will CBN freeze Bamboo, Riseinvest, Chaka accounts in foreign countries?

For Riseinvest, about N960 million was said to be recorded as outflow through Paystack, Buycoins and Beltlum Venture. This outflow, the CBN said is worrisome, and must be stopped.

In the court defence of its exparte request, the CBN said it is worried about how monies were leaving the country, and it will liaise with the US embassy and foreign affairs to curb the leakage.

Aondoaka said:

“We need to write the Embassy, we need to go to the Foreign Affairs….the Minister will serve the US to seek assistance so that we can block this linkages.".

Riseinvest, Bamboo says investment safe despite clampdown

Two of the major companies involved in the faceoff with CBN, Bamboo and Riseinvest said the frozen accounts won't put investors capital at risk.

Riseinvest said funding and withdrawals will continue to be processed without restriction, claiming that its business activity is regulated by third parties in all jurisdictions in which it operates.

With the CBN eyeing the U.S for assistance to extend its restriction, Riseinvest said the company's U.S operations remain intact while it continues Communications with Nigerian regulators.

While Bamboo stated that it is aware of the situation, and will deploy its legal and government relations teams to resolve it, adding that investors can easily access their investment.

CBN eyeing October for launch of Nigeria's digital asset

Legit.ng had previously reported that the CBN is planning on introducing digital currency backed by the government to the Nigerian market.

The financial regulator has scheduled October this year for the launch. This is coming at a period the apex bank warned against cryptocurrency trading.

Source: Legit.ng