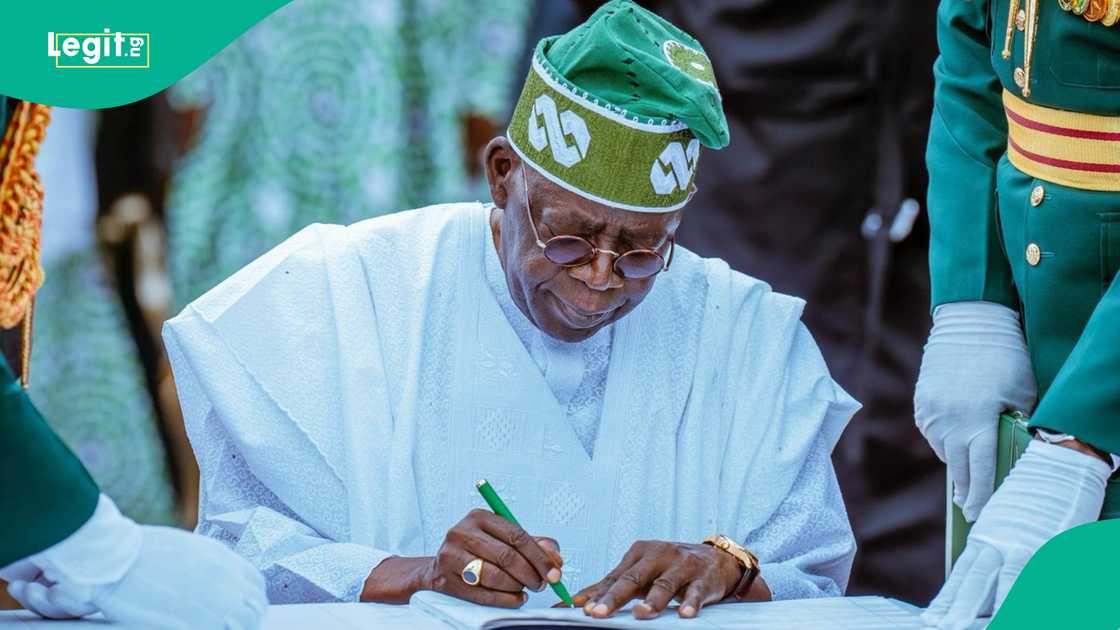

Tinubu’s Tax Reforms Tipped as Lifeline for Nigeria’s Economy, Says FIRS Boss

President Bola Tinubu’s ongoing tax overhaul is emerging as one of the country’s strongest tools for rebuilding public finances.

This was the central message delivered by Dr Zacch Adedeji, Executive Chairman of the Federal Inland Revenue Service, during the inaugural Distinguished Lecture Series at the University of Ilesa in Osun State.

Source: Facebook

Turning revenue pressure into opportunity

The event, hosted by Vice Chancellor Professor Taiwo Olufemi Asaolu, brought together academics, policymakers, industry leaders and students to examine how Nigeria can navigate a period of shrinking revenues and global uncertainty.

Adedeji used the platform to frame the country’s revenue challenges not as a looming crisis but as a chance to rewrite old systems and build stronger ones under the current administration.

Global headwinds demand structural changes

In his lecture titled Economic Resilience in an Era of Dwindling Revenue, he traced the pressures facing public finance across the world.

He pointed to rising debt, shifting global markets, climate risks, technological disruptions and overlapping economic shocks that have pushed many countries to rethink how they generate income.

For Nigeria, he said, the answer lies in stronger institutions, a broader revenue base and a tax system built for the digital age.

Four pillars of a resilient economy

Adedeji broke Nigeria’s economic resilience strategy into four pillars. The first is fiscal flexibility, which he described as the ability to adjust quickly to unpredictable global trends.

The second is policy coherence, ensuring that government agencies work toward the same revenue vision.

The third is institutional strength, which depends on reforming public institutions so they can deliver efficiently.

The fourth is human capital adaptability, a commitment to equipping Nigerians with the skills they need to thrive in fast-changing industries.

Non-oil revenue at the heart of reform

A significant part of his speech focused on the importance of growing non-oil revenue.

He noted that Nigeria must shift away from an overreliance on crude oil earnings and instead expand its tax base through innovation, transparency and easier compliance.

This, he explained, is at the core of President Tinubu’s renewed hope agenda for the tax sector.

How FIRS is modernising tax administration

Adedeji highlighted some of the major changes already underway at FIRS. These include the automation of core tax processes, wider use of the TaxPro Max platform, stronger taxpayer identification systems and formal partnerships with state governments aimed at reducing fragmentation.

Each of these efforts, he said, is focused on building a simpler, more transparent and more efficient tax system.

Universities urged to drive economic solutions

He also turned his attention to Nigeria’s universities, urging them to play a more active role in shaping national economic reforms.

He called for deeper collaboration between government and academia to design evidence-based models for digital taxation, revenue growth and economic diversification.

He described higher institutions as powerful engines of research and innovation that can strengthen policy development and sharpen Nigeria’s competitive edge.

Building a stable and inclusive future

Adedeji closed by stressing that tax reform goes beyond revenue generation.

For him, it represents a long-term strategy to strengthen economic stability, support sustainable development and build a future in which Nigeria is more resilient to global shocks.

Source: UGC

Expert explains why savings are not under government attack

Legit.ng earlier reported that an Abuja based financial analyst, Omowunmi Samuel, has clarified that Nigeria is not introducing any new tax on personal savings.

She explained that the Federal Inland Revenue Service is only enforcing an existing law that has always applied to interest earned from investment instruments.

Her clarification comes after social media posts suggested that the government plans to impose fresh taxes on Treasury bills, corporate bonds, and other short term securities. Samuel said these claims are misleading and have created confusion about how investment income is taxed in the country.

Source: Legit.ng