Year in Review: Nigeria’s Economic Performance in 6 Charts- the Good, the Bad

Legit.ng Journalist Dave Ibemere has over a decade of experience covering Tech, Energy, Stocks, Investments, and the Economy.

As the curtains closed in 2023, the Nigerian economy found itself at the intersection of growth and adversity.

From the free fall of the naira, mounting debt, and inflation, to the positive, robust performance of the banking sector, stock market, it has been a year filled with a few ups and many downs.

Using data from the National Bureau of Statistics, the Debt Management Office((DMO), and various economic reports, Legit.ng provides a snapshot of the Nigerian economy in six charts.

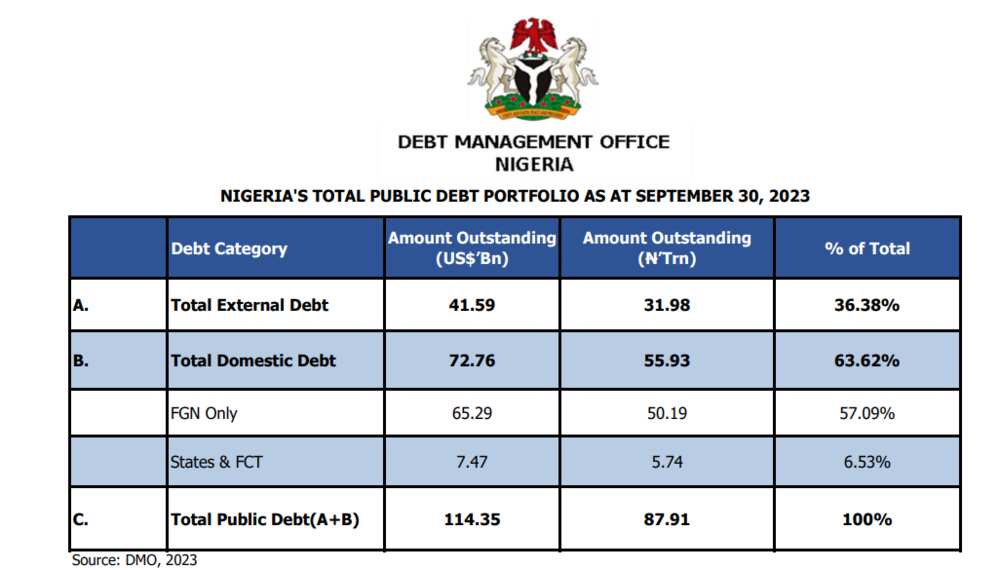

Debt

Similar to previous years, the Nigerian government accessed the debt market to address its fiscal deficit.

According to data from DMO, Nigeria's total public debt, including external and domestic debts stock which stood at N41.66 trillion, increased to N87.91 trillion as at the end of September 2023.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

This represents a massive N41 trillion jump in the space of 9 months.

It is, however, important to clarify that the increase was largely due to the secularisation of the Central Bank of Nigeria's (CBN) ways and means.

Source: Facebook

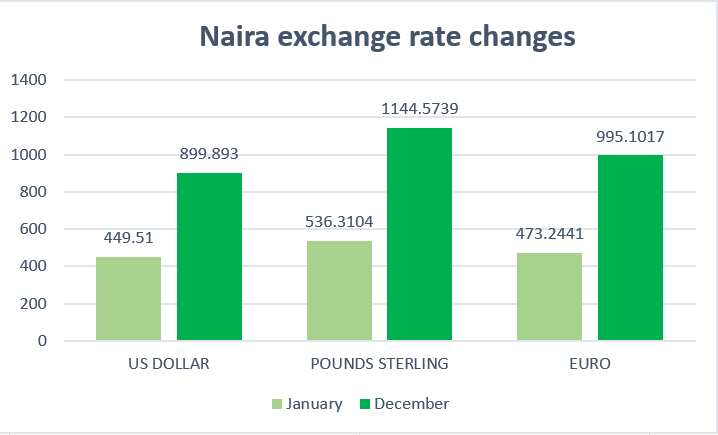

Exchange rate

In 2023, the Central Bank of Nigeria implemented a number of foreign exchange policies and reversed others from the previous administration to strengthen the Nigerian currency and close the gap between various exchange markets.

Despite this, the naira finished 2023 as the world’s worst-performing currency after the Argentine peso and the Lebanese pound among the 151 currencies tracked by Bloomberg.

Legit.ng reported that in June 2023, the apex bank announced the floating of the naira to allow the Nigerian currency to find its true value.

However, this decision exacerbated the already precarious situation for the naira in both the official and unofficial exchange markets.

In the official market, the naira closed on Friday, December 29, 2023, at N907.11 per US Dollar, indicating a depreciation in value of 49% compared to its opening rate of N461.5 per $1 at the beginning of the year.

Meanwhile, in the parallel market, also known as the black market, the naira declined from its pre-floating rate of N650 to close the year at N1,099.05 to a dollar.

By the end of 2023, the disparity between the official and unofficial windows stood at N307.89, despite the CBN's efforts to unify the exchange rate markets.

Source: Facebook

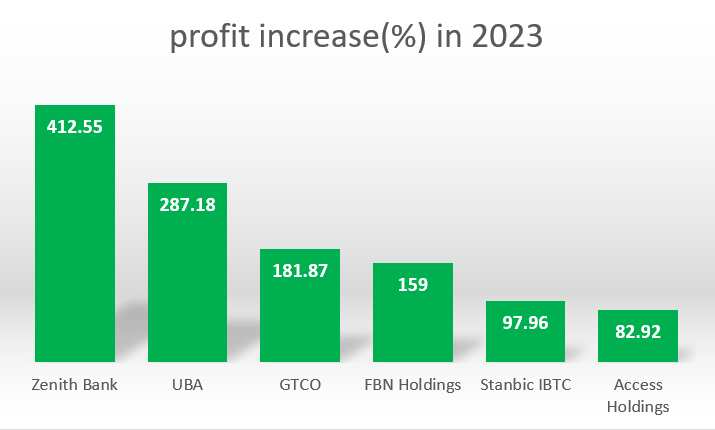

Banking Industry

The banking sector performance in 2023 is one of the few highs of the Nigerian economy.

Data from the banks' financial statements showed that six Nigerian banks in Nigeria grew their combined profits by 214% to N2.06 trillion in the period ended September 2023.

The report showed that all banks recorded triple-digit growths in their profit led by Zenith Bank, whose total comprehensive income for the period increased by 412.55% to N647.74 billion from N126.37 billion.

Also, UBA experienced a 287.18% increase in profit over the period to N109.25 billion. GTCO experienced a 181.87% increase in its profit to N367.41 billion from N130.35 billion.

FBN Holdings recorded a 159% increase to N236.50 billion. Stanbic IBTC saw its profit rise by 97.96% to N109.25 billion.

Access Holdings also increased by 82.92% to N250.44 billion from N136.91 billion as of Q3, 2022.

Source: Facebook

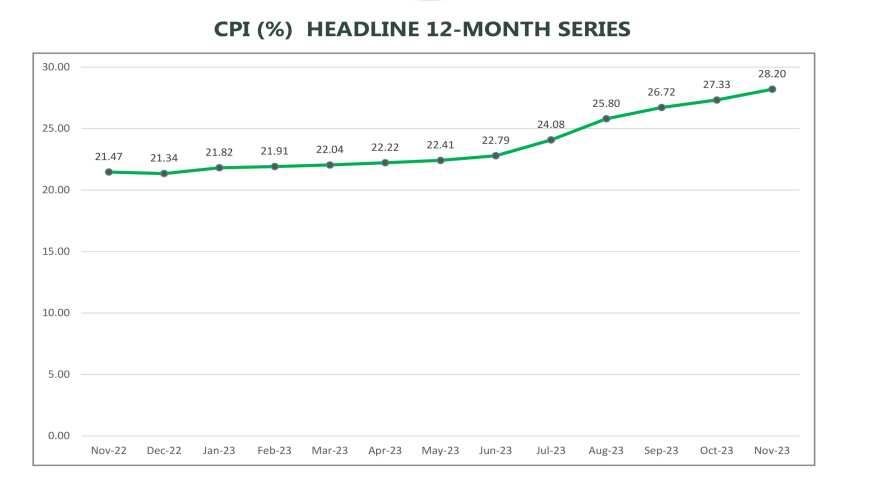

Inflation

This marks yet another low point for the Nigerian economy in the outgoing year of 2023.

According to NBS data, Nigeria's inflation rate, which began at 21.82% in January, consistently increased throughout the year.

It climbed to 21.91% in February, 22.04% in March, 22.22% in April, 22.41% in May, 22.79% in June, 24.08% in July, 25.80% in August, and further escalated to 26.72% in September.

The most recent data reveals a staggering surge, with inflation jumping to 27.33% in October and 28.20% in November 2023.

These figures indicate a significant decline in the financial well-being of Nigerians throughout 2023.

Source: Facebook

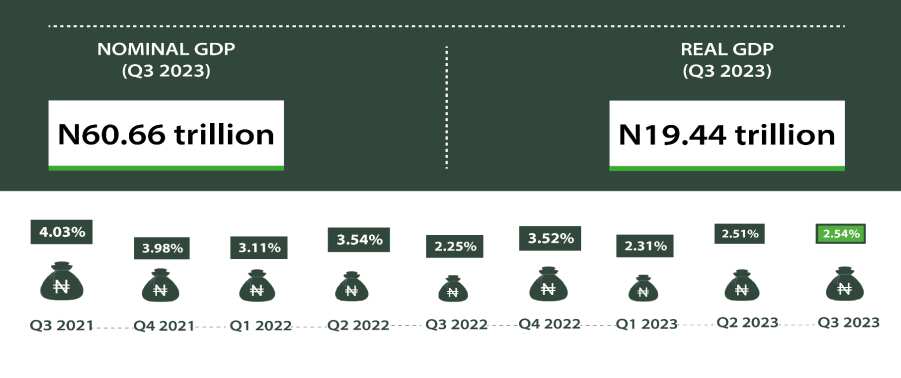

Nigeria’s Gross Domestic Product (GDP)

Economic growth, as gauged by the percentage change in Gross Domestic Product (GDP), signals a sluggish performance for the Nigerian economy in 2023.

NBS data shows that the real GDP grew by 2.31% in the first quarter of 2023, is a decline from the 3.11% recorded in the same period of 2022 and the 3.52% in the fourth quarter of 2022.

Similarly, the second quarter of 2023 saw Nigeria's GDP grow by 2.51%, a slower pace compared to the 3.54% in the corresponding period of 2022.

There was a slight uptick in the third quarter of 2023, showing a 2.54% growth rate, surpassing the 2.25% recorded in the third quarter of 2022.

The fourth-quarter GDP growth rate is yet to be released.

The overall performance suggests that the Nigerian economy will likely experience a slower growth rate in 2023 when compared to 2022.

Read also

US media agency delivers powerful prediction on naira in 2024 as it emerges worst currency in 2023

Source: Facebook

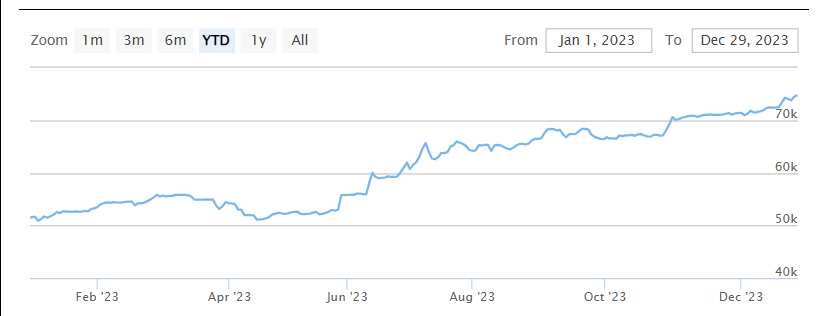

Stock performance

This is one of the positives of 2023, as the stock market community cheered some of the economic decisions of the Tinubu administration.

Nigerian stocks closed 2023 by gaining 46.6 per cent or N13 trillion. This means that the market value of equities improved by almost half when set beside that of last year.

The Nigerian Exchange Limited All-Share Index (NGX ASI) reached an all-time high of 74,773.77 points in 2023.

One sector that benefited from Tinubu's administration is the banks.

At the close of trades on Friday, December 29, the NGX Banking Index stood at 887.60 basis points, gaining 112.60% or 470.1 basis points Year-to-Date (YtD) from the 417.5 basis points it opened for trading in 2022.

In the same vein, the stock market's return stood at 44.43% as of December 22, higher than the country's inflation rate, which rose to a fresh 18-year high of 28.20% in November.

Read also

Naira sets another exchange rate record, closes gap with black market, World Bank makes prediction

The performance was so good that United Bank for Africa Plc and Sterling Financial Holdings Company Plc recorded over 200% YtD return for investors.

While the likes of Unity Bank Plc, Fidelity Bank Plc, Access Holdings Plc, and FBN Holdings recorded over 100% stock price appreciation.

Wema Bank Plc, the sole banking stock with a 40.77% YtD return as of December 22, saw the likes of Ecobank Transnational Incorporated (ETI), Zenith Bank Plc, Guaranty Trust Holding Company Plc, Stanbic IBTC Holdings Plc, and Jaiz Bank Plc recording above 50% YtD average return in 2023.

According to Uche Uwalake is a Professor of Capital Market and the Director of the Nasarawa State University Institute of Capital Market Studies, the years was very good for Nigerian stock market.

He added:

"There was a lot of reasons to smile for investors despite macroeconomic headwinds occasioned by fuel subsidy removal and exchange rates unification in 2023.

Read also

Year in review: Cash scarcity and other 10 events that made life difficult for Nigerians in 2023

"The Nigerian Exchange All Share index (ASI) defied economic shocks posting an impressive return of 45.9% thereby outperforming most emerging and developed markets.

For context, the Year-to-Date returns in respect of the Morgan Stanley Capital International (MSCI) for Emerging Markets and Developed Markets were 6.8% and 18.5% respectively.

"With inflation rate in Nigeria at 28.2% as of November 2023, virtually all major sectoral indexes recorded positive real returns."

Source: Facebook

Economists predict naira to dollar exchange rate in 2024

Earlier, Legit.ng reported that the Economist Intelligence Unit (EIU), a research and analysis firm, predicted that the Naira would close in 2023 with an exchange rate of N848/$ in the official market.

The EIU also said by the end of the following year (2024), the Naira would be exchanged at N861.5 for a US dollar.

Similarly, the EIU predicted that the pressure on the Naira would ease in 2024 without CBN implementing harsh measures.

PAY ATTENTION: Unlock the best of Legit.ng on Pinterest! Subscribe now and get your daily inspiration!

Source: Legit.ng