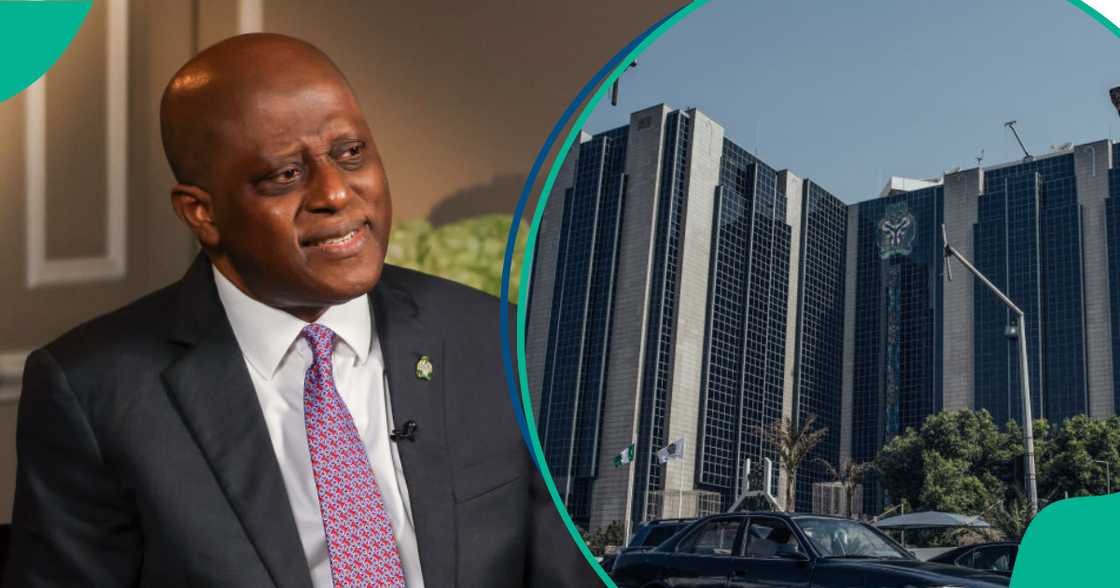

Summit Bank Launches Operations in Nigeria as CBN Grants Approval

- Summit Bank Ltd has officially commenced operations as a non-interest financial institution

- The newly-approved bank is fully licensed by the Central Bank of Nigeria as a regional non-interest bank

- The bank promised to offer a wide range of products, including personal, SME, corporate, and investment solutions

Legit.ng journalist Dave Ibemere brings more than ten years of experience in business reporting, with deep expertise in the Nigerian economy, stock market, and overall market trends.

Summit Bank has disclosed that it received a licence from the Central Bank of Nigeria (CBN) to begin operations.

The new licence brings the total number of full-fledged non-interest banks in Nigeria to six.

Source: Getty Images

Summit Bank’s managing director and CEO, Dr Sirajo Salisu, said the bank is fully operational and ready to provide ethical and inclusive banking services to individuals, SMEs, and larger organisations.

Salisu said:

“We are live, well-regulated, fully operational, and ready to serve Nigerians with clarity, integrity, and purpose.”

Read also

Group invites petty traders to apply for N100,000 business grant, releases Batch C beneficiaries

He also addressed speculation linking Summit Bank to tier-one banks, stating that the institution is independent and fully compliant with CBN regulations.

Executive Director and COO, Dr Mukhtar Adam, added that the bank’s leadership combines experienced banking executives with digital innovators.

Non-interest banking treats customers as partners rather than borrowers, sharing both risks and profits, Punch reports.

Source: UGC

The system is guided by Shariah principles, ensuring transparency, social justice, and ethical responsibility.

Summit Bank offers personal accounts, SME and corporate solutions, as well as finance and investment products to make banking straightforward and accessible for all Nigerians.

The bank was incorporated in July 2024 and received its CBN licence in February 2025.

What to know about non-interest banks

The non-interest banking system operates under a strong ethical framework, without interest, promoting transparency, fairness, and shared responsibility.

Unlike traditional banking, non-interest banking follows a model where customers, whether individuals, entrepreneurs, or businesses, are regarded as partners rather than just clients or borrowers.

This model operates with a shared responsibility, meaning that both the risks and the profits from investments or ventures are distributed between the bank and its customers.

At its foundation, non-interest banking strictly adheres to Shariah principles, ensuring complete transparency, fairness, and accountability in all financial dealings.

The system was created to harmonise ethical and religious values with practical economic needs, offering an alternative approach to finance that is morally grounded and socially responsible.

List of Islamic banks in Nigeria

- Jaiz Bank PLC is the biggest Islamic bank in Nigeria

- Taj Bank

- Lotus Bank Ltd

- The Alternative Bank

- Summit Bank- the latest entrant

NOVA bank begins operation

In a related development, Legit.ng reported that the management of NOVA Merchant Bank Limited disclosed that it transitioned to a national bank after securing the required approval from the Central Bank of Nigeria (CBN).

The bank’s board chairman, Philips Oduoza, disclosed that the bank’s full commercial operations will begin in July and spread to other parts of Nigeria.

The bank’s chairman said they will roll out the first branch in Lagos

Proofreading by Funmilayo Aremu, copy editor at Legit.ng.

Source: Legit.ng