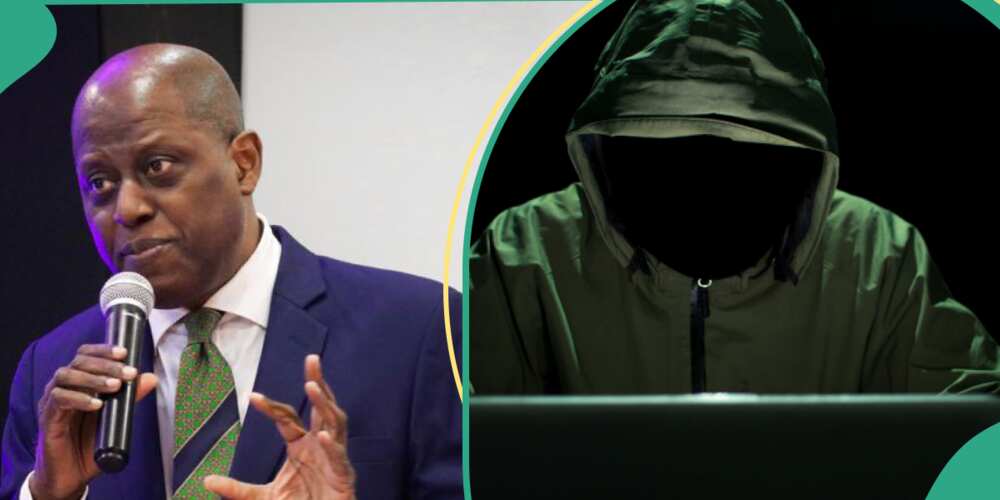

Fintechs, Banks, Others Advise CBN Against Shutting Out Cryptocurrency Operations in Nigeria

- Fintechs, banks, and other stakeholders have advised CBN on how offenders should be treated in the industry

- In addition, they want greater regulatory attention on cryptocurrency transactions in the country

- They also suggest reward and punishment should be dished out to whistleblowers and offenders, respectively

Financial industry stakeholders have issued a communique that will ensure the blacklisting of offenders in the industry.

As contained in the statement, they also advised the CBN on how to deal with perpetrators of crime using cryptocurrencies.

This was released by the attendees of the Information Security Society of Africa-Nigeria cybersecurity roundtable.

According to Punch report, the event in Lagos had as its theme “Re-thinking corporate governance rules on money transfers.”

Source: Getty Images

Important stakeholders unite

The communique was given after the event by the stakeholders, which included representatives from Deposit Money Banks, FinTechs, the FBI, the Economic and Financial Crimes Commission, the Central Bank of Nigeria, the Nigeria Inter-Bank Settlement System Plc, Internet Service Providers (Huawei), tech companies, cybersecurity companies, and legal professionals.

The communiqué read in part:

Committee agreed on the need to create effective blacklists of criminals in the financial sector. Once they have committed any infraction anywhere within the industry, they should be blacklisted industry-wide.

It stated that the ‘CBN should not shut out the crypto operators and dealers even though the channel is used to execute fraud.

It noted that many fraud proceeds get converted to cryptocurrency, and the fund’s trail thus disappears into that space.

It, therefore, advocates greater regulatory attention and torch lighting to ensure cryptocurrency does not become a hiding place for proceeds of crime.

Read also

“It will help them”: Canada announces new rule for Nigerians, others coming to study from December 1

The stakeholders said the CBN should reward persons or organizations reporting fraud by getting the beneficiary of that action – account holder or bank – to pay the whistleblower a token.

It said that this would encourage critical and beneficial information flow. It also advocated for sanctions for those who deliberately give false information.

The President of ISSAN, Dr. David Isiavwe, said there was no doubt that digital payments were growing year on year.

He said:

This trend is expected to be sustained in the nearest foreseeable future. Fintechs therefore have a critical role to play in the future of financial services. The more you innovate, the more you need to automate the attendant controls and ensure that they are strictly monitored.

A Legit.ng report earlier cited how Nigeria emerged as the most crypto-active country according to data collected from three search terms on Google Trends.

In a report, the CBN spoke about the future of cryptocurrency in Nigeria as Bitcoin’s value rose above $30,000 for the first time in 10 months.

CBN gives reasons for 2-year post-no-debit on crypto funds from banks

The Central Bank of Nigeria (CBN) has shed light on why it decided to ban cryptocurrency in the country, Legit.ng reported.

Kinsley Obiora, the Deputy Governor of Economic Policy at the CBN, clarified the Business Session of the Fiscal Liquidity Assessment Committee (FLAC) retreat in Abuja.

You will recall that in 2021, CBN banned cryptocurrency-related transactions within the country, citing concerns about money laundering and terrorism financing.

Source: Legit.ng