OPay, PalmPay, Moniepoint Alert Users as ₦50 Stamp Duty Moves to Senders From January 2026

- Nigerian fintechs alerted customers over a ₦50 stamp duty for transfers of ₦10,000 and above

- New tax law shifted transfer charges from recipients to senders, effective January 1, 2026

- Mixed reactions emerged as citizens expressed concern over rising transaction costs amid inflationary pressures

Financial technology companies in Nigeria have begun notifying customers of a key change to electronic transfer charges following the implementation of the Nigeria Tax Act 2025.

Fintech platforms including OPay, PalmPay, Moniepoint and others informed users that from January 1, 2026, all transfers of ₦10,000 and above will attract a ₦50 stamp duty, which will now be deducted from the sender’s account.

Source: Getty Images

Fintechs notify customers of new charge

In messages sent to customers, the fintech firms explained that the new deduction replaces the previous Electronic Money Transfer Levy, which was charged to transaction recipients.

OPay, in a message seen by Legit.ng, said the change is in line with the newly signed tax laws that took effect on January 1, 2026.

Read also

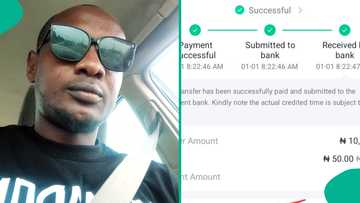

Tax law: Man cries out, displays how much was deducted from his account for sending someone N10k

The company stated: “In line with the recently signed Nigeria Tax Act (NTA) 2025, the ₦50 Electronic Money Transfer Levy (EMTL) previously deducted from recipients of electronic transactions of ₦10,000 and above will now be deducted from the sender’s account, effective January 01, 2026.”

Banks also begin customer alerts

Commercial banks have also started sending similar notifications to customers as the new tax framework comes into force.

Banks including Access Bank, United Bank of Africa, Wema Bank, Zenith Bank and others confirmed that electronic transfers of ₦10,000 and above will now attract a ₦50 stamp duty paid by the sender.

One customer message read:

“The New Tax Act (NTA) 2025 will take effect on January 1, 2026. The ₦50 Electronic Money Transfer Levy (EMTL) on money transfers will now be referred to as Stamp Duty. Transfers below ₦10,000, salary payments, and intra-bank self-transfers are exempt. The sender now bears the charge.”

Another bank clarified that the stamp duty is separate from regular transfer fees and will be clearly shown before transactions are completed.

What transactions are exempt

According to the notices issued by banks and fintechs, the following transactions will not attract the ₦50 stamp duty:

- Transfers below ₦10,000

- Salary payments

- Intra-bank transfers between a customer’s own accounts

All other qualifying electronic transfers will now have the charge deducted upfront from the sender.

Nigerians react as transfer costs rise

The policy change has sparked mixed reactions among Nigerians, many of whom fear rising transaction costs.

Several users expressed concern that senders will now shoulder multiple charges on a single transfer, especially when standard bank fees are added.

Financial analyst Osas Igho said the policy increases pressure on individuals and businesses already struggling with inflation and high living costs.

“What we have now is that the sender bears multiple bank charges. So, every transfer will now see the sender paying almost ₦100 in bank charges. Imagine individuals and businesses that carry out multiple transactions daily,” he said.

Why Nigerians will pay more per transfer

A previous report by Legit.ng noted that from January 2026, Nigerians would pay more each time they send money via bank apps or fintech platforms.

For example, a single transfer of ₦50,000 could attract close to ₦100 in total charges.

This increase is not due to banks raising fees independently but stems from a policy change that shifts the tax burden from recipients to senders.

Source: UGC

The adjustment is part of a broader overhaul of Nigeria’s tax system, subtly changing how often Nigerians pay transaction-related charges and who ultimately bears the cost.

FG clarifies debits on personal bank accounts

Legit.ng earlier reported that the federal government dismissed claims that it plans to monitor personal bank accounts through transaction narrations or transfer descriptions for taxation purposes.

The clarification was made by Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, during a recent television interview.

According to him, there is no policy directing authorities to scrutinise bank transfer narrations to determine tax liabilities.

Proofreading by Funmilayo Aremu, copy editor at Legit.ng.

Source: Legit.ng