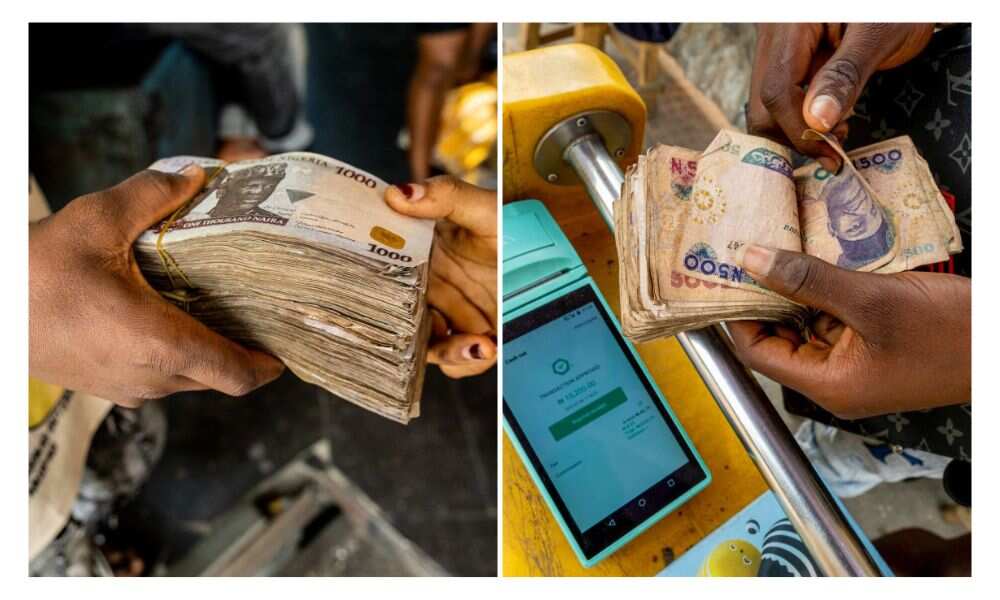

POS Operators Lament CBN's Cash Withdrawal Limit, Describe Policy as Deadly to Businesses

- PoS operators have cried out over the recent move by the CBN to restrict cash withdrawal to a certain threshold

- The operators say the move is a threat to their businesses and job creation in general and have called on the CBN to rethink the policy

- Data revealed that PoS transactions are at an all-time high in Nigeria, hitting 735.6 billion in the first nine months of 2022

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Point of Sale (PoS) operators have described the latest Central Bank of Nigeria (CBN) cash withdrawal limit as deadly and draconian to their businesses.

The daily limit of N20,000 from the PoS channel imposed by the apex bank, which takes effect on January 9, 2023, is seen as a threat and will destroy jobs and booming businesses.

Read also

From banking sector to construction, list of jobs in Nigeria likely to disappear as technology takes over

Source: Getty Images

CBN's latest move, deadly, draconian, operators say

The CBN wrote to banks and other financial institutions on Tuesday, December 6, 2022, that it had slashed cash withdrawal from ATMs, over-the-counter, PoS and cheques.

In the last few years, PoS businesses have been booming in Nigeria, which has taken those out of jobs and created jobs.

Now the operators see the latest move by CBN as deadly and draconian, aimed at killing their businesses and taking many out of jobs.

The business, also known as agency banking, has served as a means of livelihood for many people in Nigeria.

PoS business at an all-time high in Nigeria

According to reports, PoS transactions hit an all-time high of N735.6 billion in September 2022 alone.

Per data released by the Nigeria interbank Settlement System (NIBBS), Nigerians spent a total of N60.05 trillion via PoS in the first nine months of 2022. The amount surpassed the one traded in 2021, which stood at N6.4 trillion.

The report shows a 32 per cent increase on a year-on-year basis compared with the N5556.4 billion recorded in the same month of 2021.

With the CBN's latest policy, many PoS operators fear being thrown out of their jobs and losing their livelihood.

Serves as poverty alleviation initiative

Experts say it will affect agency banking because the volume of transactions will reduce drastically, a BusinessDay report says.

Agency banking is recognised as a financial inclusion initiative by policymakers, researchers and development experts and a vital tool in developing countries, especially in poverty reduction, job creation, wealth creation and improvement of living standards.

According to a recent survey, the chance of making extra income is a significant boost to becoming an agent.

International Monetary Fund (IMF) survey revealed that the number of bank agents and outlets per 1,000 square metres went up by 380.2 per cent to 680.9 per cent in 2021 from 141.8 in 2020.

Read also

Trouble for CBN governor as lawmakers make stong decision over cash withdrawal limit policy

Cash withdrawal limit: Documents required to go above CBN threshold

Recall that Legit.ng reported that on Tuesday, December 6, 2022, the Central Bank of Nigeria set limits on weekly cash withdrawals by persons and corporate bodies.

The new directive would become effective on January 9, 2023.

The policy is meant to reduce the amount of physical cash circulation in Nigeria and encourage electronic transactions.

Source: Legit.ng