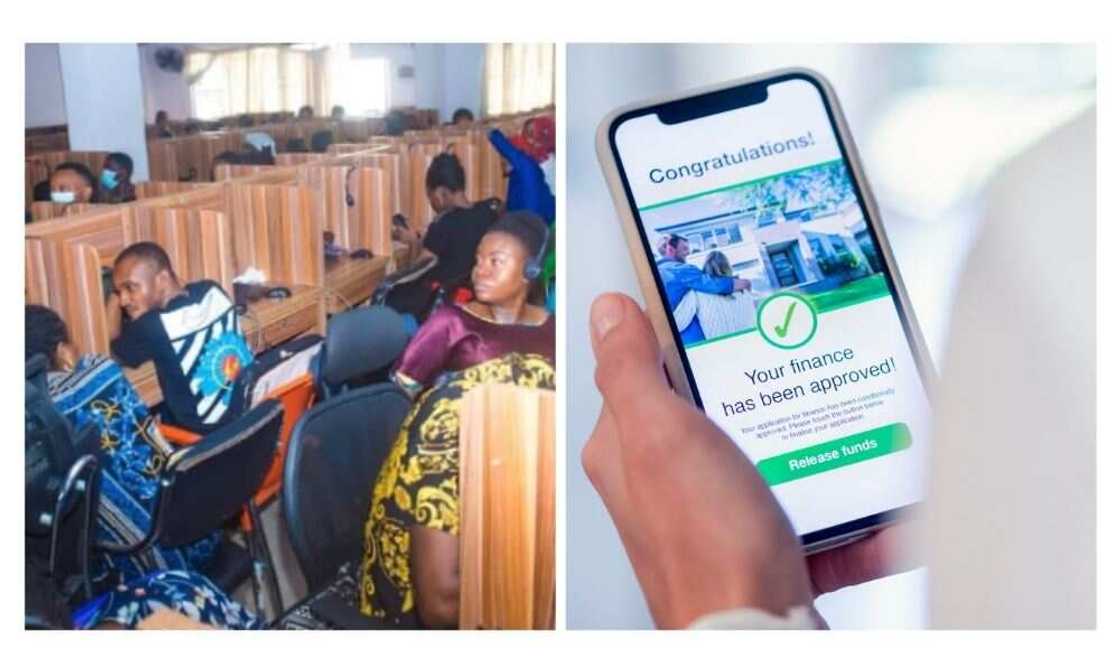

Google, Others Ignore FG’s Directives, Leaves Okash, KashKash, Other Loan Sharks in Stores

- Google, Apple and other stores have ignored federal government of Nigeria's directive to delete loan sharks

- The apps are still in the stores as of Tuesday, March 15, 2022 and have over one million downloads respectively

- According to reports, the lending apps have applied unethical practices and embarked on criminal defamation of debtors

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

It appears that the directive by the Nigerian government to Google, Apple and others to delete loan sharks raided by agencies of government last week from their stores has fallen on deaf ears.

Checks by Legit.ng show that the apps are still in the stores and having massive downloads over one million each.

Source: UGC

According to an investigation, Okash, KashKash and CreditMe are owned and operated by the digital payment platform.

It is a Chinese firm owned by Opera, the browser company. Okash operated as a payday loan in the until it started to operate as a stand alone app in the stores.

PAY ATTENTION: Install our latest app for Android, read best news on Nigeria’s #1 news app

A blighting report accuses on the company of unethical behaviour

In January 2020, a Hindenburg report had indicted the company of unethical methods, saying the it is exploitative in its lending practices in Nigeria, Kenya and India.

The company refuted the allegations of the report, saying the company employs ethical procedures in its dealings with the public.

But a recent development has shown that the company and other lending platforms in Nigeria have embarked on criminal defamation of debtors, going as far as declaring them wanted without a police report and having their obituaries splashed across social media for defaulting on their loans.

A campaign of calumny against defaulters

In a recent finding by Legit.ng, the lending platforms raided by the federal government went back to work six hours after Friday, March 11, 2022.

A source who spoke to Legit.ng on the condition of anonymity said that they returned to work a few hours later, claiming that the management of the companies may have greased the palms of those who came to shut them down.

She said:

“We went back to work immediately. I work in customer service and among those calling debtors and defaulters. I think the management settled those who came to do the raid and allowed us to resume operations. As I am talking to you, I have called about 12 people today. The job does not even require onsite activity. We work remotely sometimes and report to the office a few days a week.

Ijeoma Nwamma, one of those who borrowed money from Okash revealed that at the moment, she was reading that there was a raid, she got a call from them telling her to pay up or face consequences.

Read also

Setting the standard for others: 3 unsung Nigerian heroes that really deserve to be celebrated

Nwamma said:

“They were threatening fire and hell. They told me that they will report me to the police and Credit Bureau and so on. I have defaulted for only two days and I was getting threats to my life from them.”

Also, check shows that KashKash and Okash have had over one million downloads respectively on Google play store alone.

Online loan shark declares single mother of 2 HIV positive, sends viral message to her contacts

Legit.ng has reported that despite the crackdown on unscrupulous online money lenders by the federal government through the Federal Competition & Consumer Protection Commission (FCCPC), a single mother of two has narrated how her contact received a message that she is HIV positive.

Nasiru Ebunoluwa who spoke with Legit.ng revealed that she was owing an online loan app, Hero loan a sum of N18,000.

According to her, she took a loan of 12,000 to pay back N18,000 in 7 days. she disclosed that she defaulted for a few days and was contacted by one of their agents.

Source: Legit.ng