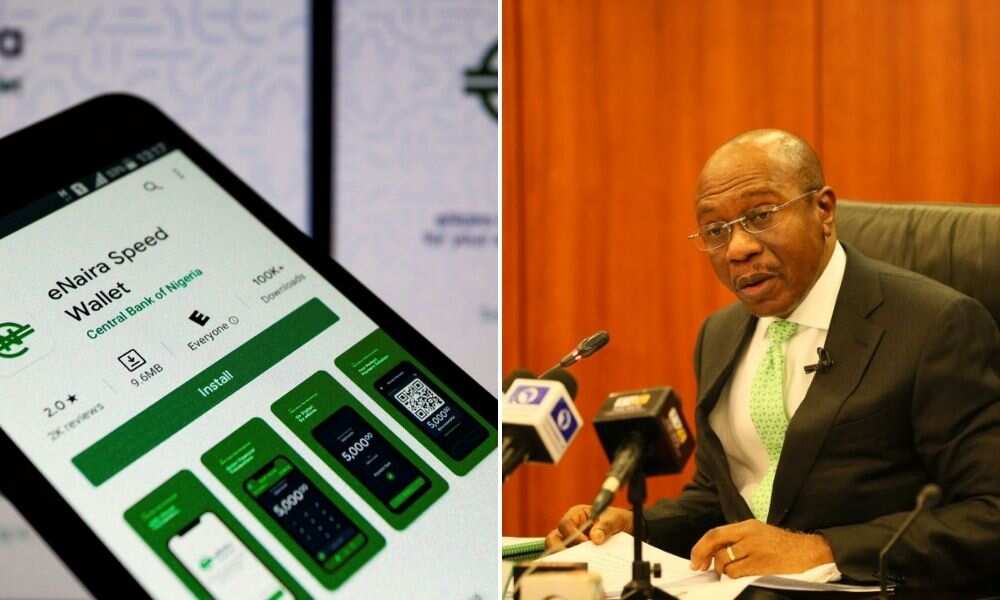

Nigeria’s Digital Currency, eNaira Slumps, Records Less Than 10% Transactions in 3 Months

- eNaira usage fell below 10 per cent in three months since its launch in October 2021, says Central Bank of Nigeria governor, Godwin Emefiele

- Emefiele said Nigerians are slowly accepting the digital currency in the country but have refused to trade it among themselves

- He stated that the digital currency was introduced for Nigerians with bank accounts and said the adoption has been slow but steady

All seems not to be going well for Nigeria and Africa’s first digital currency, the eNaira three months after it was launched.

The digital currency which was launched to entice Nigerians away from cryptocurrency has recorded less than 10 per cent in Person-to-Person (P2P) transactions according to the Central Bank governor, Godwin Emefiele.

Source: Getty Images

A spike in transactions

A rise in P2P transactions shows an increase in the use of the eNaira amongst Nigerians for their daily transactions.

PAY ATTENTION: Subscribe to Digital Talk newsletter to receive must-know business stories and succeed BIG!

Emefiele said that Person to Bank and Bank to Person makes up 90 per cent of eNaira transactions.

Nairametrics reports that it shows that users of the eNaira transacted more with banks than with each other, as Person to Person (P2P) or Person to Merchant (P2M) made up the remaining 10 per cent of the digital currency’s transactions.

The apex bank’s helmsman stated that the eNaira has seen a gradual acceptance among Nigerians since its launch three months ago.

According to him, the eNaira transactions recorded range from P2P, P2M, P2B and B2M and M2B transactions.

What the CBN is saying

The Punch also reports that the governor of the apex bank stated that the eNaira’s current rollout was meant for the banked Nigerians. He added that the inclusion of the BVN as a requirement is to prevent fraudsters from hacking into the system has strengthened the security and adoption of the new digital currency.

eNaira records thousands of downloads

Meanwhile, Legit.ng has reported that the Central Bank of Nigeria (CBN) has revealed as of November 18, 2021, 488,000, consumer wallets and about 78,000 merchant wallets have been registered with downloads coming from over 160 countries.

The CBN also showed that 17,000 transactions amounting to over N62 million with the average transaction being about N3,800 each were recorded as well.

The CBN said this at a Masterclass event in Lagos titled 'Central Bank of Nigeria Interventions as Fulcrum for Economic Diversification’, organised by the Centre for Financial Journalism.

Source: Legit.ng