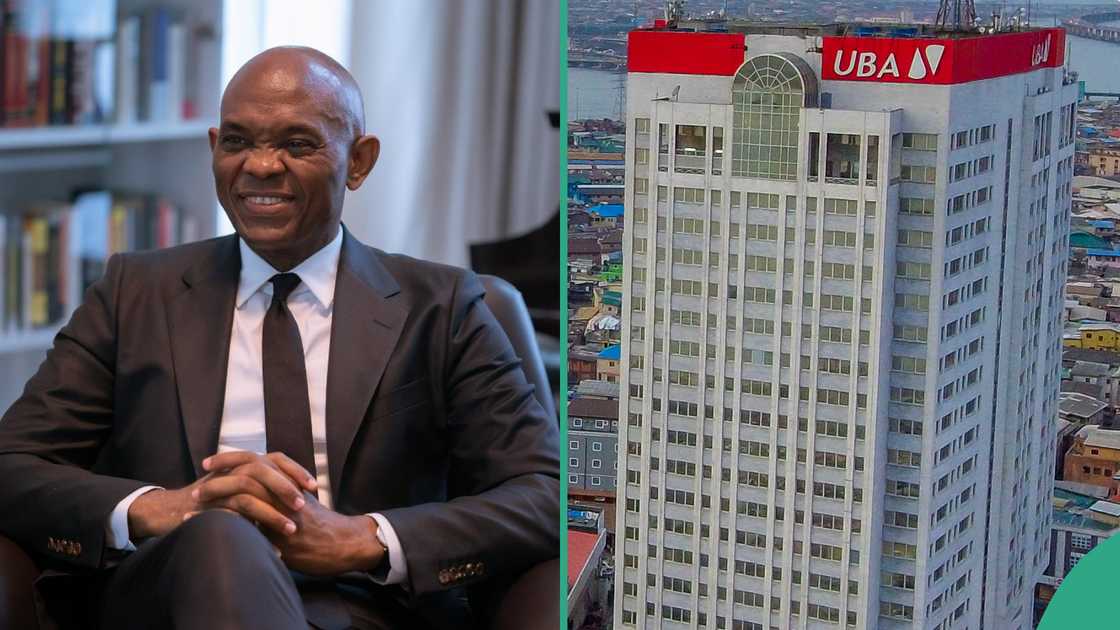

UBA’s AI Chatbot LEO Launches Africa’s First Cross-Border Payment Feature

- United Bank for Africa (UBA) has made a historic move in African digital banking.

- Its AI-powered chatbot, LEO, is now the first on the continent to support real-time cross-border payments

- The chatbot is the first AI chatbot in Africa to handle cross-border payments, marking a significant step in financial services

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

United Bank for Africa (UBA) Plc has taken a major step in redefining digital banking across the continent.

Its artificial intelligence-powered chatbot, LEO, now allows users to send and receive money across African borders instantly using local currencies.

Source: UGC

Powered by Pan-African payment infrastructure

With this move, LEO becomes the first AI chatbot in Africa to handle cross-border payments, marking a significant milestone in the evolution of financial services.

The upgrade leverages the Pan-African Payment and Settlement System (PAPSS), a platform developed by the African Export-Import Bank (Afrexim Bank).

PAPSS facilitates seamless cross-border transactions in local currencies across African nations where it has regulatory approval.

This system eliminates the need for third-party currencies like the US dollar, cutting costs and accelerating transactions for individuals, traders, and businesses.

Innovation at the heart of UBA’s strategy

Speaking on the development, Oliver Alawuba, Group Managing Director/CEO of UBA, described it as a bold leap forward.

“The introduction of cross-border payments on LEO, in partnership with PAPSS, reflects our commitment to digital innovation, Pan-African integration, and customer-centric banking,” he said.

He emphasised that the update isn’t just a technological tweak but a transformative solution to meet Africa’s evolving financial needs.

Instant transfers, zero fees, enhanced security

- LEO broadens access to African finance

- Transfers are processed within seconds

- Available via self-service digital platforms

- No charges for the receiving party

- Lower processing costs and wider access

It also offers enhanced security, confidentiality, and reliability—key concerns in Africa’s growing digital finance sector.

Chatbot expands financial access across Africa

According to Shamsideen Fasola, UBA’s Group Head of Retail and Digital Banking, this move goes beyond convenience.

“We’re not just simplifying transactions – we’re fostering intra-African trade and breaking down longstanding barriers to financial inclusion,” he said.

With LEO now integrated into PAPSS, users can carry out transactions in real time, reducing reliance on informal networks and boosting transparency in regional trade.

Aligned with continental free trade ambitions

According to external reports, including The Nation, this innovation supports the goals of the African Continental Free Trade Area (AfCFTA), which aims to boost trade and economic unity across Africa.

By enabling fast, affordable, and localised payments, UBA empowers individuals and businesses to grow within a harmonised financial ecosystem.

UBA remains ahead in digital innovation

UBA serves over 45 million customers across 20 African countries, as well as in the UK, USA, France, and the UAE.

With 25,000 employees, it is a leader in financial inclusion and digital innovation.

Source: UGC

The launch of LEO’s cross-border payment feature is another example of how the bank continues to set the pace in AI-powered banking and customer-focused transformation.

In another report by Legit.ng, UBA has applied for approval to raise ₦157 billion in capital through a rights issue.

Read also

Taraba State backs tech start-up Izesan Limited's move to preserve its indigenous languages

This will bring the bank closer to achieving the Central Bank of Nigeria (CBN) recapitalisation target.

The Nigerian Exchange Limited (NGX) has confirmed that UBA sent the notice on Wednesday through its stockbrokers, United Capital Securities Limited.

This will bring the bank closer to achieving the Central Bank of Nigeria (CBN) recapitalisation target.

Zenith Bank hits ₦3 trillion valuation

Legit.ng earlier reported that Zenith Bank has officially hit a market capitalisation of ₦3 trillion, making it Nigeria’s second most valuable bank on the Nigerian Exchange Limited (NGX).

The bank’s stock peaked at ₦72 per share on Monday, July 14, 2025, before closing at ₦71.50—a testament to strong investor interest ahead of its second-quarter earnings.

The achievement comes just after Zenith successfully met the Central Bank of Nigeria’s (CBN) ₦500 billion recapitalisation target, a key factor boosting investor confidence.

Source: Legit.ng