Tax Managers Should Rise to The Challenges of Global Tech Growth, FIRS Boss Says

- Tax administrators have been asked to keep abreast of tech development in the tax sector

- Chairman of the Federal Inland Revenue Service and President of the Commonwealth Association of Tax Administrators, Muhammad said this

- Nami said that due to the evolving trends in tech development, tax managers need to develop capacity and competence

PAY ATTENTION: See you at Legit.ng Media Literacy Webinar! Register for free now!

Tax administrators must keep up with the dynamics and pace caused by disruptive new technologies of the 21st century and arm themselves with the necessary skills, capacit,y and character for effective and efficient tax administration in the fourth industrial revolution age.

Tax administration is contantly changing due to technology

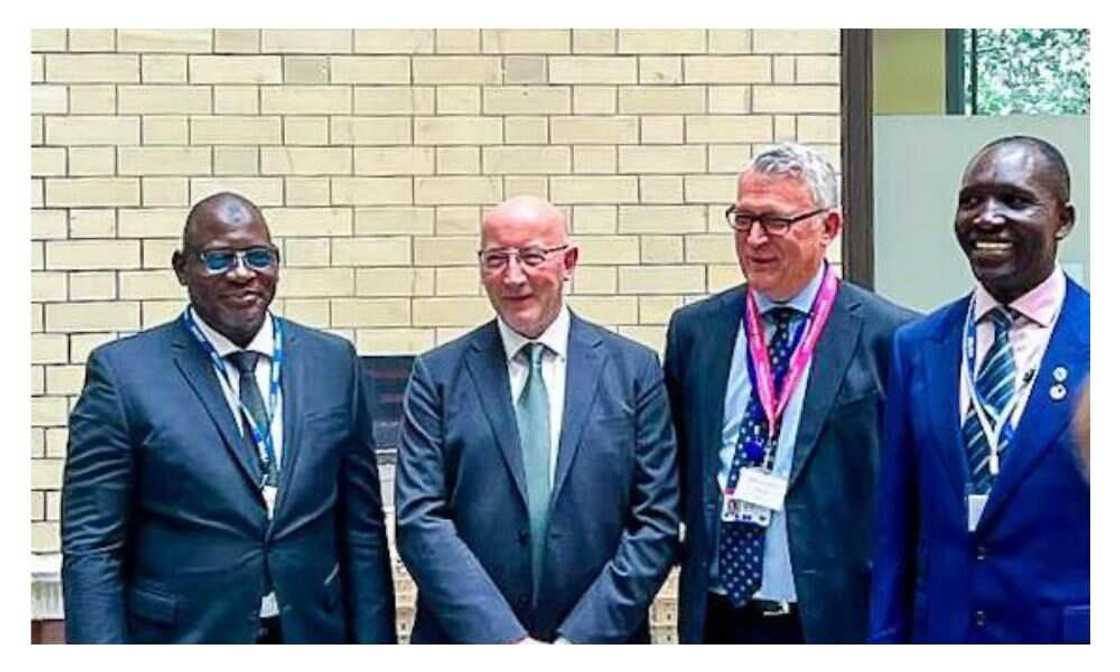

This was the position of the President of the Commonwealth Association of Tax Administrators (CATA), and Executive Chairman of the Federal Inland Revenue Service (FIRS), Muhammad Nami in his charge to the 2022 CATA Senior Leadership cohort, during the closing ceremony of the programme held at His Majesty’s Treasury Headquarters, London, United Kingdom, on Friday, March 17, 2023.

Read also

Firsts Bank asks for applications to Management Associate Programme, releases links to apply

Source: Getty Images

Nami highlighted that due to technological advancements in actualising human needs, fulfilling social interactions and conducting commercial activities, tax administration is constantly changing. He called for tax managers to keep up with the times by improving their skills and competence in line with these changes.

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

Nami said:

“The global tax arena is continually changing. The growing reliance on technology for much of basic human needs, social interactions, and business dealings means that the tax turf remains in constant flux.

“The taxman is only able to match the depth and pace of the changes if equipped with relevant, adequate and up-to-date skills.”

The CATA President applauded the Commonwealth association for its investments and contributions through its Senior Leadership Programme, which he noted has helped bridge the capacity gaps of tax officials in member countries.

Read also

Nigeria's revenue agency, FIRS, signs MoU with UK's HM Revenue and Customs on capacity building

“I am glad to note that CATA has, over the years, continued to organize the Senior Leadership Programme to meet the capacity development needs of tax officials in commonwealth countries. CATA has become a tradition to provide participants in this programme with top-notch tuition using case studies in a fun-filled environment.

What CATA does to tax administrators

The CATA Senior Leadership Programme is a yearly senior-level Leadership Programme delivered by the UK’s His Majesty’s Revenue and Customs (HMRC) on behalf of the Commonwealth Association of Tax Administrators.

The programme pools together senior leaders of tax authorities in Commonwealth countries to equip them with the requisite leadership skills to navigate their organisations in a dynamic and complex landscape. The programme recognises the importance of good leadership to result-driven tax administration in the 21st century.

The 2023 edition combined residencies in India and the UK, accompanied by virtual sessions, and work within the domestic tax authorities of participants.

Read also

Emefiele speaks on central bank policies in Africa, seeks tighter banking regulation amid banks collapse in US

FIRS debuts portal for easy tax clearance certificate in 24 hours

Legit.ng reported that Nigeria’s Federal Inland Revenue Service (FIRS) has said taxpayers can now get their tax clearance certificate in a single click via its TaxPro Max solution.

It is a tax administration module presented by the FIRS in June 2021 as a one-stop shop for taxpayer registration, tax returns, tax revenue filings, payment, and tax clearance certificates, among other functions

Vanguard reports that the special assistant to the executive chairman of FIRS on media and communications, on Monday, January 2, 2023, said the tax clearance certificate, which used to take two weeks to obtain, is now available in a single click.

Source: Legit.ng