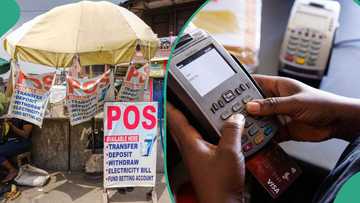

CBN Issues New Agent Banking Guidelines with Fines Starting at N5 Million

- The CBN has revised its agent banking guidelines, imposing stiff penalties for violations, including fines starting at N5 million

- Unauthorised activities, such as agents offering core banking services, will lead to profit forfeiture and disqualification

- The update aims to regulate the fast-growing agent banking sector by consolidating all policies into one comprehensive framework

Legit.ng journalist Victor Enengedi has over a decade's experience covering Energy, MSMEs, Technology, Banking and the Economy.

The Central Bank of Nigeria (CBN) has issued a stern warning to agent banking operators, stating that violations of its newly updated Agent Banking Guidelines will attract severe financial penalties.

The new guidelines were disclosed in a circular signed by Musa Jimoh, director of the CBN’s payments system policy department, on Monday, October 6, 2025.

Source: UGC

Any agent found participating in unauthorised activities will face a minimum fine of N5 million, along with an additional N100,000 for each day the breach continues.

Furthermore, any profits gained from such violations must be surrendered.

CBN to fine agency banking defaulters

Under the revised framework, operating without a valid Super Agent licence carries a penalty of N10 million, with an additional N200,000 charged for every day the infraction remains unresolved.

The CBN revised guidelines stated:

“Operating without a valid Super Agent licence attracts a fine of not less than N10 million and N200,000 for each day the default persists. Engaging in non-permissible agent banking activities attracts a fine of not less than N5 million and N100,000 for each day of the default."

The apex bank added that any earnings from these activities are also subject to forfeiture.

The CBN also emphasised that financial institutions that fail to obtain prior approval or a “No Objection” letter as required by the guidelines will incur a fine of N2 million.

This fine also applies individually to each director or senior manager found responsible.

Read also

There’ll be consequences: CBN lists those eligible to operate PoS business, blacklists debtors’ BVNs

In addition, failure to keep accurate accounting records will result in a minimum fine of N5 million for the institution, while any staff member who deliberately causes such a lapse will face a personal fine of at least N2 million.

Examples of prohibited actions include Super Agents engaging directly in agent banking services, agents performing core banking functions such as opening customer accounts, processing loans, handling investments, or dealing in foreign exchange.

Other violations include delegating agent functions to unauthorised third parties, using automated systems or machines as agents, and any other activities the CBN may classify as non-permissible.

CBN bars certain agents

The apex bank has barred individuals or organisations from participating in agent banking if they have had non-performing loans within the past year, have been declared bankrupt, are undergoing insolvency proceedings, or have a Bank Verification Number (BVN) flagged on official watchlists.

According to the CBN, the update to the Agent Banking Guidelines was prompted by the fast-paced growth and technological advancements in the sector.

The new document consolidates previous regulations to provide a comprehensive framework that addresses the evolving dynamics of agent banking in Nigeria.

Source: UGC

The CBN also set a daily Point of Sales (PoS) cumulative cash transaction limit of N1.2 million for agents, while individual customers can only transact up to N100,000 per day.

Police to crack down on illegal PoS operators

Meanwhile, Legit.ng earlier reported that the federal government has pledged that security agencies would take action against PoS operators who do not comply with the directive to register with the CAC.

PoS operators in Nigeria who fail to register with CAC at the expiration of the deadline would be tagged as illegal.

As a result of their failure to register their operations, security operatives would escalate actions against them.

Proofreading by Kola Muhammed, copy editor at Legit.ng.

Source: Legit.ng