“They’ll Create Confusion:” KPMG Flags 4 Major Errors, Gaps in Nigeria’s New Tax Laws

- Nigeria's new tax laws, effective from 2026, contain significant errors and inconsistencies identified by KPMG

- Definitions related to community taxation in the laws create uncertainty and potential disputes across jurisdictions

- KPMG calls for urgent clarifications to improve compliance and align tax laws with fairness and efficiency

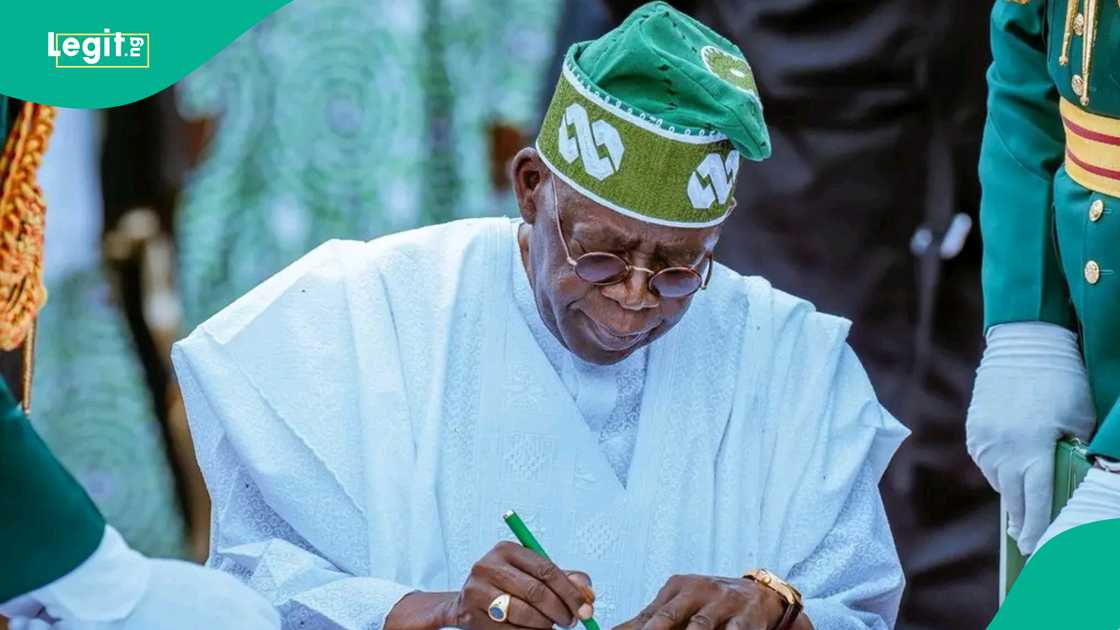

Nigeria’s newly gazetted tax laws, which took effect on January 1, 2026, contain several errors, gaps, and inconsistencies that could create confusion for businesses and taxpayers, according to a detailed review by KPMG Nigeria.

In a report examining the Nigeria Tax Act (NTA), Nigeria Tax Administration Act, Nigeria Revenue Service Establishment Act, and the Joint Revenue Board Establishment Act, the professional services firm warned that some provisions may undermine compliance, tax planning, and operational efficiency if left unaddressed.

Source: Getty Images

“There are certain errors, inconsistencies, gaps, omissions, and lacunae in the new tax laws that need to be urgently reconsidered to ensure the attainment of the stated objectives,” KPMG said.

Uncertainty over the taxation of communities

One of the key issues identified relates to the definition of taxable persons under Section 3(b) and (c) of the Nigeria Tax Act. KPMG noted that the section omits the word “community,” creating uncertainty about whether communities are liable to pay tax under the new regime.

According to the firm, this omission could lead to disputes and uneven enforcement across jurisdictions.

If lawmakers intend to tax communities, KPMG said this should be stated clearly in the law. If not, the legislation should expressly confirm that communities are exempt from taxation to avoid ambiguity.

Foreign dividends may face different tax treatment

KPMG also highlighted potential inconsistencies in how dividends are taxed, particularly under Section 6(2) of the NTA.

The firm warned that the provision could result in foreign dividends being taxed differently from dividends paid by Nigerian companies.

“It thus appears that such dividends will be taxed at the income tax rate,” the report noted, adding that this would create unequal treatment between domestic and foreign-sourced dividends.

Read also

Nigeria Tax Act: GTBank issues fresh notice to customers on N50 stamp duty on electronic transfers

Such differences, KPMG said, could complicate tax planning for investors and multinational companies operating in Nigeria.

Compliance risks for non-resident companies

Another major concern raised involves non-resident companies. KPMG pointed to Sections 17(3)(b) and (c) of the NTA, which deal with tax registration and withholding tax obligations.

The firm argued that non-resident companies without a permanent establishment or Significant Economic Presence in Nigeria should not be required to file tax returns. However, the law does not clearly exempt such entities, potentially exposing them to unnecessary compliance obligations and regulatory uncertainty.

Restrictions on FX and VAT-related deductions

Sections 20 and 21 of the NTA also drew criticism. These provisions limit deductions on foreign currency expenses to the official Central Bank of Nigeria exchange rate and disallow expenses on which VAT has not been charged.

KPMG cautioned that, given current economic realities, policymakers should prioritise improving liquidity rather than imposing rigid restrictions.

The firm recommended stricter reporting and monitoring of foreign exchange transactions instead of outright disallowances that could strain businesses.

Call for urgent clarifications

KPMG warned that the identified gaps could affect tax compliance, financial reporting, and investment decisions for both local and multinational firms.

Source: Facebook

The company urged urgent clarifications and amendments to align the laws with their stated goals of fairness, efficiency, competitiveness, and sustainable revenue generation.

While the firm expressed hope that the National Assembly’s release of the certified versions of the Acts would resolve some concerns, it noted that the real test would be how the laws are interpreted and applied in practice.

Tax experts clarify deductions on bank balances

Legit.ng earlier reported that tax experts dismissed widespread claims that Nigerians’ bank balances are now subject to tax under the country’s new tax laws, clarifying that only specific electronic transfers attract a ₦50 stamp duty.

The chairman of the Chartered Institute of Taxation of Nigeria (CITN), Abuja District, Mr Ben Enamudu, made this clarification during an interview recently, stressing that misinformation has fuelled unnecessary anxiety among bank customers.

According to Enamudu, the ₦50 charge often discussed is not a tax on deposits but a stamp duty applied to qualifying electronic transfers.

Proofreading by Kola Muhammed, copy editor at Legit.ng.

Source: Legit.ng