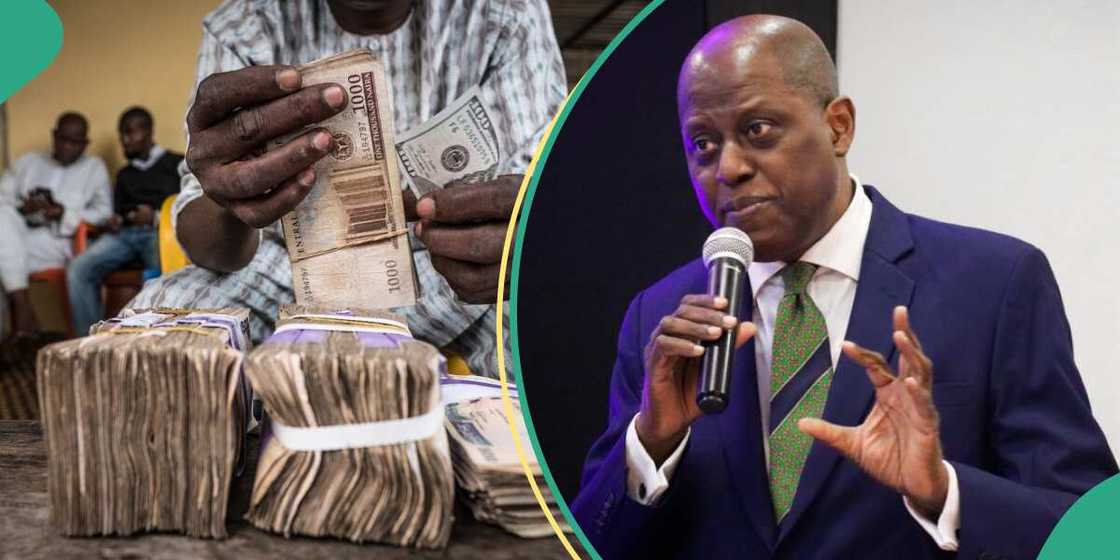

CBN Discloses Reason Naira Gained Over N100/$, Says 31 Banks Paid to Offset FX Backlogs

- The Central Bank of Nigeria (CBN) has revealed the reason for the excellent performance of the Naira lately

- The CBN governor, Olayemi Cardososaid, the apex bank, has paid Forex backlogs to about 31 banks

- He said the CBN action is responsible for the improved liquidity in Forex turnovers at the Forex market

Pascal Oparada has over a decade of experience covering Tech, Energy, Stocks, Investments, and Economy.

The Central Bank of Nigeria said it has made tranche payments to 31 banks to clear the Forex backlogs plaguing the FX market.

The bank also said it has set up foreign exchange mechanisms to address FX issues.

Source: UGC

CBN pays Forex Backlogs to 31 banks

The governor of the Central Bank of Nigeria (CBN), Yemi Cardoso, disclosed this on Friday, November 24, 2023, at the bankers' dinner in Lagos.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

The apex bank governor said there had been an improved Forex market liquidity in recent weeks as the market responded positively to part payments made to about 31 banks to clear the backlogs of forward obligations.

He said:

"We envision that foreign exchange reserves can be rebuilt to comparable levels with similar economies with discipline and focused commitment."

Cardoso's statement comes amid continued volatility in the Forex market, with Forex liquidity improving most of the time.

Naira gains N161 against the dollar

On Friday, November 24, 2023, the Naira rallied against the US dollar at the Nigeria Autonomous Foreign Exchange Market (NAFEM), where it traded for N794.89 against the dollar as against the N956.33 per dollar sold on Thursday, November 23, 2023.

Read also

No more N25 billion: CBN to increase Nigerian bank recapitalization ahead of $1 trillion GDP target

Analysts believe that the decline in the value of the Naira is due to forex backlogs owed to foreign investors, causing the erosion of trust among investors in the Forex market.

Nigeria pumps $6 billion into the Forex market

Nigeria recently said that it paid about $6.5 billion of the estimated $7 billion backlogs, which financial experts believe was responsible for the excellent performance of the Naira against the US dollar, especially in the parallel market.

According to reports, the apex bank started paying off some of its forex debts with Citibank, Stanbic IBTC, and Standard Chartered banks.

The recent measures are expected to ease the forex backlog, primarily responsible for investors' lack of confidence in the Nigerian economy.

Cardoso stressed that the payment of the obligations will continue until it clears the FX backlogs completely.

More scarcity ahead as CBN moves to mop up cash to tame inflation, strengthen Naira

Legit.ng reported that The governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, said on Friday, November 25, 2023, that the bank will introduce a set of foreign exchange rules to address the naira crash and achieve exchange rate stability.

Cardoso said the bank would conduct a new round of recapitalization exercises for the banking industry by asking banks to increase their minimum capital base to a new level to support the vision of a $1 trillion economy proposed by President Bola Tinubu.

The CBN boss disclosed this in Lagos during his keynote speech at the 2023 Annual Bankers Dinner of the Chattered Institute of Bankers of Nigeria (CIBN).

PAY ATTENTION: Donate to Legit Charity on Patreon. Your support matters!

Source: Legit.ng