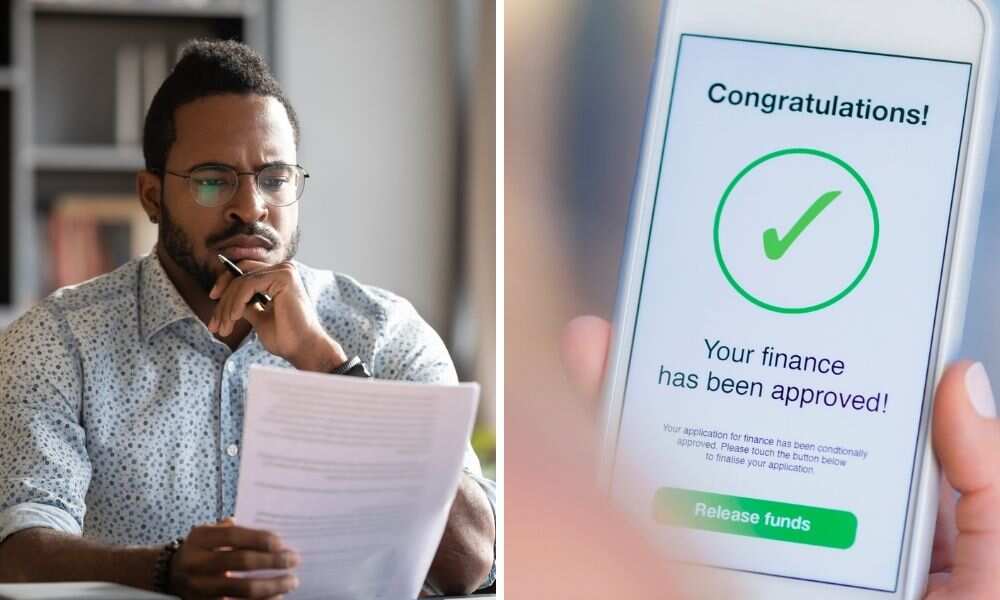

Rate of Loan Defaults Skyrocket as Lending Apps Face Bleak Future in Nigeria

- Lending apps in Nigeria are having it hard getting their monies back from borrowers who employ different methods to evade repayment

- The defaulters employ different measures and excuses in order not to pay and the apps write off the loans as bad

- Chinese-owned loan apps dominate the landscape with many apps and replicating it as times goes by

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

Operators of lending apps in Nigeria are not having it easy. The rates of defaults by customers have more than doubled in the industry in the last two years.

Exacerbated by the COVID-19 pandemic and the torrid economic situations in Nigeria, lending apps are finding it hard to get their monies back from defaulting customers.

Source: Getty Images

Experts reacts

Experts who have monitored the operations of the novel credit givers say their casual approach to loan facilitation exposes them to more risk, especially in countries like Nigeria where identification is a challenge.

PAY ATTENTION: Install our latest app for Android, read best news on Nigeria’s #1 news app

Indeed, the financial powerhouses they have built in the short period of their existence are falling apart. On account of rising job losses, borrowers face tough challenges repaying their facilities. Reacting to the rising risks, the lenders seem to have started to learn new trade tricks, According to a report from the Guardian.

For instance, a pioneer operator started readjusting pre-COVID payment terms signed with customers a few months ago. Some of the emails sent during the Coronavirus lockdown informed customers that their payment dates were rescheduled, with some of them asked to repay 10 days earlier than the agreed monthly due dates.

The same operator, it was learned, has restricted loan coverage to Lagos, the Federal Capital Territory, and Rivers State. An employee in charge of a new client said the decision was taken as part of the company’s measures to “reduce the rate of default and mitigate impacts of COVID-19” on its operations.

The majority of the players are rolling back the hitherto ambush marketing the industry is known for, concentrating effort in servicing and recoiling to servicing “reliable customers.”

A marketer also disclosed that they “no longer chase customers to top-up anymore because you may not know what may have happened to their jobs in the past six months. We also do more due diligence to be sure that a job exists. If you grant a loan and there is a default, you are in trouble. So everybody is careful,” reports the Guardian.

Customers of these lending apps give varied reasons for defaulting.

Many lending apps have been forced to recalibrate their business models and employ stricter measures before lending.

The Chinese dominate industry

The Chinese dominate the lending app industry in Nigeria and have built layers of authorities to insulate themselves from complaints and possible industrial action by the workers, who Legit.ng learn are getting dissatisfied with their high-handedness.

A staff of one of the lending apps, Okash owned by OPAY, who spoke to Legit.ng anonymously for fear of losing her job, tells how hard it is getting customers to repay their loans.

According to her, customers give reasons like being in the hospital, loss of jobs and bad economic situations for not paying up.

She said:

“Some tell you they lost their jobs, they lost their husbands, parents etc. While some will tell you, they are not paying as if it’s their father’s inheritance."

She said other customers give excuses of high-interest rates after taking the loans.

She said the apps go as far as deducting directly from customers account in case of defaults.

And when they know that the company deducts their money, they stop putting money there, she said.

The many lending apps in the app stores have suddenly become inactive as many of them have either gone bust or have piloted to other things.

Branch, one of the popular lending apps have added investment savings to their business models in order to stay afloat.

While the apps employ aggressive measures such as calling defaulters’ contacts, threatening them with arrests and lawsuits, the numbers of defaulters keep increasing.

John Okoro, financial risk expert believe the measures used by lending apps to recover their loans are not far-reaching enough.

Okoro said

“Calling a random contact of a defaulter is not enough. These apps need to invest in technology that can track an active contact of a debtor." I might have a contact who barely knows me or whom I have not spoken to say like in a year or two. You need to have a facility to tract contacts of siblings, spouses and children of defaulters."

Nigerian government moves to protect Nigerians against loan sharks

Legit.ng reports that the federal government of Nigeria is set to punish lending companies like NowCash, Sokoloan, 9credit over data breach.

Read also

Coronavirus: Engaging activities you can do to avoid boredom following the stay at home order

This was disclosed by the National Information Technology Development Agency (NITDA) in a press statement on its Facebook page.

The agency says it has received over 40 petitions from members of the public on the personal data abuse of some lending companies.

Source: Legit.ng