US auto worker strike hits October industrial production

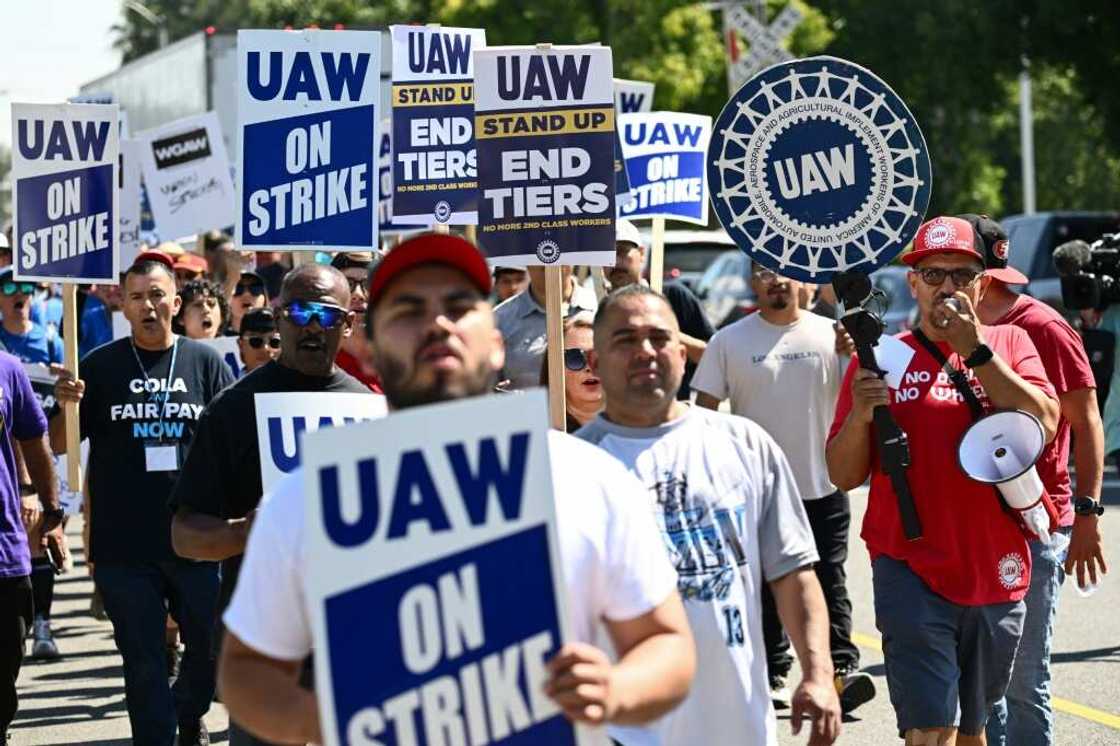

Source: AFP

US industrial production declined more than expected in October, with the auto workers strike exerting downward pressure on a range of market groups, the Federal Reserve said Thursday.

The United Auto Workers (UAW) union called off a sprawling six-week strike late last month after reaching agreement with Detroit's "Big Three" automakers over better pay and working conditions.

US industrial production fell 0.6 percent in October from a revised 0.1 percent rise in September, the US central bank announced in a statement.

This was below the median expectation of economists surveyed by MarketWatch.

Manufacturing output, which declined by 0.7 percent, was dragged down by "a 10 percent drop in the output of motor vehicles and parts that was affected by strikes at several major manufacturers of motor vehicles," the Fed said.

"Industrial production was harder hit by the UAW strike than either we or the consensus anticipated," Oxford Economics lead US economist Bernard Yaros wrote in a note to clients.

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

Among the major market groups, output was mixed, with the impact of strike action "exerting downward pressure on a number of categories," including the index for consumer durables, which fell 5.8 percent.

Meanwhile, the output of business equipment moved down 0.5 percent, "because of a drop in the transit component," while the index for defense and space equipment recorded its 10th consecutive monthly rise, according to the Fed.

Looking ahead, industrial production is forecast to decline this quarter and the next, Yaros from Oxford Economics said.

He said tighter lending standards would likely hold back business investment, while the higher dollar could hurt exports, and the high interest rate environment is acting to "undermine consumer spending on discretionary goods."

Source: AFP