Top Nigerian Bank Rebrands, Gets New Logo, Colour, CEO Shares Target, Reason

- Jaiz Bank Plc has announced its decision to rebrand with refreshed corporate colours, logo

- The bank, in a statement, said the rebrand reflects its vision for the future, customer needs, and commitment to ethical financial service

- Jaiz Bank is one of the leading non-interest banks licensed by the Central Bank of Nigeria for ethical banking

Legit.ng journalist Dave Ibemere has over a decade of experience in business journalism, with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

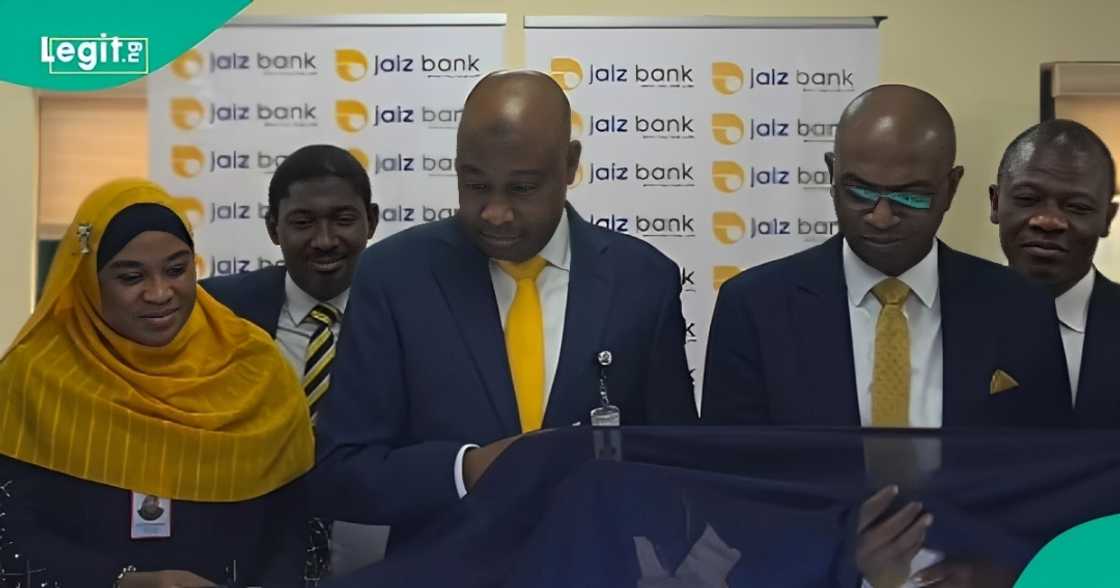

Jaiz Bank Plc has announced a rebrand, featuring a new logo and refreshed corporate colours, with yellow as the dominant colour.

In a statement released on NGX, the non-interest bank said the rebranding reflects its vision for the future and commitment to customers.

Source: UGC

Jaiz Bank rabrands

The company's secretary said the rebranding of the company will take effect from Thursday, August 19, 2025, introducing new visual elements designed to enhance the bank’s identity in the financial services sector.

The changes include the adoption of yellow and green as its primary colours.

The statement reads:

"Effective August 19, 2025, Jaiz Bank Plc announced a refreshed corporate identity, including new colours and a redesigned logo.

The new colours – lagoon, trust blue, sunburst yellow, and professional green – were introduced to symbolise trust, growth, sophistication, and optimism.

“The bank hereby adopts the new brand identity as part of its commitment to innovation and customer-focused service."

Jaiz Bank CEO speaks on rebranding

Speaking on the rebranding, Haruna Musa, the managing director and chief executive officer of Jaiz Bank, said the bank is determined to become the dominant financial institution in Africa, offering non-interest banking benefits.

He noted:

“We want to be a key contributor to the Federal Government’s $1 trillion economy goal by 2030, with a focus on micro, small, and medium enterprises (MSMEs).

"We are among the best specialised MSME banking institutions, and we believe MSMEs are the engine of any economy. That is why we are relaunching our MSME programme to make it easier for business owners to access financing.

Read also

Apply: Nigerian bank opens application for N20m grant, lists requirements, target beneficiaries

"We remain committed to making a positive impact on society. Today, our volume of financing stands at over N500 billion, and in the coming years, we aim to surpass the N1 trillion mark.”

Source: Twitter

What to know about Jaiz Bank

Jaiz Bank is Nigeria’s first non-interest bank that operates based on Sharia principles, which prohibit the payment or charging of interest on loans.

This implies that if you borrow N50,000 for a business venture from an Islamic bank, you are expected to repay the same amount without additional interest charges.

According to the Nigeria Deposit Insurance Corporation (NDIC), five banks in Nigeria operate the Islamic banking model (non-interest banks). They are:

- Jaiz Bank PLC

- Taj Bank

- LOTUS Bank

- Sterling Alternative Finance

- Suntrust Bank Nigeria Limited

Jaiz Bank Plc to meet CBN's new target

Earlier, Legit.ng reported that Jaiz Bank Plc expressed hope regarding reaching the N20 billion recapitalisation deadline set by the CBN.

The bank is only N1.3 billion short of the goal, according to its managing director, Haruna Musa. Musa announced this at the bank's Annual General Meeting (AGM).

Before the CBN's announcement, the bank had proactively raised N10.4 billion through a private placement, increasing its total capital to N18.7 billion.

Proofreading by James Ojo, copy editor at Legit.ng.

Source: Legit.ng