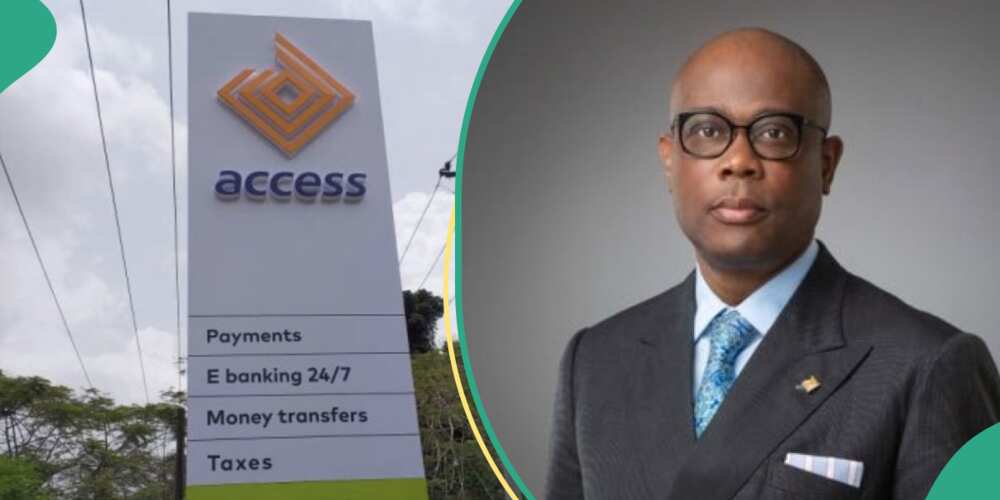

Access Bank CEO Herbert Wigwe Explains Decision To Buy Insurance Company and Banks in 2 Countries

- Herbert Wigwe, the GCEO of Access Holdings, the parent company of Access Bank, has explained the recent acquisition

- In recent weeks, Access Bank has made several acquisitions, including two banks, an insurance company, and a fintech company

- Access Bank is determined to become the best financial institution in Nigeria, with branches in at least 20 African countries

Access Holdings, one of the biggest banks in Nigeria, recently made three significant acquisitions, which include two banks, a fintech, and an insurance firm.

In a different statement published on the Nigerian Exchange, Herbert Wigwe, the Group Chief Executive Officer of Access Holdings, explained the acquisition and outlined plans for the future.

Source: Facebook

Access Bank buys insurance company

Speaking on the acquisition of Megatech Insurance Brokers Limited, an insurance brokerage company, Wigwe said:

“This acquisition is a natural step in our evolution as a globally connected community and ecosystem and aligns with our mission to build and sustain one global platform, open for anyone to join where people can be connected to exceptional opportunities.

“Megatech will strive to create a world where risk is efficiently managed so that we can confidently seek and seize growth opportunities.”

He added that the company will design and provide intelligent solutions that mitigate the unique risks individuals and businesses face in an ever-changing world using leading risk management tools and governance standards.

Access Bank acquires banks in Zambia and Uganda

Access Bank, through its subsidiary Access Bank Zambia Limited, completed its acquisition of African Banking Corporation Zambia Limited, trading as Atlas Mara Zambia, after obtaining all requisite regulatory approvals.

Read also

After slashing price by 21%, Elon Musk picks Nigerian company to sell its Starlink in Africa

Speaking on the acquisition, Wigwe said:

" “This represents a major achievement for Access Bank Plc in our pursuit of becoming the most esteemed African bank globally.

" We're well-positioned for success, aligning the strong brands, extensive history, common values, and top-notch strategies of both entities to generate opportunities that benefit all stakeholders across Zambia and the SADC region.”

Another major deal is the agreement reached to acquire 80% of Finance Trust Bank Limited (FTB) in Uganda

Wigwe said on the investement:

“We are building a strong and sustainable franchise to support economic prosperity, encourage Africa trade, advance financial inclusion thereby empowering many to achieve their financial dreams.

“The expansion to Uganda will support the realization of our aspiration to become Africa’s payment gateway to the world.”

Access, GTB, UBA others to debit customers' bank accounts for FG

Earlier, Legit.ng also reported that the federal government has instructed all Nigerian banks to debit customers with domiciliary accounts.

The debit is for old foreign currency transactions carried out between 2021 and 2023 by customers and will be remitted to the government.

Access Bank, GTB, UBA, Zenith, and other commercial banks have sent messages to customers to expect the debits.

PAY ATTENTION: Stay Informed and follow us on Google News!

Source: Legit.ng