Top Nigerian Banks Pay Over N112 Billion to AMCON for Banking Resolution Cost in Q1, 2023

- Eight banks paid over N112 billion to AMCON as sector resolution cost in the first quarter of 2022

- The surveyed banks experienced a 24.77% growth in aggregate assets, reaching a total of N59 trillion

- Access, Zenith Bank, and GTBank recorded the highest AMCON expenses among the eight banks

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

The Asset Management Corporation of Nigeria (AMCON) received N112.15 billion from eight commercial banks listed on the Nigerian exchange market as part of the Sector Resolution Funds in the first quarter of 2023.

The figures represent a significant 26 percent increase compared to the same period in 2022.

Source: Facebook

What are AMCON charges?

AMCON was established to help buy bad loans and savage the industry from collapse following the financial crisis of 2009.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Read also

Mike Adenuga's Conoil records 400% increase in profit as revenue from petroleum products sales exceeds N34bn

Based on AMCON regulation, every bank must make an annual contribution of 10 bases of their total asset.

Banks Assets

The surveyed banks captured for this analysis are Access Holding Plc, Guaranty Trust Bank (GTCO), Fidelity Bank, Stanbic IBTC Bank, United Bank for Africa (UBA), Union Bank, Wema Bank, and Zenith Bank.

These banks total assets increased by 24.77 percent, reaching N59.016 trillion during Q1 2023, compared to N47.30 trillion in the previous year.

Breakdown of the banks AMCON payments

Access Holding Plc, a Nigerian financial holding company, paid the highest AMCON charges in Q1 2023, amounting to N33.32 billion, reflecting a 24.8 percent increase from the same period in 2022.

This surge can be attributed to the company's remarkable 30.3 percent growth in total assets, which reached N15.74 trillion during the first three months of 2023.

Zenith Bank followed closely with an AMCON payment of N28.69 billion in Q1 2023, indicating a 34 percent increase from the previous year.

Read also

Elumelu consolidates UBA ownership as HH Capital acquires additional 19.34 million units of shares

The bank's total assets stood at N13.36 trillion, marking a substantial 29.5 percent increase from Q1 2022.

Other banks' AMCON charges and Assets

GTCO paid N13.72bn to AMCON in Q1 2023, with total assets of N6.74tn.

Fidelity Bank paid N11.56bn to AMCON in Q1 2023, with total assets of N4.14trillion.

Stanbic IBTC Holdings paid N9.36bn to AMCON in Q1 2023, up 7.46% from Q1 2022, with total assets of N3.21trillion.

Union Bank paid N3.93bn to AMCON in Q1 2023, up 9.47% from Q1 2022, with total assets of N2.93 trillion.

Wema Bank paid N1.39 billion to AMCON in Q1 2023, with total assets of N1.54 trillion.

Zenith Bank gets CBN approval to become a new company

In another report, Zenith Bank has received approval from the Central Bank of Nigeria to operate as a financial holding company.

Legit.ng reports that the approval allows it to change its organisational structure and establish a financial holding company, Zenith Holdco Plc.

Read also

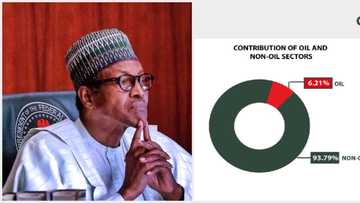

Oil, agriculture missing: Top 10 fastest growing sectors in final phase of Buhari's administration emerge

With this move, Zenith Bank joins a few other Nigerian banks, including First City Monument Bank and Access Bank, that have already adopted the model.

Source: Legit.ng