Access Bank Leads as 11 Banks Approve N21.1trn Loans & Advances to their Customers in Search of Funding

- Nigerian bank loans to customers would surpass N2 trillion in October 2021, demonstrating the CBN's commitment to increasing lending to the private sector

- These loans are provided at varying lending rates based on the sector and the customer's credit worthiness

- Nigerian banks have developed a variety of products in recent years to make it easier for customers to obtain loans

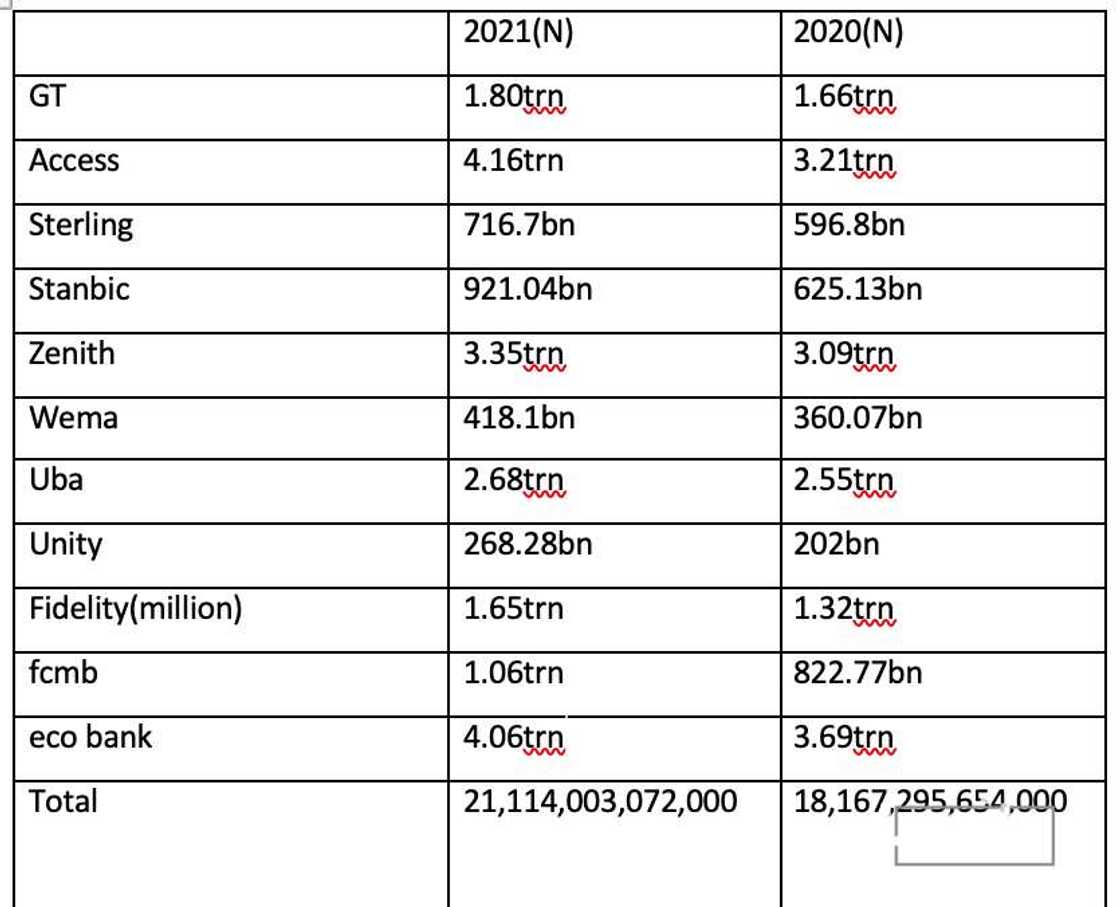

Nigerian banks customers in search of funding have so far borrowed from 11 commercial banks, totalling N21.1 trillion as of the end of 2021.

The current level is a N2.9 trillion or 16.2% increase when compared to the N18.2 trillion the loans and advances stood in 2020.

The figures are according to the analysis of the banks' 2021 financial year results submitted to the Nigerian exchange.

Breakdown

The 11 banks surveyed are First City Monument Bank (FCMB), Guaranty Trust Holding Company (GTCO), Zenith Bank, Wema, Unity, United Bank for Africa (UBA), Sterling bank and Stanbic bank, Eco Bank, Unity Bank, Fidelity and Access Bank.

PAY ATTENTION: Subscribe to Digital Talk newsletter to receive must-know business stories and succeed BIG!

Breakdown of the data shows Access Bank, Ecobank Transnational Incorporated (ETI) and Zenith Bank Plc gave out the highest loans and advances with N4.16 trillion, N4.06 trillion and N3.35 trillion respectively

United Bank of Africa loans to customers hit N2.68 trillion while Fidelity's bank loan of N1.5 trillion completed the top five.

Source: Original

CBN drive to increase lending to private sectors

The reason for the growth in banks' loan books was as a result of the implementation of the Loan to Deposit Ratio (LDR) policy of the Central Bank of Nigeria (CBN), instituted to increase lending to the real sector in order to grow the economy.

The CBN had on its part made funds available and accessible through its various intervention programmes to the banks to lend to their customers.

Read also

Nigeria risks boycott of foreign airlines as CBN refuses to release $450 million belonging to them

Ecobank leads as 10 commercial banks spend over N400bn on staff salaries

Meanwhile, Legit.ng had earlier reported that working in the banking industry is a dream for many Nigerian graduates because they believe there is a lot of money to be made

The report showed how ten commercial banks paid workers salaries and wages of over N400 billion in 2021.

The amount captured in the report only covers salaries and wages and does not include other staff costs, pension contribution that makes up personnel cost.

Source: Legit.ng