Again, CBN Retains Benchmark Interest Rates At 27.5%, Cites Economic Factors

- For the second time in 2025, the Central Bank of Nigeria has refrained from raising or lowering the benchmark interest rates

- According to the announcement from CBN, all members of the MPC voted unanimously to hold the rates

- Their reasons are also explained in the press briefing, even as the CBN speaks on what to expect in the near future

Legit.ng journalist Ruth Okwumbu-Imafidon has over a decade of experience in business reporting across digital and mainstream media.

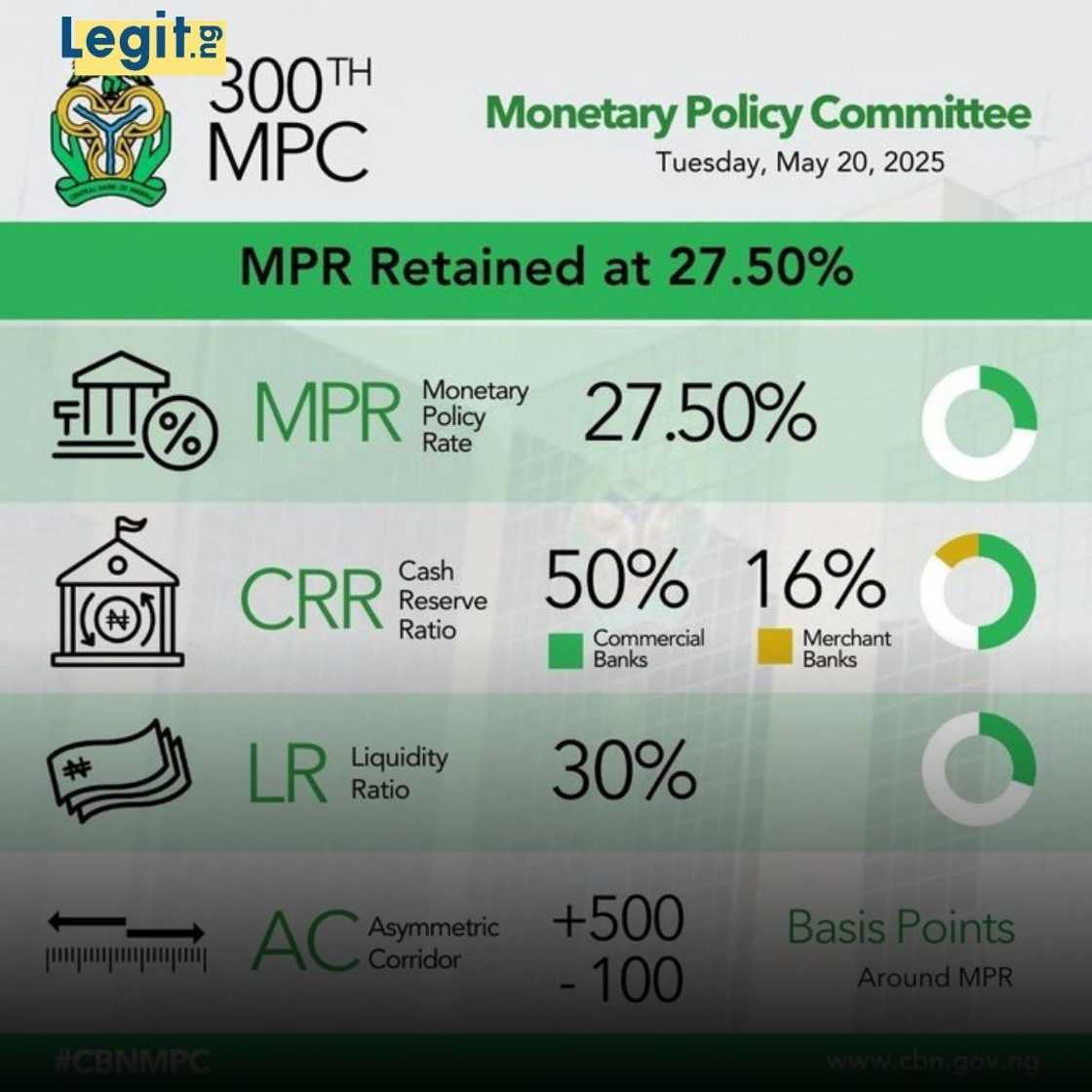

The Central Bank of Nigeria (CBN) has retained the Monetary Policy Rate (MPR), also known as benchmark interest rates, at 27.5% for the second time in 2025.

This follows a unanimous vote from all members of the Monetary Policy Committee to hold the rates as is.

The CBN Governor, Olayemi Cardoso, announced this at the press briefing following the 300th Monetary Policy Committee meeting.

Source: Getty Images

The committee also voted to hold the Cash Reserve Ratio (CRR) at 50% for Deposit Money Banks and 16% for Merchant Banks.

CBN explains decision to hold interest rates

Speaking at the press briefing, Cardoso explained that the committee’s decision to retain the rates was to allow time to better understand near-term developments.

The Committee also retained the Liquidity Ratio (LR) at 30% and the Asymmetric Corridor at +500/-100 basis points around the MPR of 27.5%.

The CBN Governor noted that there have been improvements in the key macroeconomic indicators, and this could help moderate crisis in the short term.

He said;

“These include the progressive narrowing of the gap between the Nigerian foreign exchange market, bureau de change (BDC) windows, the positive balance of payments position and the easy price of PMS.”

Cardoso added that the committee also took note of the progressive moderation in food inflation, a key result of the government addressing core issues around food supply and insecurity in farming communities.

He urged security agencies to continue to play their part in improving the situation to further boost food production and moderate prices.

The latest data from the National Bureau of Statistics shows that food inflation has declined to 21.26% from last year.

Even though the CBN survey shows that 65% of Nigerian households want the bank to lower interest rates, the committee is choosing to observe a bit longer.

Inflation now driven by high electricity tariffs, others

Governor Olayemi Cardoso added that the committee acknowledged the role of high electricity tariffs, high foreign exchange demand, and other factors in driving inflationary pressures.

Source: Twitter

He stated;

“The MPC noted new policies introduced by the federal government to boost local production, reduce foreign currency demand pressures, and thus lessen the pass-through to domestic crisis. Given the relative stability observed in the foreign exchange market, members urged the bank to sustain the implementation of the ongoing reforms to further boost market confidence.”

As the chairman of the MPC, Cardoso also urged the federal government to sustain efforts strengthen Nigeria’s foreign exchange earnings especially from the gas oil and non-oil exports.

Recall that the CBN similarly held interest rates at the 299th MPC meeting held in February 2025, after the rebasing of the Consumer Price Index (CPI) and Gross Domestic Product (GDP).

House of Reps warns CBN against raising interest rates

In related news, the Federal House of Representatives Committee on National Planning and Economic Development warned the Central Bank of Nigeria (CBN) not to raise rates again.

Speaking last week ahead of the 300th MPC meeting, Gboyega Isiaka, the chairman of the committee, called on the apex bank to consider the effect the high interest rates had on business in Nigeria.

He added that the high interest rates was reducing access to credit for small and medium enterprises, as well as the big manufacturers, making it difficult for them to employ more people.

Source: Legit.ng