In Eight Hours, Stock Investors in Nigeria make over N262bn, thanks to the Performance of 31 Companies

- Nigerian stock markets return from the public holiday with an impressive performance for investors

- Data from the Nigerian exchange shows that 31 companies helped lift the market with a gain of over N262bn

- There are 156 public listed companies on the Nigerian exchange which are traded on a daily basis

Stock investors in Nigeria in eight hours pocketed over N262.8 billion following the resumption of trading activities on Wednesday, 4 May 2022 after the public holiday to mark the Workers Day and Eld-el-Fitr celebrations.

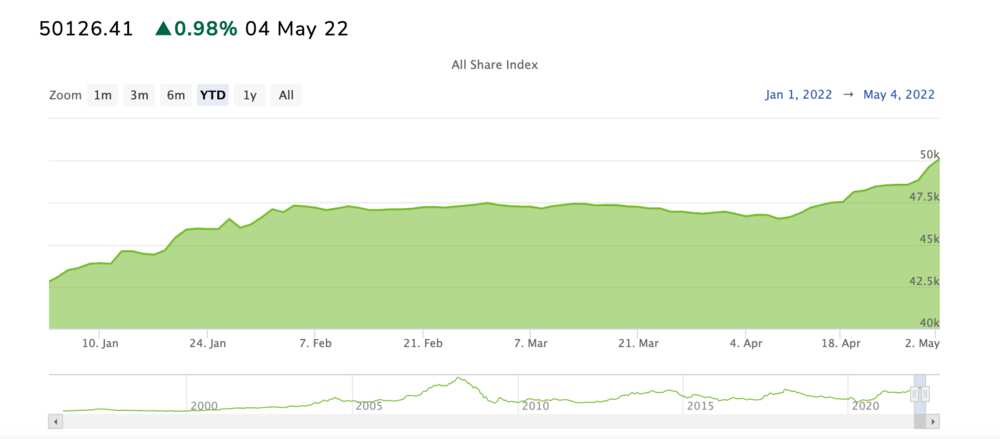

Data from the Nigerian Exchange Limited shows that the market capitalisation of the equities listed on the NGX rose by 0.98 per cent to N27.023tn on Wednesday.

This is an improvement from the N26.760 trillion the market closed on Friday 29, April 2022.

Source: Facebook

Breakdown of the performance

The NGX All-Share Index also rose to 50,126.41 basis points from 49,638.94 basis points.

Read also

Naira firms up at official market but loses at the black market, exchanges at N602 per dollar

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

The All-Share Index tracks the general market movement of all listed equities on the Nigerian Exchange

The Punch reports that NGX data shows 31 companies recorded gains at the end of trading on Monday, while 27 companies recorded losses.

During the trading, it was revealed that 669.299 million shares valued at N5.988bn were traded by investors in 7,251 deals.

Gainers table

Okomu Oil and Wema Bank topped the gainers' list as their share prices rose by 10 per cent each to N161.70 and N3.85 respectively.

Also, NB’s share price also appreciated by 9.98 per cent and rose to N62.8 while Eterna and Presco gained 9.97 per cent each and rose to N6.62 and N157.7 respectively.

Losers table

Oando, Transexpr and Mansard topped the losers list as their share price fell by 10 per cent, 9.88 per cent and 7.79 per cent to close at N5.67, 73kobo and N2.25 respectively.

Also on the losers’ list, Ikeja Hotel, Cutix and FCMB’s share prices fell by 7.14 per cent, 6.15 per cent and 5.93 per cent to close at N1.30, N2.29 and N3.65 respectively.

Over 158,000 Crypto investors have all their funds wiped out as bitcoin buckles

Recall that Legit.ng has reported about 158,832 traders to have their investment liquidated, which totalled about $387.96 million. It is the biggest single liquidation on Okx, a BTC-USD-220930 transaction at $2.93.

The premier crypto, bitcoin and Ethereum have their prices have broken their key $4ok and 3k support levels individually as investors' sentiments are at a bearish level.

The important driver of the round of liquidations, promoters say, was a very sharp selloff in the week before which was driven by a strong dollar that has gotten to the new highs in two decades.

Investors lose N2.6 Billion in 24 Hours as First Bank

Legit.ng had earlier reported on the confusion about the highest majority shareholder of FBN Holdings.

As of Wednesday, 27th October 2021 the total shares outstanding is 35,895,292,792.00 out of which 1,818,551,625 is held by Otedola which is just over 5 percent.

First Bank has however come out to explain that Tunde Hassan-Odukale has 5.36 percent stake through his 0.07 percent direct shares and 5.29 percent indirect stake through Leadway Holdings Limited subsidiaries.

Source: Legit.ng