Lidya, Loan App Founded by Nigerian, Tunde Kehinde, Raises N3.41billion

- Over N3.41 billion was raised by Nigerian financial technology company, Lidya, as the company's total funds obtained in last four years reach N6.78 billion

- The new capital was raised from investors such as Bamboo Capital Partners, Accion Venture Lab and Flourish Ventures, and uMunthu Fund, owned by Alitheia Capital

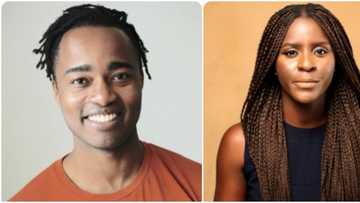

- Lidya, which has continued to attract capital from several local and foreign investors, was created by former Africa Courier Express employees, Tunde Kehinde and Ercin Eksin

Lidya, a Nigerian loan app for small and medium businesses, has raised additional funds, as its total fundraising hit N6.78 billion ($16.5 million) in about three years.

The lending startup recently conducted a pre-Series B funding round, which led to Lidya raising N3.41 billion ($8.3 million) through several investors led by Alitheia Capital, through its investment arm, uMunthu Fund.

It was also gathered that Bamboo Capital Partners, Accion Venture Lab and Flourish Ventures also contributed to the capital raised by Lidya.

Source: Instagram

Aside from this recent funds obtained, in a 2017 seed round, Lidya received $1.3 million, and a year after, during a Series A funding, the company raised $6.9 million.

Who funded Lidya, and why

Lidya was founded by Nigerian, Tunde Kehinde and Ercin Eksin, after they got the idea while working for logistic firm, Africa Courier Express (ACE).

Kehinde and Eksin were inspired by the struggles of small businesses in obtaining financial support - some of these enterprises were clients of ACE.

The duo who were part of founding executives of Jumia Nigeria, went on to establish their lending platform in 2016 despite the existence of competitors, who they believe can't provide all the loan demanded by small businesses.

Today, they have disbursed over $3 million for over 25,000 loan demand. They offer credit in the range of $500 to $50,000 within 24 hours.

Two Nigerians who raised funds for small businesses

In related news, Legit.ng had previously reported that two Nigerians, Chioma Okotcha, Uche Nnadi and Zach Bijesse, established Payhippo to assist small businesses get funds.

They recently raised N411.49 million from several local investors such as Ventures Platform, Future Africa, Launch Africa, Sherpa Ventures, DFS Lab and others.

This capital is expected to boost the operation of Payhippo, and ensure they have the capacity to continue providing financial assistance to SME.

Source: Legit.ng