What is cash book and how do you use it?

What is a cash book? Only experts know the answer to this question. And in this article, we will try to explain it in such a way that even a child could understand. We assure you that you will find here a lot of interesting and useful information about a cash book and how to use it correctly!

Source: Depositphotos

No organisation performing cash transactions can work without this document. One of the main requirements is its proper execution. What is the purpose of this financial journal and why is it so important? We will tell you below.

What is cash book and types of cash books

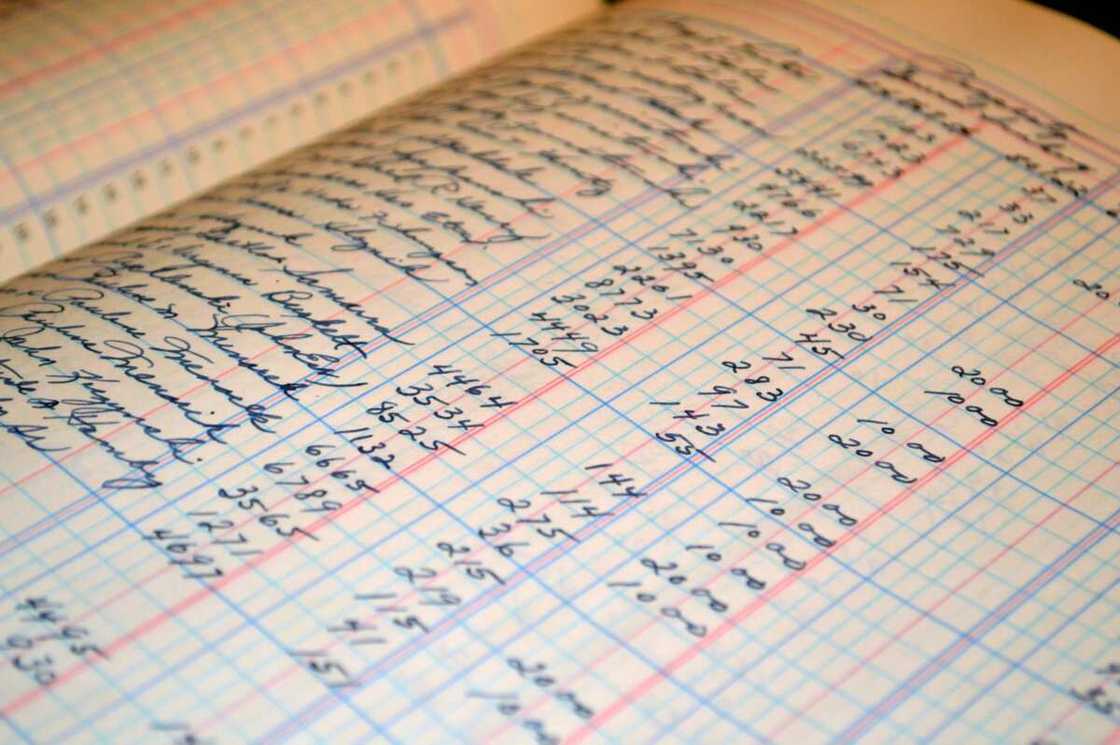

Let's start with the definition of a cash book. It is an accounting document, which reflects all cash transactions. Such accounting record should be present in all enterprises where there is a cash register. An exception is not even those legal entities or individuals that operate under the simplified tax system. There are three types of cash book. Let's take a closer look at each of them.

- Simple cash book. It consists of only one column (debit and credit), which indicates the number of payments and receipts. Filling such a journal is effortless. You just need to understand the rules of transactions, that is, what precisely to charge and what to enter.

- Two column cash book. If a company is engaged only in accounting operations, then a simple one will be enough. One more column is needed in case of recording banking transactions. Such a column is called banking. Here is a record of all cash transactions that are conducted through the bank.

- Petty cash book. This document is uncommon in the world of business and trade. This book consists of all expenses, from small to large ones. Such payments are often repeated because the procedure is somewhat cumbersome. Most often, several cashiers or accountants work on such a journal.

The chief accountant performs control over the correct maintenance of the ledger. After the period of this financial document is completed, all the papers are bound. Then the stitched sheets are sealed with a final layer.

What is the purpose of a cash book?

Source: Depositphotos

READ ALSO: Functions of financial management in an organization

The main purpose of the ledger is the fixation of all receipt and payment transactions with funds of the organisation. With the help of records, you can track the movement of money. Daily reconciliation of the balance at the cash register and available cash allows timely identification of deficiencies and surpluses.

This document deserves closer attention since representatives of various regulatory bodies regularly check it. According to the law, every company should have only one cash book. But if we are talking about a large enterprise that has separate divisions allocated for a different balance, then each division maintains its own ledger.

Its original takes place in a separate division, and only copies of primary documents and this financial journal are transferred to the head office. All data on cash balances are shown in its balance sheet and are taken into account when drawing up the consolidated balance sheet for the enterprise.

Source: Depositphotos

If you are planning to do business, now you have to keep such a book. It will not only simplify the counting of all cash but also save you from government punishment.

Cash book entries

Now you know that this document is the accounting record necessary for registering all cash transactions. It is possible to fill such a financial journal either manually or automated. The last one is permissible if the subject can ensure the safety of electronic accounting and prevent unauthorised access. Next, we will talk about these two methods.

Keep reading, and you will find out which method is better. It is very important in business. The well-being of your organisation depends on further choice.

The manual maintenance of the cash book

Source: Depositphotos

In this case, the sheets of the book should be numbered before use, strung together and sealed with a wax or mastic seal. The last sheet indicates the total number and is certified by the signatures of the head and chief accountant of the organisation.

Entries are made immediately after receipt or issue of cash for each document (credit or debit order). All records are created in duplicate through carbon paper with a ballpoint pen. The first copy is called a supplementary sheet, and the second one is a loose page. The first and second copies are numbered with the same numerals.

At the end of each working day, the cashier calculates the results of transactions registered for the day, and the remaining money is displayed for the next day. These data are entered into the financial document, after which the second (loose) copy is torn off and transferred to the accounting department as a cashier's report along with receipt and payment documents. Rasure and unspecified corrections are not allowed. They must be certified by the signatures of the cashier, as well as the chief accountant of the organisation.

This method is the most common and convenient. A lot of companies and enterprises use it, because what could be more convenient than personal control and less possibility of mistake?

The automated maintenance of the cash book

Source: Depositphotos

It is also allowed to maintain such a financial document in an automated way. The sheets are formed automatically, on the basis of documents registered in the program. Following the requirements of this book maintenance procedure, by the beginning of the next working day, it is necessary to form in the program and print out the loose paper of this financial journal and the cashier’s report.

Formed sheets must have the same content and include all the details provided by the form. The numbering of such sheets in the program should be carried out automatically in ascending order from the beginning of the year.

After printing out this report and loose paper, a cashier is obliged to check the correctness of the documents, sign them and send the report along with credit and debit documents to the accounting department.

The formed loose pages are bound in chronological order. The signatures of the head and chief accountant certify the total number of sheets for the year of the company, and the book is sealed. The chief accountant of the enterprise controls the correct maintenance of the ledger.

Source: Depositphotos

This method requires more control and attention but is also considered as a good option. Doing it manually or automatically is your choice, but you must do it responsibly.

What is the difference between a cash account and a cash book?

This question is considered the most frequently asked. We will be glad to answer it. So, the cash account is entries in the book. That account is structured as a book and not vice versa. It is not a bank account and not some kind of program. We also have to say that such journal use and consist of a ledger folio. On the contrary, accounts use only a journal folio.

Source: Depositphotos

Once again we emphasise that a cash book consists of account with the same name, that is, in other words, it is the records in the document.

Carrying out any activity with the use of payments, an individual entrepreneur or a legal entity must pay attention to the accounting discipline. It is important to arrange all transactions correctly. You should familiarise yourself with the cash book, study the peculiarities of its maintenance, and carry out cash transactions properly.

READ ALSO: What is petty cash book and how to use it

Source: Legit.ng