Loan in Nigeria: Top 5 ways of getting money quickly and easily

Want to develop your own business? Eager to visit different places but have no cash? Your apartment's rent is due, and you are in desperate need of money? This article will help you sort your issues out. Find out about top 5 ways to get a loan in Nigeria with the help of one of the popular loan apps.

Source: Getty Images

One of the major challenges of starting up a business is capital. Potential entrepreneurs search for companies that can provide them with an instant loan in Nigeria without collateral. Others might simply be looking for a way of getting some cash before the next paycheck. Whatever the reason may be, sometimes you just need money, and fast.

We aim to make this search easier for everyone by offering a list of available loan apps in Nigeria. Take a look and find the application that serves your needs best.

Top 5 ways to get an online loan in Nigeria

Whether you are looking for some money to start your own business, buy a car, book a trip, or just to have some money on hand, there definitely is a way for you to get an instant online loan in Nigeria.

Below, you can find 5 most popular apps that can get you your cash in no time.

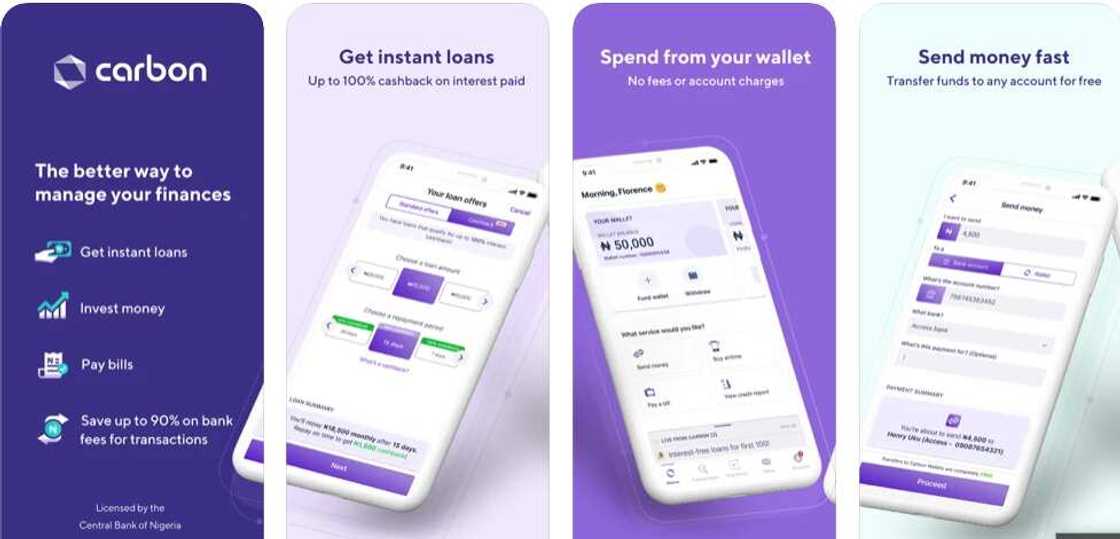

1. Carbon

Source: Facebook

Carbon loan app, formerly known as PayLater is an easy-to-use website and app.

It is a simple, entirely online lending platform that provides short term loans to help cover unexpected expenses or urgent cash needs. The application process is quick and can lend you up to 1 million naira.

If you need a quick loan in Nigeria without collateral, Сarbon app will undoubtedly help you out. All you need to do is download it and apply for this service.

It is essential to know that there are no hidden charges – they are all mentioned preliminarily before your registration. Moreover, Сarbon assures that the data you input on the website is entirely secure and encrypted through Secure Sockets Layer (SSL) technology.

Once your loan application is approved, you will receive your funds within five minutes. One more point to mention is that your application may fail (it is not common but, it may happen), and in such cases, an agent will contact you as soon as possible to let you know the reason(s).

The Carbon platform also allows you to make payments for recharge cards, bills and other services. You can download the app from the play store or their official website.

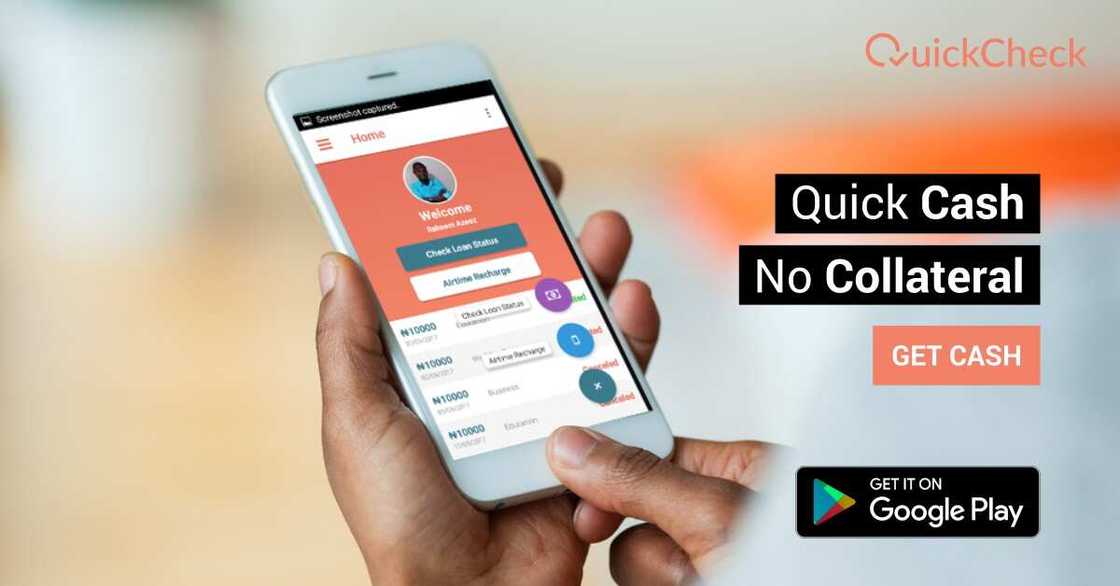

2. QuickCheck

Source: Facebook

QuickCheck is the a loan app that allows individuals to borrow easy loans with very affordable interest rate payments.

Сlients of the platform can receive instant and readily accessible funds of up to 30,000 naira for a period of either fifteen or thirty days without providing any collateral in exchange.

The more loans you take and repay, the higher your credit score, and you will gain access to more elevated amounts. QuickCheck app is available on Google Play.

The QuickCheck system is accomplished with machine learning algorithms, which helps this lending platform foresee an individual's behaviour and estimate credit applications.

These algorithms also enable approvals in not more than 24 hours!

3. KiaKia

Source: Facebook

Another app for quick online loans in Nigeria is KiaKia (the title is derived from a Nigerian word which means "QuickQuick" in English). It is a digitized funds lender created for businesses.

This platform uses data bulk, computer forensics, psychometry, and machine learning to secure credit ratings and enable the repayment risk evaluation algorithm to guarantee direct individual and business credits.

You can borrow from 10,000 to 200,000 naira. Their interest rates are from 5% to 24%, depending on your credit score and the duration of the loan. The due date of loan repayment is between seven to thirty days.

4. FairMoney

Source: Facebook

FairMoney is also one of the popular loan apps that can guarantee you fast money access in need of emergency. Its percentage rates vary depending on the amount an individual is borrowing and the payment deadline period.

All you need to do for a fast and easy application process is download the app from Google Play Store and receive your money without collateral. You will be able to repay your loan in fifteen days or one month. However, this only applies if you meet the terms and conditions of the loan application details.

Apart from giving out loans, FairMoney also offers airtime recharge and paying off bills services on their app.

5. Branch

Source: Facebook

The Branch loan app is another option you could consider. Borrowing money from this app is very easy and can be done within twenty minutes or less. You do not need any collateral to get a loan.

All you need is your phone number or Facebook account, and a bank account number. You can borrow as little as 1000 naira and as much as 200,000 naira from Branch, and with little interest. You can download the app on Google Play Store.

While most of these platforms claim to provide fast loans with no collateral, it is a good idea to read their Terms & Conditions (T&C) before applying.

The interest rate and payback period are both important factors to consider. If you are a company, you will not want to take out loans with a short payback period unless you are sure you will quickly repay the money.

Now all you have to do is check out the apps we have talked about and find the best loan app in Nigeria for your specific needs.

DISCLAIMER: This article is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Sources:

- Top 10 Financial Institutions In Nigeria That Give Loans Without Collateral (schoolings.org)

- 10 Places To Get Loan In Nigeria Without Collateral (nyscinfo.com)

- Top 7 Mobile Loan Apps For Online Lending In Nigeria (invoice.ng)

- Get Quick Cash Anytime, Anywhere (quickcheck.ng)

- The financial marketplace to access and lend out personal and business capital (kiakia.co)

- Get a loan of up to ₦500,000 within 5 minutes! (fairmoney.ng)

- Money at the speed of life (branch.co)

- Digital banking for all lifestyles (ng.getcarbon.co)

READ ALSO: Bet9ja agent commission percentage and benefits in Nigeria

Legit.ng recently published the most detailed article on the Bet9ja agent commission percentage and benefits in Nigeria. Bet9ja is one of the leading betting firms in Nigeria, and it provides multiple ways of making cash, including partnering with business people, who later become Bet9ja agents, to establish Bet9ja shops.

Bet9ja is among the biggest and well-known online sports betting websites in Nigeria. The site has spread its roots to different parts of the country, becoming the first most-visited local site and the third most-visited website in Nigeria.

Source: Legit.ng