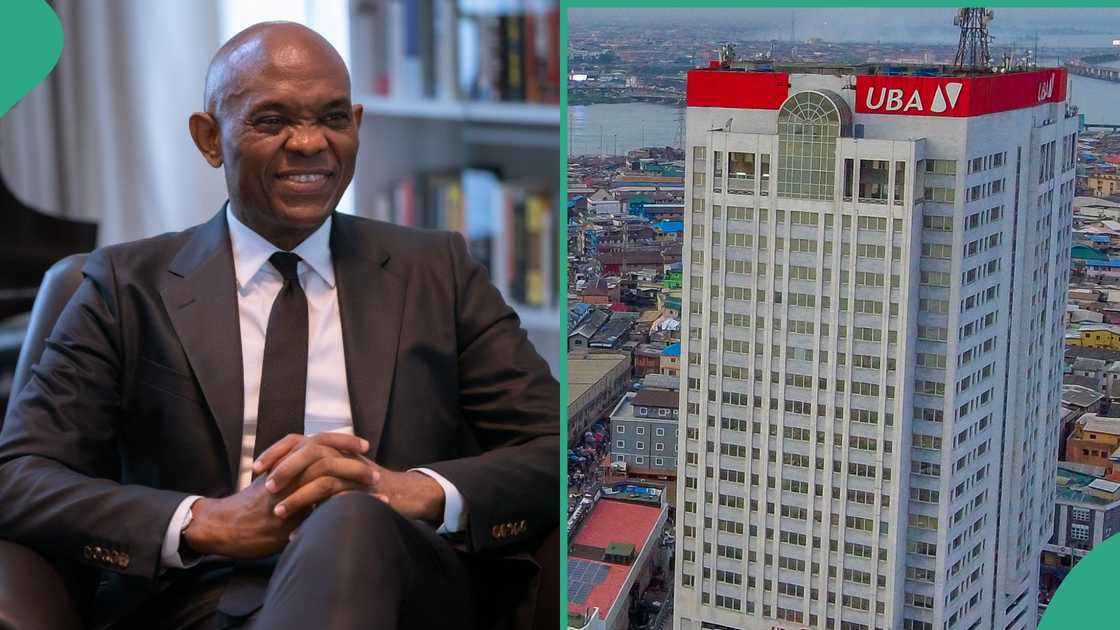

Nigerian Billionaire Tony Elumelu Boosts Stake in UBA, Acquires 1.2 Billion Shares in 2 Days

- Tony Elumelu, chairman of United Bank for Africa, has been gradually increasing his stake in the UBA group

- The billionaire has spent heavily to purchase over 1 billion UBA shares in May, consolidating his position as a major shareholder

- Meanwhile, UBA is still gearing up for the capital raising exercise that will come up in the third quarter of 2025

Legit.ng journalist Ruth Okwumbu-Imafidon has over a decade of experience in business reporting across digital and mainstream media.

The Chairman of the United Bank for Africa (UBA) Group has purchased over 1.2 billion shares in the bank within two days.

This comes barely a week after a smaller purchase of 45 million shares and suggests that the billionaire is consolidating his position as majority shareholder ahead of the next capital raising exercise.

The details of the transaction were contained in a regulatory filing to the Nigerian Exchange Group (NGX) on Monday, 2 June 2025, and signed by the Group Secretary, Bili Odum.

Source: UGC

According to the document, the multiple transactions happened between Thursday, 29 May, and Friday, 30 May 2025.

Tony Elumelu spends N43.9 billion to acquire more UBA shares

The filing reveals that the billionaire spent N43.91 billion in several transactions to buy 1,267,669,350 (1.2 billion) UBA shares at an average price of N34.64 per share.

Out of the purchase, Elumelu bought 17,669,350 shares at N34.70 per share, and another 50,000,000 shares at prices ranging from N34.70 to N34.55.

Elumelu had announced his plans to increase his stake in the tier one bank sometime in May, and the recent purchases confirm his intentions.

Tony Elumelu spends N1.53 billion to buy 45 million UBA shares

Legit.ng reported that Elumelu also made some big purchases on 23 May, spending about N1.53 billion to buy 45,034,044 shares at N34.3 per share.

All of these moves from the business tycoon and industrialist suggest that there could be big news ahead for the UBA group.

Meanwhile, Elumelu's oil company, Heirs Energies, is also gearing up to hit 100,000 barrels of crude oil production daily.

UBA to raise additional capital ahead of CBN deadline

As the Central Bank of Nigeria (CBN) recapitalisation deadline draws closer, several banks are making moves to meet the target and retain their current banking licence.

UBA announced on 25 April 2025 that it would be embarking on another capital raising exercise in Q3 2025.

Elumelu disclosed at the time that the bank would also be exploring private investments, among other options.

Source: Twitter

This exercise would help raise additional N144.8 billion, as UBA works towards raising the full capital before CBN’s 30 March 2026 deadline.

UBA named Nigeria's strongest brand

In related news, United Bank for Africa (UBA) and First Bank have been listed as Nigeria’s strongest banking brands, delivering value and customer satisfaction.

A new report from a UK-based firm reveals that UBA emerged the strongest Nigerian brand this year, with a Brand Strength Index (BSI) score of 92.4/100 and a triple-A-plus rating.

According to Brand Finance, UBA displaced GT Bank from the top position, rising from ninth place in last year’s ranking.

Source: Legit.ng