“Foreign Exchange Has Improved”: World Bank Speaks on Supplying Dollar to Nigeria

- A report from the World Bank found that Nigeria's economy may now grow with the support of over $15 billion in investment

- This is as it recently approved a $2.25 billion loan to aid Nigeria's most disadvantaged citizens

- The funding is expected to support fiscal sustainability and allow for the provision of high-quality public services

PAY ATTENTION: Legit.ng Entertainment Awards 2024 Voting Is Alive. Choose the best entertainer in 15 categories for FREE.

Legit.ng journalist Zainab Iwayemi has over three years of experience covering the Economy, Technology, and Capital Market.

The World Bank has said that it now has more than $15 billion in funding and technical advice available to help Nigeria's economy expand.

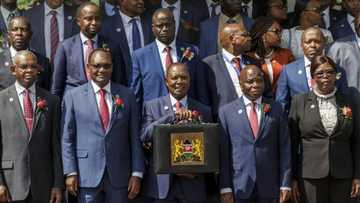

Source: Getty Images

The international lender said this in a feature article titled "Turning The Corner: Nigeria's Ongoing Path of Economic Reforms" on its website on Friday.

The bank revealed that it had invested in renewable energy and dependable power, women's economic empowerment and girls' education, resilience to climate change, water and sanitation, and governance reforms.

This occurred in the context of a $2.25 billion loan recently approved to aid Nigeria's most disadvantaged citizens and enhance the country's economic stability.

The $750 million Nigeria Accelerating Resource Mobilization Reforms Program-for-Results and the $1.5 billion Nigeria Reforms for Economic Stabilization to Enable Transformation Development Policy Financing Program comprise the combined package.

Fundings to improve revenue

This initiative aims to protect and increase the nation's non-oil revenue generation, which will support fiscal sustainability and allow for the provision of high-quality public services.

It stated that the country had made progress toward reforms, which would require all the right alliances and assistance to realize the long-term objective of a thriving economy that creates jobs and greatly advances human development.

The bank stated that the support could provide the region with an example of how governance and macro-fiscal reforms, when combined with ongoing investments in public goods, can boost growth and enhance the quality of life for inhabitants.

The report read,

“Since May 2023, Nigeria has embarked on far-reaching and long-overdue reforms to stabilise the economy and set the country towards the growth path.

“The Central Bank of Nigeria unified the multiple official exchange rates, fostered a market-determined official rate, cleared the verified foreign exchange backlog, and tightened monetary policy. As a result of the reforms, the supply of foreign exchange has improved, which is good for businesses, consumers, and economic growth.”

According to the statement, there is no longer a significant difference between the official and parallel market currency rates, which enhances transparency and prevents dishonest behaviour like round-tripping.

According to the World Bank, in order to start the process of phase-outing the gasoline subsidy, which had cost the nation over N8.6tn (US$22.2bn) between 2019 and 2022, the government also made significant adjustments to gasoline prices.

Empirical evidence suggests that this program did not help the poor; rather, it benefited consumers who were relatively better off and led to extensive out-smuggling and the black market.

It further said:

“As Nigeria pushes forward to attain economic prosperity, the country will need sustained efforts to deliver key public goods for its citizens.

“The World Bank is supporting Nigeria to achieve this with both technical advisory and financing, which stands at over US$15bn in sectors that include reliable power and clean energy, girls’ education and women’s economic empowerment, climate adaptation and resilience, water and sanitation, and governance reforms.”

Charles Abuede, a financial analyst said,

"The significant increase in currency in circulation, as indicated by the recent Central Bank of Nigeria (CBN) data, highlights a notable surge in the amount of physical currency within the economy over the span of one year."

World Bank lists countries indebted to China

Legit.ng reported that in the last decade, there are now major concerns since the external debt of low- and middle-income nations has increased and has outpaced economic growth.

The trend is observed in countries with extreme poverty, where the stock of debt has risen.

More low-income nations that qualify for aid from the World Bank's International Development Association (IDA) are more vulnerable to debt, with more than 60% expected to be in high risk of financial crisis by 2023.

PAY ATTENTION: Donate to Legit Charity on Patreon. Your support matters!

Source: Legit.ng