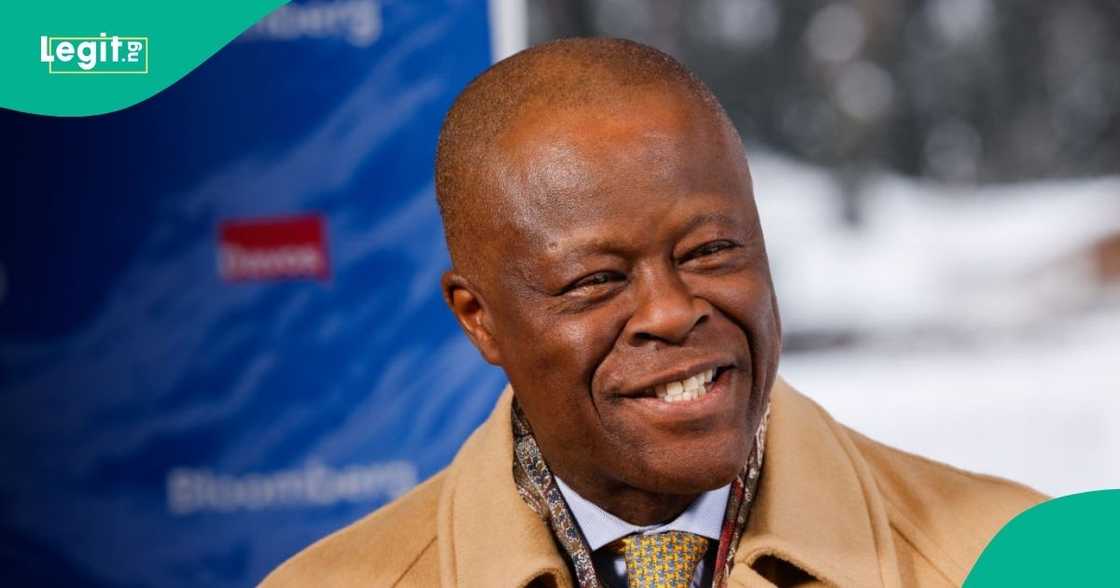

Wale Edun: Federal Government Set to Begin Sale of Selected Public Assets in Nigeria

- Minister of Finance Wale Edun has said that the federal government is planning to start selling some selected state-owned assets in 2026

- Edun, who spoke at the AlUla Conference in Saudi Arabia, said the government is currently determining which assets will be sold and the timeline

- Edun said recent reforms have made Nigeria more attractive to investors and noted public-private partnerships are central to job-rich economic growth

Oluwatobi Odeyinka is a business editor at Legit.ng, covering energy, the money market, technology and macroeconomic trends in Nigeria.

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, has said the federal government plans to begin selling selected state-owned assets to private investors in 2026.

Source: Twitter

According to Bloomberg, Edun disclosed this on Monday, February 9, 2026, during an interview on the sidelines of the AlUla Conference for Emerging Market Economies in Saudi Arabia, The Cable reported.

FG to offer selected assets in 2026

Edun said the government is currently reviewing which assets will be put up for sale and the timeline for the transactions.

He added that recent economic reforms have improved Nigeria’s investment climate, making the country more competitive and attractive to investors.

Edun stressed that Nigeria is becoming more conducive and welcoming to investors, as the President Bola Tinubu administration offers them attractive incentives.

“What we have put in place has made Nigeria very competitive in terms of the economic conditions and very attractive in terms of the incentives for investors. I think investors are now more comfortable investing in Nigeria,” he stated.

FG to prioritise PPP, asset optimisation

The minister noted that the government is also prioritising public-private partnerships (PPPs) and asset optimisation as part of its broader strategy.

Earlier, on January 22, Edun said Nigeria is pursuing job-rich and inclusive economic growth, stressing that investment remains key to improving productivity and expanding the economy.

He also maintained that the country is continuing with reforms aimed at restoring policy credibility and strengthening macroeconomic stability.

The minister’s remarks come amid ongoing efforts by the federal government to reposition the economy and attract long-term capital. These reforms have been praised by international organisations such as the International Monetary Fund (IMF), while some economic experts have expressed concern and argued that the reforms do not reflect in the lives of ordinary Nigerians.

Source: Getty Images

Tinubu approves incentives for Bonga oil project

Legit.ng earlier reported that Tinubu approved the gazetting of targeted incentives aimed at supporting Shell’s proposed Bonga South West deep-offshore oil project and similar offshore developments.

Tinubu described the deep-offshore project as strategically important to Nigeria’s economy, noting that it could generate thousands of direct and indirect jobs, attract substantial foreign exchange inflows, and provide steady revenue to the government over its lifespan. The president urged Shell to take investment decision on the projects by 2027.

Shell’s CEO, Wael Sawan, said Nigeria’s investment environment has improved significantly under the Tinubu administration, adding that the company is increasingly confident in the country’s long-term investment prospects.

Proofreading by James Ojo, copy editor at Legit.ng.

Source: Legit.ng