US Fed on track to cut rates again in penultimate decision of 2025

Source: AFP

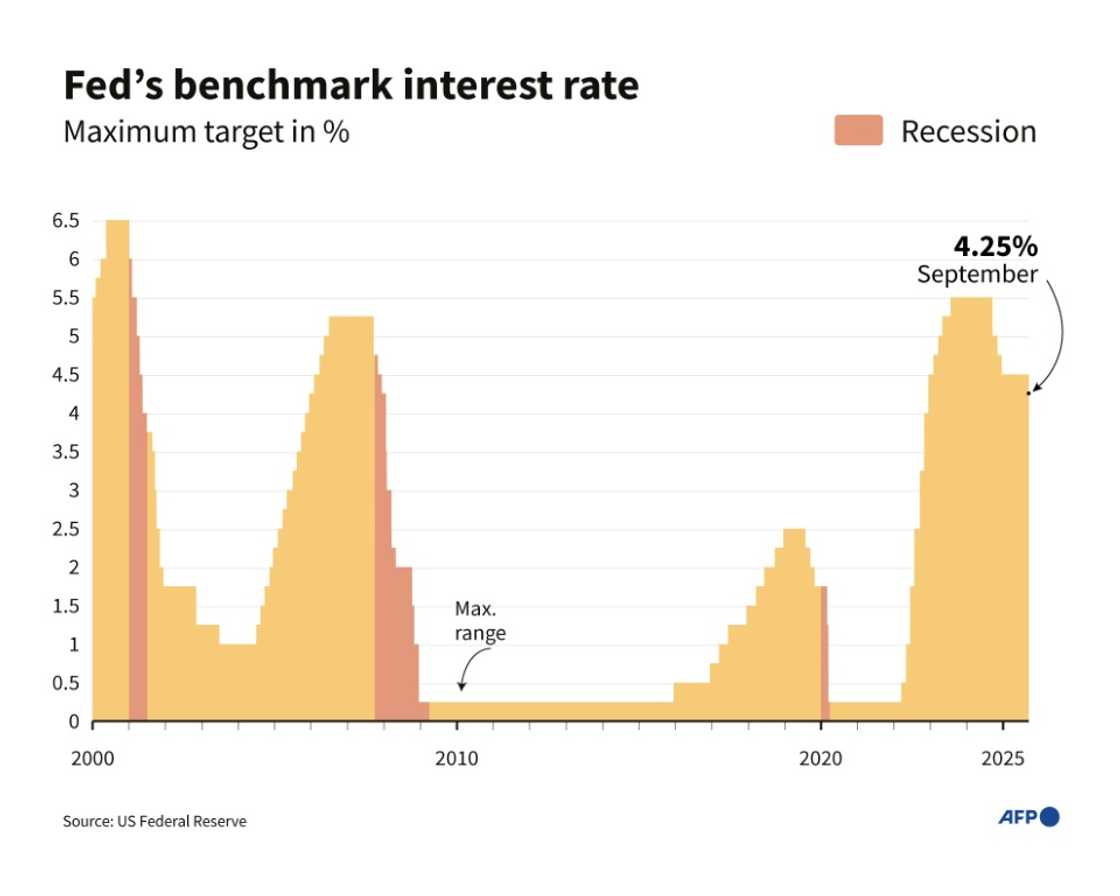

The US Federal Reserve is almost certain to cut interest rates for a second straight meeting on Wednesday, and could also shed light on what it will do next.

Analysts and traders expect most policymakers on the Fed's rate-setting committee will back a quarter percentage-point cut, which would lower the bank's benchmark lending rate to between 3.75 percent and 4.00 percent.

A cut would boost an American economy still digesting the effect of President Donald Trump's sweeping tariffs, and buy policymakers some more time as they wait for the end of the government shutdown.

Source: AFP

Republicans and Democrats remain politically gridlocked almost a month after the start of the shutdown, which has resulted in a suspension of publication of almost all official data.

The Fed has a dual mandate to act independently to tackle both inflation and unemployment, which it does by either hiking, pausing, or cutting its key lending rate.

Lower rates stimulate the economy and the labor market, typically feeding through into lower mortgage rates. Higher rates act to constrain activity and dampen inflation.

Fed officials have in recent months flagged concerns that the labor market is cooling, causing them to shift their attention to bolstering hiring, even though inflation remains above the Fed's target.

"There's definitely some weakening on the employment side of the mandate, and I think they'll go ahead and take out another insurance cut against that risk," former Cleveland Fed president Loretta Mester told AFP.

"But it's important that they not lose sight of the inflation part of the mandate," added Mester, now an adjunct professor of finance at the University of Pennsylvania's Wharton School of Business.

"The inflation risks, I believe, remain to the upside," she said.

December less clear-cut

Source: AFP

Quarter-point cuts in both October and December are more-or-less baked into the financial markets, according to CME Group data, mirroring the median expectation of Fed policymakers at last month's rate decision.

But analysts widely expect Fed chair Jerome Powell to tell reporters during the bank's post-decision press conference on Wednesday that the rate-setting Federal Open Market Committee (FOMC) is keeping an open mind about the following meeting.

"I don't think it's a given that there will be a majority of FOMC voters that will favor easing in December," EY chief economist Gregory Daco told AFP.

Powell "has not made up his mind yet for one as to whether a December rate cut will be necessary," added Daco, who nevertheless expects the Fed to make two quarter-point rate cuts this year.

The Fed could also use Wednesday's rate decision to announce an end date for its steps to reduce the size of its balance sheet, which ballooned in the early days of the Covid-19 pandemic.

"I think they're very cautious about stresses in the financial markets," said Mester.

"They could probably get the balance sheet down a little bit further," she added. "But I don't think there's much appetite for that."

Also simmering in the background are Trump's attempts to exert greater control over the management of the Federal Reserve, and Treasury Secretary Scott Bessent's widely-publicized plans to find a replacement for Powell, whose term as Fed chair ends in May.

But that's unlikely to feature in the actual discussions this week, with policymakers most likely remaining squarely focused on interest rate policy, according to Mester, a former voting member of the FOMC.

"They're really basing it on their best assessment...of where the economy is, where it's likely go, and how they can set monetary policy to achieve maximum employment and price stability," she said.

Don't miss out! Join Legit.ng's Sports News channel on WhatsApp now!

Source: AFP