US consumer inflation rose less than expected in September, delayed data shows

Source: AFP

US consumer inflation continued to heat up last month, but by less than expected, according to official data published nine days late due to the ongoing government shutdown.

However, the acceleration is unlikely to dim expectations of another rate cut from the Federal Reserve next week as it looks to support the flagging labor market.

The consumer price index (CPI) picked up to 3.0 percent in September, accelerating from 2.9 percent on a year-on-year basis a month earlier, the Labor Department said in a statement.

Prices rose 0.3 percent from a month earlier.

Both the annual and monthly inflation data came in slightly below the median forecast of economists surveyed by Dow Jones Newswires and The Wall Street Journal.

A significant reason for the monthly increase came from the gasoline index, which jumped 4.1 percent between August and September.

The food index rose by a more modest 0.2 percent, spurred by a 0.3 percent rise in the cost of food at home.

Underlying so-called "core" inflation, excluding volatile food and gas prices, also came in below expectations at 3.0 percent, the Labor Department said.

The data provides economists and traders with some much-needed insight into the health of the world's largest economy, with almost all other official data releases halted due to the US government shutdown.

Policymakers on Capitol Hill remain in a standoff, with Republicans so far digging in and refusing to grant the Democrats' demands to extend subsidies that make health insurance affordable for millions of Americans.

In the absence of official data, people have had to rely heavily on private sources of information, muddying the waters for policymakers at the Fed as they mull what to do about interest rates.

Rate cut widely expected

Source: AFP

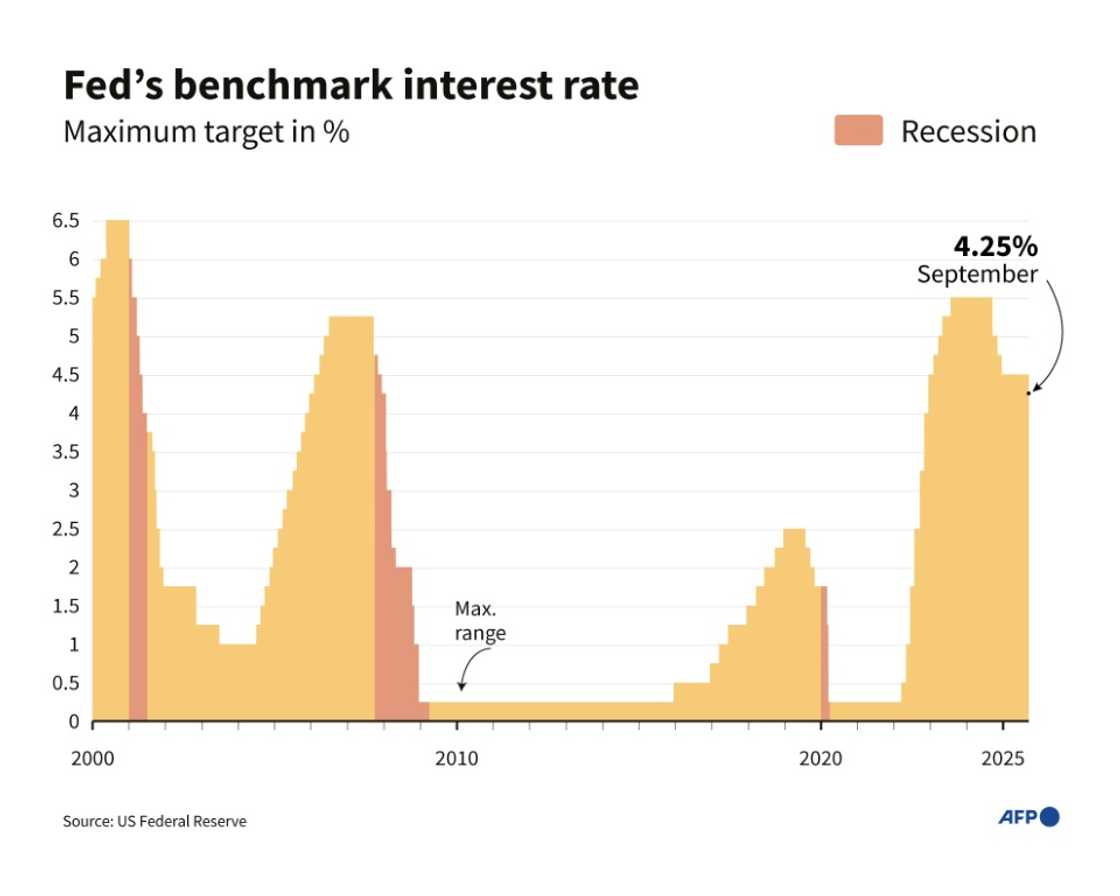

Policymakers at the US central bank are widely expected to cut rates by another 25 basis points next week, despite the September acceleration in inflation.

The move would build on the bank's decision to implement its first rate cut of the year in September, when officials voted overwhelmingly to bring the bank's benchmark lending rate down to between 4.00 percent and 4.25 percent.

That's because policymakers, who have a dual mandate from Congress to tackle inflation and unemployment, are currently flagging concerns about the sharp slowdown in job creation in recent months.

US job growth came in at just 22,000 in August, according to the most recently available data from the Department of Labor.

Futures traders see a roughly 99 percent chance that the Fed will announce a 25 basis point cut on Wednesday, bringing its benchmark lending rate down to between 3.75 and 4.00 percent, according to CME Group data.

Source: AFP