4 Major Benefits in Nigeria’s New Tax Law Taking Effect in 2026

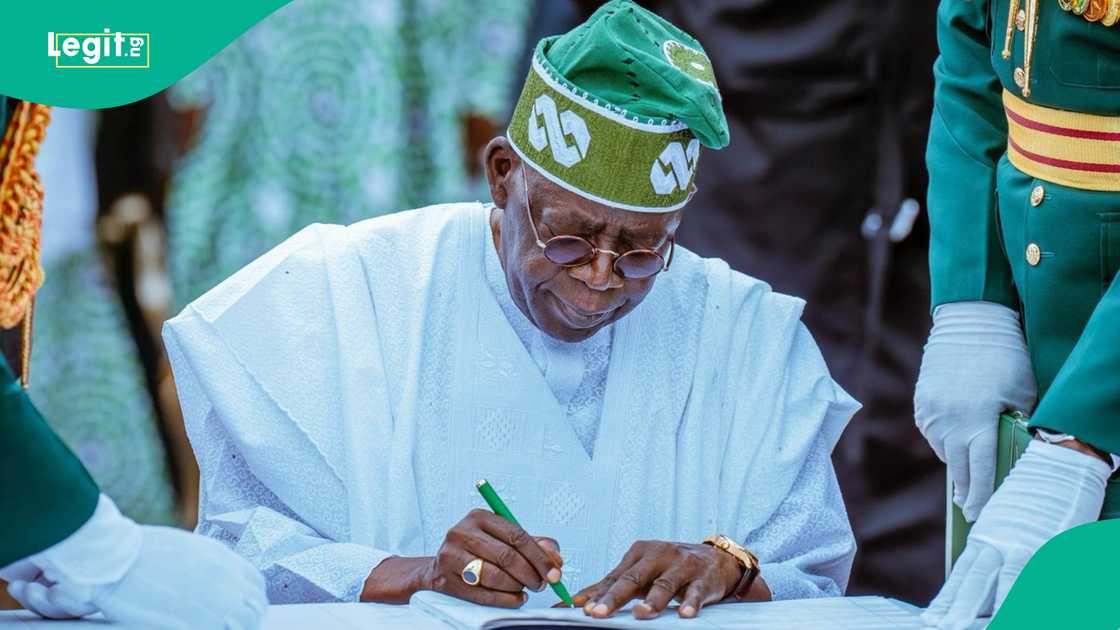

- Nigeria has a new tax law, signed by President Bola Tinubu, and it is set to become effective in January 2026

- The new tax law highlights key benefits for small businesses, states, individuals and households nationwide

- A tax expert, Aderonke Atoyebi, lists four key benefits and changes in the new laws, which will benefit Nigerians

President Bola Ahmed Tinubu has signed into law four major tax reform bills, marking a significant shift in how taxes will be collected, paid, and administered in Nigeria.

The reforms, which take effect from January 1, 2026, aim to simplify the tax regime, reduce multiple taxation, and provide relief to low-income earners and small businesses.

Source: Facebook

Unified tax law ends multiple levies

The four laws—Nigeria Tax Act, Nigeria Tax Administration Act, Nigeria Revenue Service (Establishment) Act, and Joint Revenue Board (Establishment) Act—are expected to standardise and modernise Nigeria’s tax landscape.

According to Arabinrin Aderonke Atoyebi, Technical Assistant on Broadcast Media to the Executive Chairman of the Federal Inland Revenue Service, the Nigerian Tax Act simplifies the system by combining several outdated tax laws.

“Unnecessary taxes have been removed, and paying multiple taxes on the same income or goods is no longer allowed,” she said.

All tax authorities across federal, state, and local levels are now mandated to follow consistent rules nationwide.

“Whether you live in Lagos or anywhere else, tax officers are required to apply the same standards,” Atoyebi added, emphasising that the reform would end confusing and overlapping tax demands.

VAT exemptions on essentials to ease the cost burden

While the VAT rate remains at 7.5%, the law exempts or zero-rates essential goods and services like food, rent, education, healthcare, and public transport.

Atoyebi noted that these changes were designed “to reduce the cost burden on Nigerians.”

Businesses will now benefit from a strengthened input VAT system, allowing them to claim credits on VAT already paid.

“This prevents double taxation and encourages business growth,” she said.

Additionally, all taxpayers must now obtain a Tax Identification Number (TIN) to improve transparency and ease of compliance.

New revenue agency and appeal tribunal established

Replacing the Federal Inland Revenue Service, the Nigeria Revenue Service (NRS) will collect all federal taxes, fees, and levies, and introduce digital platforms for registration, filing, and payments.

Source: Getty Images

“This modernisation is expected to reduce delays, errors, and opportunities for corruption,” Atoyebi stated.

The Joint Revenue Board will coordinate tax policies across tiers of government and introduce uniform standards to reduce conflict.

Importantly, two new institutions—the Tax Appeal Tribunal and the Office of the Tax Ombudsman—will ensure taxpayer rights are protected and disputes are fairly resolved.

Low-income earners and SMEs get tax relief

In one of the most direct benefits to citizens, the reforms exempt individuals earning below ₦800,000 annually from personal income tax.

Small and medium-sized businesses will also see simplified compliance procedures and reduced burdens.

“These measures aim to support growth and ease the pressure on small traders and entrepreneurs,” Atoyebi affirmed.

With the implementation set for January 2026, the government plans a nationwide awareness campaign and capacity-building for tax officials to ensure a smooth transition.

“The Renewed Hope administration belongs to every Nigerian,” she concluded.

“So, congratulations to all Nigerians for stepping into this new era. Together, we are building a Nigeria that works for everyone.”

Specialist stresses need for nationwide tax orientation

An economic development specialist, Ejike Okpa, has expressed strong reservations about the expected impact of Nigeria’s new tax reform laws set to take effect in 2026, stating that structural deficiencies could undermine their implementation.

“Taxation infrastructure in Nigeria is basically non-existent as it is a cash economy, and many activities happen without proper recordation/reporting, and assessment of what happened,” Okpa told Legit.ng.

According to him, while taxation is widely disliked, it remains a crucial revenue tool for government operations. However, he argued that without effective infrastructure and visible benefits to taxpayers, reforms alone would fall short.

“Without a robust infrastructure, and the average person NOT seeing the benefits of paying taxes, no amount of fancy paperwork, especially one that PwC assisted in creating, basically a gobbledygook, will address the shortcomings,” he said.

The expert stressed the importance of mass education on tax matters, saying,

“There should be an education and orientation on the benefits of taxation and why it is necessary.”

The Nigerian-American also criticised the broader economic structure, noting,

“Nigeria has a shallow economy, anchored on cash without expanded credit facilities, further complicated by insincerity on how political figures and federal/state operators collude to cheat the system they seriously don't want to improve.”

Concluding on a skeptical note, he added,

“But what do I know - I know it will not produce the expected outcome until there is proven sincerity in the populace that is committed to enhancing their existence without the typical culture of self-inflicted conduct.”

9 key tax changes explained as NRS replaces FIRS

Legit.ng earlier reported that President Bola Tinubu has recently signed the most talked-about tax reform bills into law.

The signing ceremony took place at the presidential villa on Thursday, June 26.

The four bills, which have now been signed into law, are the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

Editorial assistant Ololade Olatimehin provided exclusive commentary from an economic development expert for this report.

Source: Legit.ng